There appears to be a great deal of complication today concerning rising cost of living, rate of interest, as well as present Federal Book plan. A structure for discovering this has lots of components: what the Fed (certainly) understands, just how it reveals those sights via plans like FOMC prices, ZIRP, QE, QT, and so on

There stays the inquiry of where the Fed is actually incorrect.1

It is the last that I discover interesting, as well as where we can determine the reasons the Federal Book as well as markets appear to be up in arms on the future course of prices.

Let’s offer the Fed some credit rating – they understand items rising cost of living came to a head months ago – they can take a look at rates for oil, lumber, utilized autos, delivering containers, and so on. And also they definitely recognize that FOMC plan has significant delays of in between 6 as well as twelve month.

What are the primary blunders that are presently driving Fed plan?

• Late: Most of us recognize that the plan of the Reserve bank runs with hold-up. Background recommends that the Fed’s acknowledgment of vital financial as well as market indications is additionally far too late. The outcome is that the Fed is constantly late to the event.

To consider: In the 2010s, the Fed remained in a state of emergency situation from 2008, when it pressed prices to 0 (absolutely no) up until December 2015 (this produced a great deal of distortions). After that, once again in the 2020s, they continued to be in a post-Covid emergency situation, in spite of adequate proof of financial healing.2

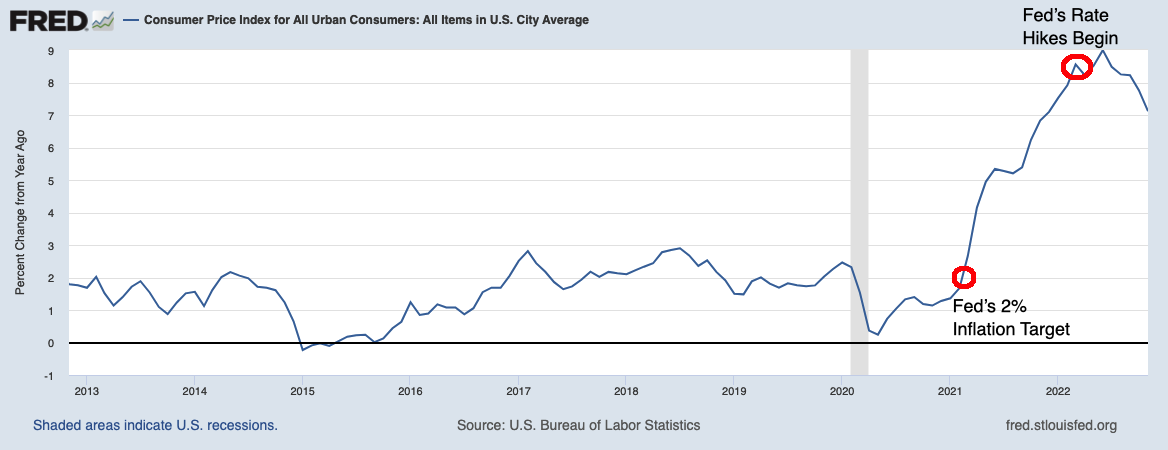

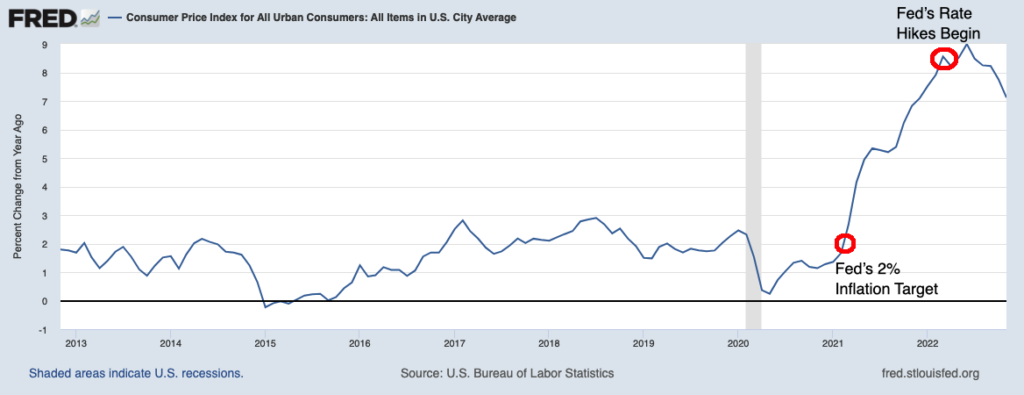

The Fed was sluggish to act upon increasing inflation, waiting a complete year from the moment the CPI surpassed its 2% target to increase prices (see graph over). Today, they appear to be duplicating the exact same error, late in recognizing that rising cost of living came to a head in June as well as home rates have dropped dramatically.

