Table of Contents

What Is the Client’s Responsibility During the Financial Planning Process?

What Is the Client’s Responsibility During the Financial Planning Process?

Identifying Goals

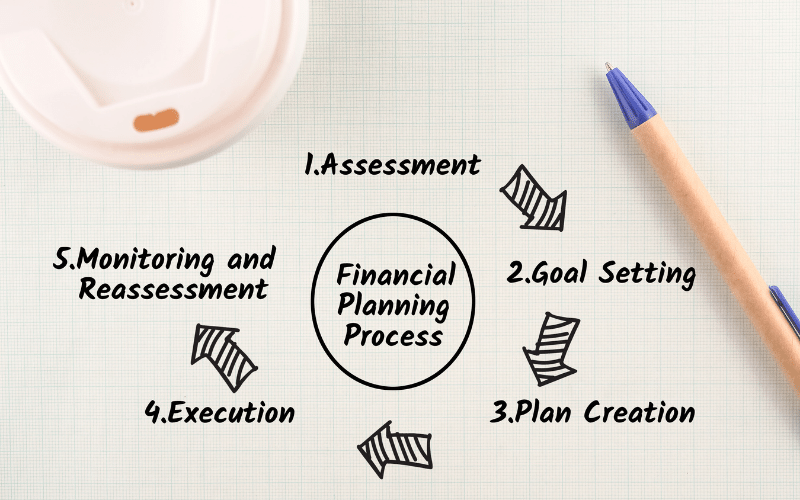

The first step in the financial planning process is identifying the client’s goals. A CFP(r) professional can help clients identify and prioritize their goals and then apply reasonable assumptions and estimates to reach them.

During this process, the CFP(r) will discuss with the client the options available, including the period and amount of investment returns that may be needed.

Once the goals are identified, the next step is to prioritize them. This involves several steps. A financial advisor can help clients prioritize their goals, but the client is ultimately responsible for ensuring that their financial plans achieve them.

The client may not understand their financial goals and, thus, will need help from an adviser. This is why clients need to communicate and understand their goals in advance.

A financial plan is a living document, but it will only be helpful if the client regularly updates it. The planner and client should monitor it and report back periodically so that they can adjust the recommendations as needed. The client must be willing to commit to a monitoring process so that they can make changes as needed.

The first step of the financial planning process is determining the client’s financial status. During this step, the planner will analyze the current financial situation, their goals, and their financial situation to develop a comprehensive plan.

Then, they will make recommendations based on the analysis. During this process, the planner will also present the facts to the client and help them make the best decisions.

Once the client and the financial adviser have completed the financial planning process, they will sign the final report that summarizes the results of the planning process. Suppose the client is happy with the plan.

In that case, the adviser may implement the recommendations, act as a coach, coordinate with other professionals, or handle the interaction with financial product providers. After the plan has been implemented, the client and advisor should periodically review the plan to make sure that the goals are still being met.

Defining the Scope of Engagement

During the financial planning process, it is vital to determine the scope of the engagement between the client and the financial planner.

The scope of engagement sets the parameters of the work involved. It should be mutually defined so both parties can understand what is required. The financial planner must also communicate to the client the significance of certain information.

Defining the scope of engagement is important to ensure that the advice given is based on a thorough analysis.

After defining the scope of the engagement, the two parties must discuss their expectations, responsibilities, and conflicts of interest. The two will also discuss the financial goals and priorities of the client.

A financial planner will then collect quantitative and qualitative information about the client’s needs and priorities to analyze their financial situation.

A CFP(r) professional must also limit the work they perform for a client. If the client is unwilling or unable to provide sufficient information, a CFP(r) professional must terminate the engagement. Depending on the nature of the engagement, a CFP(r) professional may continue their work in a different area.

After defining the scope of engagement, the financial planner must determine which products or services are appropriate for the client.

The practitioner can provide alternative suggestions if the client is uncomfortable with specific recommendations. Depending on the nature of the engagement, a CFP(r) professional may have a conflict of interest or material relationship with another professional.

A financial planner can assist the client with taking action on the recommendations. In some cases, this may include providing periodic progress updates on the client’s financial goals.

Other times, it may require the planner to help the client revise the recommendations. This is why it is important to define the scope of the engagement before starting the work.

Monitoring progress

A financial planner can monitor his or her plan’s progress at regular intervals. This can be accomplished through technology. For example, financial planning software can alert the planner automatically whenever relevant events occur.

For example, if the probability of the client’s plan’s completion drops below a threshold, the software will inform the planner automatically. The planner can then review the situation with the client.

As the financial planning process evolves, so should it’s monitoring. It is essential to keep an eye on the plan’s overall progress and make changes when necessary.

This is because life events can bring new perspectives and require adjustments to a financial plan. In addition, changes in tax laws, interest rates, and stock market fluctuations may necessitate updating.

As we age, our priorities change. Similarly, our plans should be flexible enough to adjust as we age. For instance, if we plan to run a family business, we must plan for the future, as we never know what the future may hold. A financial plan should consider these changes and allow for future growth.

It is also vital to communicate with your financial advisor regularly. A minimum of once per year is adequate, but two to three times is ideal.

Conversations with your financial advisor can help you keep a close eye on your progress and your plans. They can also help you assess risk tolerance and adjust your strategy based on new circumstances.

After the financial planning process, the final step is to review your plan periodically to ensure it meets your goals.

The financial planner should provide regular reports to keep you updated on your financial plan’s progress and assess whether or not you should make any changes.

They should also be contacted when you experience significant life changes to ensure that the plan meets your needs.

Developing a Strategy for Implementing Your Plan

Financial planning is a two-way process: the financial professional works for you work for them to create a plan that meets your goals.

A financial professional also teaches you about your role and responsibilities. Your financial plan should be a living document, evolving and changing with your circumstances.

Financial planning starts with understanding a client’s financial situation. It then analyzes the client’s current course of action and alternative courses of action.

The financial planner then develops a recommendation based on the analysis. The recommendation is then presented and implemented to help clients achieve their goals.