dbvirago/iStock content through Getty Images

Despite trading at unbelievably reduced degrees as well as having an overall funding dramatically greater than existing market capitalization, the marketplace remains to get rid of ZIM Integrated Delivery Provider (NYSE: ZIM) share cost due to the basic decline in products prices. Although the firm has actually just recently reported exceptional economic outcomes for the 3rd quarter, there is a threat that till extra drivers arise as well as general container need boosts, causing a boost in delivery orders, ZIM’s stocks they can maintain dropping.

Fortunately, regardless of the United States’s continuous decoupling from China, a number of extra geopolitical advancements can enhance the scenario for ZIM, which can reinforce the favorable instance for the firm’s supply, as well as this write-up will to highlight the majority of them.

Incredibly underestimated business

A couple of weeks earlier, ZIM launched its third-quarter profits record, which revealed that its organization remains to create solid returns regardless of dropping products rates. Throughout the quarter, the firm took care of to create $3.23 billion in income, up 3.2% year-over-year, while its GAAP EPS of $9.66 was $0.21 over road price quotes.

At the exact same time, regardless of remaining in a sector understood for its huge funding needs, ZIM’s most significant benefit is that it is an asset-light firm, offering it a lot more economic as well as functional adaptability contrasted to its peers. The firm counts greatly on the hired ability approach, under which it straight possesses just a handful of the greater than 130 ships that remain in its fleet, while the remainder are hired for a set duration from their particular proprietors.

Besides that, as I currently stated in my previous write-up concerning the firm, ZIM additionally counts greatly on numerous electronic options to enhance the general effectiveness of its organization. Many thanks to buying a number of technology start-ups previously this year, ZIM has actually significantly boosted its huge information as well as AI capacities, causing a total renovation in its products prices, which were just recently greater contrasted to others.

What is additionally vital to discuss is that ZIM has a really healthy and balanced annual report. At the end of the 3rd quarter, its overall financial debt was $4.7 billion, while overall liquidity was $4.45 billion. At the exact same time, the majority of the financial debt remains in the type of financing leases, as lease responsibilities are your most significant cost under the accredited ability approach, yet the rate of interest cost on them is greater than workable considering that the rates of interest ZIM’s web take advantage of at the end of the last quarter was 0x, up from greater than 3x 2 years ago.

In addition to all this, regardless of reducing its yearly expectation, the firm can report document revenues for the year. Already, ZIM administration anticipates to create EBITDA in the variety of $7.4 bn to $7.7 bn in 22, while readjusted EBIT is anticipated to be in between $6bn as well as $6.3 bn throughout the exact same duration. In addition to that, ZIM’s overall funding stood at $5.8 bn at the end of the 3rd quarter, dramatically over its existing market capitalization of ~$ 2.6 bn, while its P/E proportion is much less than 1x.

With this in mind, it’s risk-free to state that the firm is trading at ludicrous degrees based upon principles alone, which is why Looking for Alpha’s Quant ranking system offers the firm an A+ ranking for its existing evaluation. Nonetheless, the occasions of the previous couple of months have actually revealed that an outrageous evaluation is inadequate to revitalize the supply as well as make certain ZIM’s supply cost gratitude. In the meantime.

Geopolitics to conserve the day

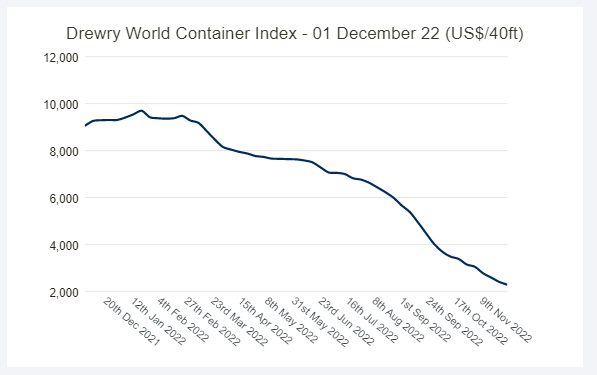

Collapsing products prices, which have actually been diminishing over the previous 40 weeks, are the major factor ZIM shares are down ~ 65% YTD regardless of reporting outstanding Q3 efficiency as well as trading at unbelievably reduced degrees.

Drewry Globe Container Index ( Drewry)

However, fortunately is that regardless of such a reduction in products prices, ZIM took care of to reveal a suitable operating efficiency in the last quarter. Although the firm’s quantity brought in the 3rd quarter was 842,000 TEUs, simply 5% much less than the previous year, its typical products price per TEU was $3,353, 4% greater than the previous year, although the prices they were dramatically greater a year earlier than they are today. At the exact same time, the quantity delivered in FY22 is anticipated to be steady Y/Y as well as the major concern financiers are asking today is exactly how effective ZIM can be in 2023 in the brand-new setting with greater products prices. reduced.

