Table of Contents

What is a Personal Financial Statement Example?

A Personal Financial Statement (PFS) is a must-have document for anyone seeking to make sense of their financial situation. This document consists of assets, Liabilities, Income, and Expenses. The Assets section of the PFS includes your assets and liabilities, while the Liabilities section consists of your income and expenses.

Assets

A personal financial statement example includes a list of all assets and liabilities of a person. As of August 8, 2017, John has a total net worth of $93,100, with assets worth $353,600 and liabilities totaling $260,500. To calculate your net worth, you must subtract your debts from your assets. Your debts include any accounts you owe, credit cards, and mortgages.

You may also want to categorize your assets based on their purpose. For example, cash in a checking account is used for current expenses, and cash in a savings account is a short-term investment. On the other hand, investments in real estate are long-term investments that require a lot of debt and are illiquid.

An asset can belong to you, but it must be your own. Examples of assets are real estate, automobiles, life insurance policies, jewelry, and firearms. In addition to these, you may also have business assets, such as business loans. Other assets include cash in a checking account, stock and inventory, and business books. Some assets are more valuable than others, such as rare coins or fine art.

A personal financial statement includes the person’s full legal name, address, and phone number. Other information may be included, such as the name of the company for which the person is seeking loans. The balance sheet also contains the total assets and liabilities of a person. These numbers represent the individual’s net worth.

Personal financial statements should be reviewed annually and when significant changes occur in their financial situation. They are an essential step towards being in control of your finances. Fortunately, many resources are available to help you prepare a personal financial statement.

Liabilities

Liabilities refer to the debts and obligations you owe to others or are cosigners. These debts include personal loans, credit card balances, small claims against you, and unpaid taxes. It is important to be as accurate as possible when listing your liabilities.

The first step to preparing a personal financial statement is to list all your debts and assets. Then, total up the figures. Deduct your liabilities from your assets, and you’ll have a net worth. If you have a mortgage, you’ll need to subtract the amount you owe on it from your assets.

You can also include the value of rented items and property. However, if you’re renting, they won’t count as an asset. Also, don’t forget to include any unpaid debts that you owe.

Liabilities are debts you owe to other people or institutions. They may include things you owe on credit cards, but if you pay them off each month, they don’t count as a liability.

You need to be as honest as possible when calculating your net worth. Even if you have a high net worth, you may have several financial problems. Creating a personal financial statement requires that you place these issues in context.

For instance, you may accrue a lot of debt while pursuing higher education but bring in little income. However, the education investment supposedly pays off in higher salaries after graduation.

The balance sheet on a personal financial statement should include a full name, home address, and total assets and liabilities. In addition, you should include the total net worth (also known as personal equity) – the amount of money you would have left over after selling all of your assets.

Income

A personal financial statement provides a snapshot of an individual’s assets and liabilities. It typically includes information about a person’s assets, such as liquid assets, real estate, cars, furniture, and investments. It also lists their liabilities, such as debts and overdue taxes.

An individual must understand the various terms used in a personal financial statement. It can help someone obtain credit or provide an overview of their financial situation.

The income on a personal financial statement includes all types of income, including salary, tips, commissions, and other sources of income.

In most cases, income and liabilities are reported monthly or yearly. However, a person’s mortgage may qualify as a positive debt if the person is making regular mortgage payments.

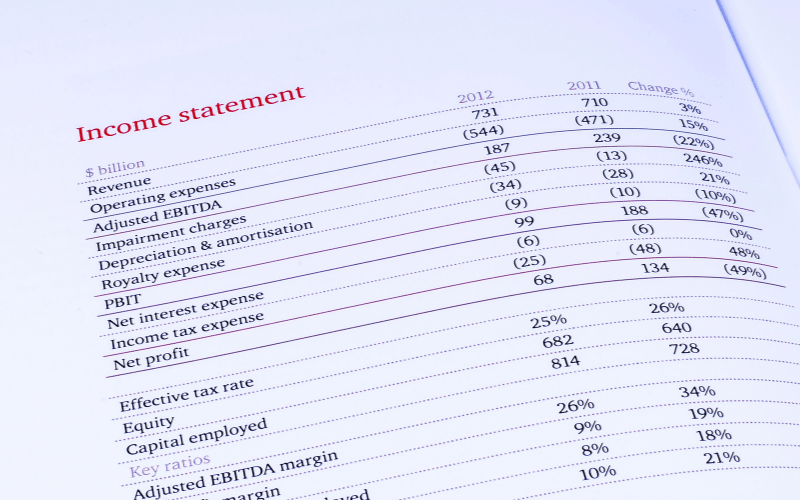

A personal financial statement comprises two main parts: the income statement and the balance sheet. Each section focuses on a different aspect of an individual’s financial situation. Income on a personal financial statement measures a person’s net income, and expenses reflect living costs.

In addition to assets, a personal financial statement also lists expenses. Assets are items owned by the individual. These items may include student loans, car payments, utility bills, and insurance. Personal property may also be listed as an asset, but only if it is of significant value.

Typical assets include real estate, mineral rights, riparian rights, oil and gas rights, and checking and savings account balances. Some people may avoid personal expenses, such as eating out or paying medical bills. While this is an integral part of a personal financial statement, it isn’t intended to be a comparative analysis of your neighbor’s income and expenses.

Expenses

The purpose of a personal financial statement is to give a comprehensive picture of your financial situation. This document includes assets, liabilities, and sources of income. A PFS can be required for various reasons, most commonly when applying for a loan. Its primary purpose is to give lenders an accurate picture of your finances.

Expenses are costs that you incur to generate revenue. Examples of everyday expenses include employee wages, equipment depreciation, and suppliers’ payments. Expenses are divided into operating and non-operating categories.

Operating expenses are those generated from your core business activities, while non-operating expenses are those that are not. For example, if you are a homeowner, expenses may include mortgage payments, rent, and entertainment.

The information you enter on your financial statement should include your full legal name, address, telephone number, and other contact information. You may also want to include the name of your business if you are applying for a loan.

Your net worth should also be indicated. The financial statement should also include any loans you have taken out and any other assets you have.

While personal financial statements are designed for individual use, they can also be used to obtain credit and to determine your overall financial situation. They list all forms of income and expenses, usually in monthly and yearly amounts. The statement will not include business-related assets or liabilities, like business loans.

Examples of Personal Financial Statements

A personal financial statement is an essential tool for planning your financial future. It can help you monitor your expenses and increase your net worth. You can also use it to measure your progress toward achieving your financial goals.

Personal financial statements come in various formats and can be as simple or complex as you like. However, they all summarize your financial position and help you determine how well you are doing in terms of your financial goals.

When preparing a personal financial statement, it is essential to include details such as your legal name, address, telephone number, and other contact information. Including the name of your business if you are an entrepreneur is also helpful. The statement also includes a balance sheet, which lists your assets and liabilities and calculates your net worth.

A personal income statement reflects your monthly income and expenses and is similar to a company’s income statement. It shows your net cash flow, as well as dividends and interest. Banks use this type of financial statement to determine your capacity to repay loans. You can also include investment income and rental income.

Personal financial statements contain two main parts: an income statement and a balance sheet. The income statement is the more comprehensive of the two. In a balance sheet, you list your assets on the left and liabilities on the right.

Both of these sections show the health of your finances. It also tells lenders your net worth and how much you owe. Personal financial statements are also used for credit applications and mortgage loans.

While calculating your net worth, it is essential to be as truthful as possible. However, it is crucial to understand that your financial situation can change significantly.

For example, a person might spend a lot of money pursuing an advanced degree while earning a small income. This educational investment will pay off after they graduate and earn a higher salary.