Table of Contents

Last week, the Fed elevated its benchmark rate of interest by half a portion point, a downturn from previous sprints. Still, the fed funds price goes to its highest degree because 2007. While investors are wagering that the Fed will certainly begin reducing the fed funds price in the second fifty percent of 2023, historic fads recommend a various timeline. And also while financial experts at significant companies are split on where as well as when prices will certainly come to a head, Fed policymakers have indicated that prices are most likely to continue to be raised up until 2024.

Why the various price quotes? No person makes certain for how long it will certainly be in the past high rates of interest struck the work market or if we will certainly go into an economic downturn. Rising cost of living has actually persisted (albeit decreasing) mainly because of reduced joblessness as well as supply chain troubles, the professionals say.

When has the Fed traditionally reduced rates of interest?

Interest prices have actually come to a head for approximately 11 months in the last 5 cycles. Nonetheless, in previous price walk cycles, the Fed acted before control rising cost of living as well as slowly rise prices.

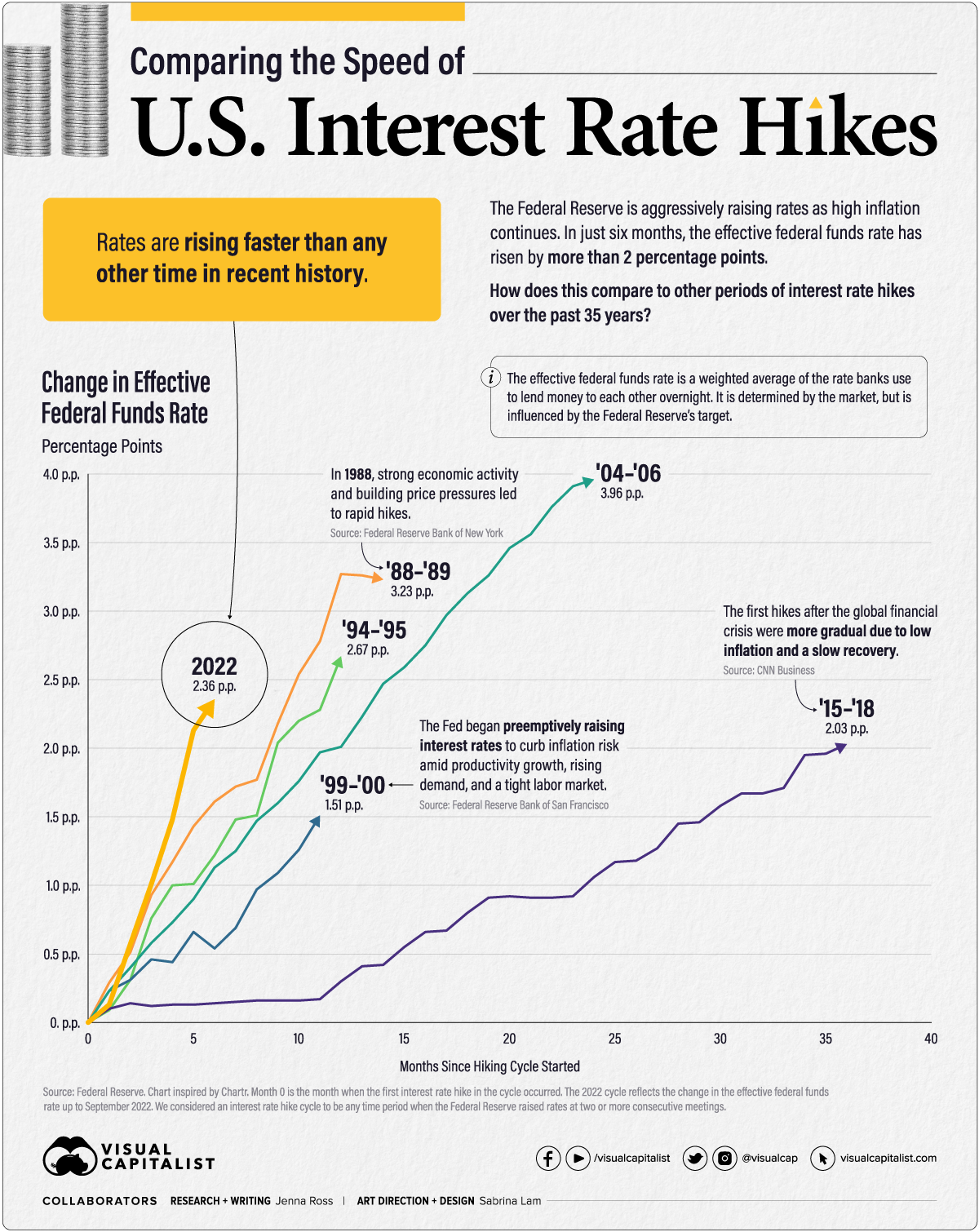

Since high rising cost of living in 2022 was originally believed to be a short-lived as well as “temporal” outcome of the worldwide pandemic, rising cost of living was permitted to go beyond target for twelve month prior to the Federal Book acted. This resulted in the fastest price walk cycle ever before, a boost of greater than 2 portion factors in simply 6 months. With rising cost of living a lot more sticky than in the past, a longer-than-average holding duration might likewise be essential.

Fed policymakers anticipate extra rises in 2023 to an array of 5% -5.25% . Price cuts are not anticipated to occur prior to 2024. However that’s not established in rock. The Fed’s very own projection encounter investors’ assumptions, while background appears to sustain the Fed’s schedule. Still, a much faster decrease is feasible if a deep economic crisis happens, experts claim.

What do financial experts anticipate this time around?

financial business Morning Star anticipates rising cost of living to transform faster than the Fed presently projections, projecting price cuts in the 2nd fifty percent of 2023 that will certainly proceed via 2024. The company keeps that the Fed is attempting to “speak” to the marketplace towards keeping problems. Limited monetary plans as bond returns drop in the previous 2 months as well as financial development reduces, recommending that the battle to manage rising cost of living will certainly finish in 2023.