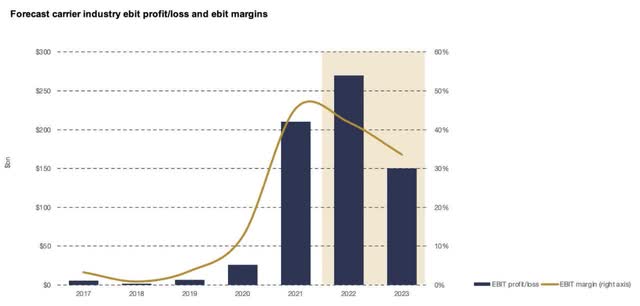

I currently stated in my previous write-up concerning the firm that delivery business will certainly not have the ability to duplicate the successes of 2021 as well as 2022 in the direct future, as the rise in supply combined with the decline popular will certainly not assist them to establish brand-new economic documents. Nonetheless, there are still indicators that the container delivery organization remains in for a reward following year as margins are anticipated to stay at reasonably high degrees contrasted to the pre-pandemic days.

Transport Market EBIT Profit/Loss Projection as well as EBIT Margins ( Drewry)

With this in mind, there is an opportunity that solid returns combined with a number of favorable drivers can protect against a more stagnation in products prices as well as enhance the general expectation for the delivery sector. In among his current meetings on this subject, expert Jefferies expert Omar Nokta, that has actually covered delivery business for almost 20 years, had this to state:

My sensation when I talk with financiers is that it’s a bit various in this cycle for container delivery. Financiers do not intend to obtain included today as products prices remain to go down. However by the time we begin to see some security in products prices, I assume customers are mosting likely to group to this market due to the worth that these supplies are. Individuals are truly anxious to purchase these supplies the minute there are steady products prices.

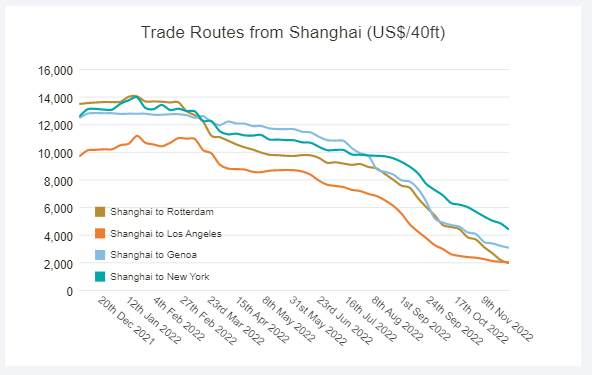

Currently, we are currently seeing products prices for the Shanghai-Los Angeles profession path gradually stabilize, which can be the initial indication of cost normalization that can result in a turnaround of the down fad in the direct future.

Products prices for profession paths from Shanghai ( Drewry)

As we obtain closer to a rate normalization, a number of drivers can increase the abovementioned turnaround, which can eventually result in ZIM supply gratitude.

First, although that China as well as the United States remain in the middle of decoupling, which adversely impacts products prices, profession in between the various sovereign celebrations on which our human being is constructed is going no place. component. Although we would certainly see reducing supply chains, cross-border profession would certainly still be a vital part of the Chinese as well as American financial systems to attain their particular nationwide passions.

We currently saw in ZIM’s most current profits discussion that while the quantity delivered through the Pacific as well as Atlantic profession lanes has actually worn away somewhat year-over-year until now this year, the quantities delivered through the Pacific as well as Atlantic profession lanes Intra-Asia, Latin America as well as Cross-Suez professions are nevertheless over Y/Y. The Cross-Suez path specifically is most likely to see a boost in quantity delivered in the future, as China’s Belt as well as Roadway Campaign experienced a trouble previously this year after Russia attacked Ukraine, it led to an interruption to rail website traffic that has actually not totally recuperated. day.

At the exact same time, the United States as well as EU economic situations remain to expand regardless of encountering high rising cost of living as well as a power situation, while the feasible leisure of the zero-covid plan in China can return need for transportation orders marine sell the Pacific. path quickly. In addition to that, the IMF anticipates that the worldwide economic situation would certainly however expand in 2023 regardless of all the difficulties, while there are additionally indicators that the been afraid excess supply is not as huge as formerly believed. This can additionally motivate merchants once more to purchase even more products, particularly after having reasonably effective Black Friday as well as Cyber Monday sales.

General, all those macro as well as geopolitical advancements can make certain the normalization of products prices as well as serve as the most significant drivers for the favorable instance for ZIM in the coming quarters.

All-time low line

With the biggest visibility of retail financiers, ZIM has actually come to be a battlefield supply. On one side, we have the bears, duplicating their end ofthe world situations concerning exactly how the worldwide economic situation will get in a 1929-style clinical depression that would certainly press products prices to unimaginably reduced degrees. On the various other hand, we have bulls that assume that ZIM can conveniently outshine in the future contrasted to its successes in 2021 as well as 2022. The reality is someplace in between.

Yes, there are possible concerns of excess ability as well as need devastation, which can remain to damage ZIM’s supply. Nonetheless, there are additionally some favorable macro as well as geopolitical advancements, which can conveniently turn around the fad as well as press ZIM shares greater after months of underperformance. At the exact same time, after the current writedown in ZIM shares, we can securely state that reduced profits in 2023 contrasted to the previous 2 years are greater than marked down at this phase.

What is additionally specific at this phase is that if the existing products price stabilizes as well as holds at existing degrees for some time, after that we could think that we have actually bad. If that’s mosting likely to hold true, after that there’s a solid opportunity financiers will certainly begin to prefer ZIM once more over supplies in various other sectors, since there’s no rejecting the unbelievably affordable price ZIM is currently trading at today..

.