• service inflation: What is the effect of the fastest price boost in background? High government funds prices are creating high home loan prices, which subsequently is protecting against lots of people from acquiring domestic realty. The internet outcome: possible purchasers come to be occupants, increasing house rates. Comparable Lease to Proprietors is the biggest part of CPI’s Solutions industry.

The corrupt outcome is that the Fed is making the CPI design reveal greater as well as extra sticky rising cost of living.

• The riches effect: Jay Powell appears to be targeting property rates, despite the fact that supplies aren’t component of the twin required.3

The factor for this is that the Federal Book has actually been institutionally “completely spent” in the Wide range Result concept. The reasoning right here is that a climbing securities market makes Americans really feel richer, which causes extra investing as well as greater rising cost of living.

There are lots of troubles with this declaration, however allow’s offer you both most significant ones: The majority of Americans do not very own supplies; most of whom have small holdings in Individual retirement accounts as well as 401ks that they will not touch for several years. It hardly drives investing for 70-80% of customers.

The secondly is just to perplex relationship with causation. The exact same hidden variables that drive greater supply rates (boosting GDP, work, as well as salaries) additionally drive customer investing as well as rising cost of living. Consequently, the Fed thinks that a climbing securities market is what causes rising cost of living. If you quit to believe for a minute, you will certainly see that they are totally incorrect concerning this.

• Jay Powell describes economists: Powell is an attorney as well as financial investment lender, not an economic expert. This by itself is not a poor point. Nevertheless, it boosts the danger that he will certainly offer way too much away to financial experts (see Wide range Result, over).

It advises me of Joan Robinson’s remarkable quote: “The objective of examining business economics is not to obtain a collection of prepared solution to financial concerns, however to find out just how to stay clear of being misguided by financial experts.”

One needs to ask yourself just how much of the Fed’s present as well as previous plan blunders can be mapped back to this informative truism.

Bear in mind that I am not component of the Fed haters backup, neither do I believe we should.” End the Federal Reserve” or various other comparable rubbish.4 I think the Federal Book makes an excellent belief initiative to perform its objective, a work that it in some cases succeeds as well as in some cases much less well.

I despise spontaneous mistakes. Present plan appears to be ready to fall under an error, one that is so apparent as well as simple to stay clear of, however it appears like the FOMC is mosting likely to trigger a great deal of unneeded discomfort anyhow.

If I were Fed Chairman, I would certainly proclaim rising cost of living beat, plant my flag as well as yell triumph, and after that go house. The fight has actually currently been won. The best danger today is to seize loss from the jaws of triumph.

See also:

Jerome Powell’s grim rising cost of living overview is at probabilities with markets (WSJ Dec 14, 2022)

Markets do not think the Fed (WSJ Dec 16, 2022)

Previously:

Reports concerning the riches result have been substantially overemphasized (November 16, 2010)

The riches result is a malcorrelation dream (April 25, 2016)

Behind the Contour, Component V (November 3, 2022)

When your only device is a hammer (November 1, 2022)

How the Fed Creates Rising Cost Of Living (Version) (Oct 25, 2022)

Why is the Federal Book constantly late to the event? (October 7, 2022)

__________

1. There is a longer discussion concerning just how the expenses of Federal Book plan have actually dropped overmuch on the bad; this is past today’s conversation.

2. Adhering to the March 2020 price cuts, the Fed was held at absolutely no up until March 2022. Over the exact same amount of time, the S&P 500 increased 67.9% (2020) as well as 28.7% (2021 ).

3. The Fed’s dual required: initially, maintain work at its optimum, as well as 2nd, maintain rates secure (rising cost of living reduced) as well as lasting rate of interest modest. The rather difficult job for the Federal Book is that throughout durations of circulation, there is a fundamental dispute in between those 2.

4. As I outlined in Bailout Country, the Federal Book has an abundant background of being “typically incorrect, seldom doubtful.” Nevertheless, I book my best rage for the previous educator, Alan Greenspan, whose devastating regime not just caused the bubble as well as the.com accident, however additionally established the phase for the terrific economic dilemma.

.