Barclays originally anticipated prices to drop in the 3rd quarter of 2023 too, yet pressed back the projection to November 2023 because of durability to rising cost of living. Nonetheless, the business’s price quotes continue to be in advance of the Fed’s timetable because of the high likelihood of a following economic crisis. And also Morgan Stanley remains to forecast that the very first cut will certainly happen in December 2023. JPMorgan Chase scientists claim the Fed can reduce prices next year as well, yet just if variables such as increasing joblessness, reduced rising cost of living, as well as damaging financial task merge in time.

Meanwhile, a lot of financiers evaluated by the financial institution do not anticipate prices to go down up until 2024. Goldman Sachs financial experts concur. Principal financial expert Jan Hatzius states rising cost of living has actually been even more consistent than anticipated as well as does not anticipate rate cuts up until 2024.

Still, Bloomberg Business economics is almost sure an economic downturn will certainly hold within a year, as well as a lot of economists agree. Some claim that if joblessness climbs high sufficient, the Fed can hinge on its efforts to strike the 2% rising cost of living target price, as there are signs the rising cost of living price will certainly continue to be over that target for the near future. Regardless, it is most likely that prices will certainly enhance in the future up until 2023, which will certainly likewise impact home mortgage prices. Also in the most effective of times, a lot of professionals do not anticipate home mortgage prices to go down up until they end of 2023and they can continue to be raised via 2024 if a durable economic situation needs the Fed to be a lot more hostile.

On The marketplace is organized by Fundrise

Fundrise is transforming the means you buy realty.

With straight accessibility to top quality realty financial investments, Fundrise allows you construct, handle, as well as expand a profile at the touch of a switch. By integrating advancement with experience, Fundrise optimizes your lasting return possibility as well as has actually swiftly come to be America’s biggest direct-to-investor realty financial investment system.

.

Find out more concerning Fundrise.

BiggerPockets Keep in mind: These are viewpoints composed by the writer as well as do not always stand for the sights of BiggerPockets.

.