Table of Contents

What is a Bond in Investing?

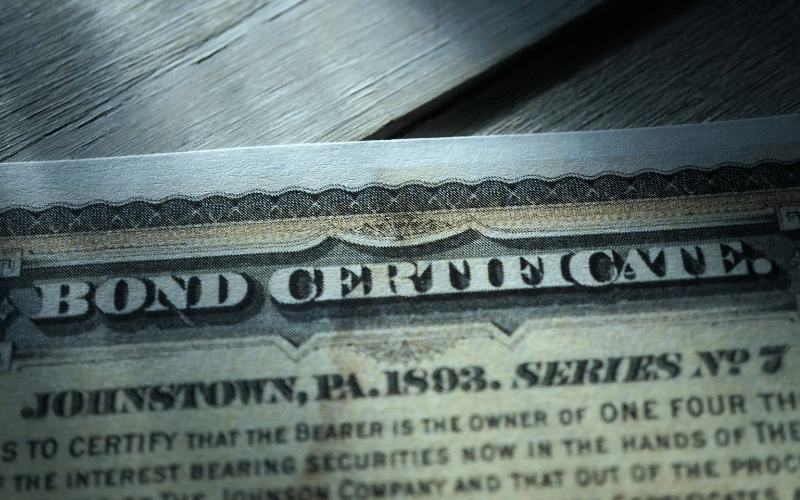

A bond is a type of investment that pays interest. Governments and companies issue them when they want to raise money.

You are lending the entity the money to continue operations by purchasing one. In return, you receive interest at a predetermined interval.

There are two types of bonds: fixed-rate bonds and floating-rate bonds. You can invest in these two types of bonds or a bond fund.

Interest on a Bond is Collected When You Buy a Bond

When you buy a bond, you will receive periodic payments of interest. These payments will be made at specific intervals, usually every six months or yearly.

This is known as a coupon. The interest is calculated from the time the bond was issued. The bondholder is then entitled to receive the amount of the contract price of the bond plus the interest.

Buying a bond does not give you ownership of the item but represents a loan to the issuer. The bond issuer may be a government or company.

The bond has a stated interest rate, which changes over time as it becomes more valuable to buyers. Bonds with shorter maturities and higher quality generally have lower interest rates.

When you buy a bond, you will receive a coupon. The coupon is the interest you will receive when the bond matures. During this period, the bond issuer will pay you the face value of the bond, which is typical $1,000.

During this period, you will receive a payment of interest equal to the amount you have received in the past, known as the coupon rate.

Bonds are long-term investments, so make sure you buy the right ones based on your financial goals.

For example, if you are saving for a down payment on a home or a child’s college education, you should consider buying a bond that matches your goals. Investing in bonds allows you to build wealth without risking your capital.

Bonds have fixed and floating interest rates. Fixed interest rates stay the same for the bond’s life while floating interest rates change every six months. Typically, you will be paying 5% of the face value of the bond each year.

Interest on a Bond is Collected at Maturity

A bond is an investment that pays its investors interest upon maturity. Although the bond price does not matter until maturity, it will depend on interest rates when the investment is made. At maturity, the bondholder receives the face value of the bond, provided the issuer doesn’t go bust or default on payments.

Bonds are one of the most popular forms of investing. They offer investors a fixed income, and many experts believe the market is turning around. A bond is essentially a loan from one investor to another.

The investor pays the other party interest throughout the term, and the other party only has to pay the loan back at maturity.

A bond can be purchased directly from an issuer or a broker. Each bond is assigned a credit rating, which tells investors how likely the issuer will pay back its investors. A bond has a maturity date ranging from a day to a hundred years. The majority of long-term bonds mature around thirty years.

Buying a bond is an investment that is usually long-term. Therefore, choosing the proper bond aligned with your financial objectives is essential.

For example, you might want to invest in bonds to save for a downpayment on a new home or a child’s college education. Each bond has a coupon, the annual interest rate paid on the borrowed money. Individual bonds generally pay out the coupon every six months or annually.

If you invest in interest-bearing bonds, the money you invested in them will be paid out at maturity. The interest is calculated annually and is added to the original amount invested. This compounded interest continues to grow over time, meaning you will receive money year after year.

Fixed-rate and Floating-rate Bonds

Regarding investing, fixed-rate and floating-rate bonds are two types of securities. Fixed-rate bonds pay fixed interest rates, while floating-rate bonds are tied to various benchmarks.

Investors may purchase floating-rate bonds because they believe interest rates may increase, but they should remember that these securities are subject to market risks.

Both types of bonds have advantages and disadvantages. Fixed-rate bonds are generally less volatile than floaters. The performance of floaters can depend on whether the Fed hikes its target rate too often.

If it does, the price of floaters could decrease. However, investors should remember that floating-rate bonds are subject to a higher risk of default, especially if the issuer’s credit rating isn’t vital.

Fixed-rate bonds are less expensive than floating-rate bonds. Fixed-rate bonds are less volatile but are subject to market risks.

Fixed-rate bonds have a low price when the interest rate is low, but as interest rates rise, they lose value. However, investors can make reasonable investments even if they know the maturity price.

Fixed-rate bonds are less volatile than floating-rate bonds, but they can carry additional risks, including MTM losses and coupon returns.

If you want to be fully protected against interest rate increases, you should opt for a fixed-rate bond with a more extended maturity period. But remember that the longer the maturity period, the higher the interest rate will be.

While fixed-rate bonds offer more security and stability, they are also subject to a high level of risk. A fixed-rate bond pays a fixed amount of interest for a specific period, while a floating-rate bond pays a variable rate.

The rate of interest changes according to the benchmark interest rate and can even fluctuate with the market. A fixed-rate bond, for example, pays more money if the interest rate is higher than the benchmark.

Investing in a Bond Fund

Investing in a bond fund is a way to diversify your portfolio by taking on more risk. Bond funds invest in various bonds, depending on the investor’s risk tolerance and desired return. They may consist primarily of government bonds or be a mix of different types.

The risk and return associated with each type are different. The fees and track record of each fund should also be carefully considered.

Bond funds invest in various securities, including government bonds and corporate debt. While the investor does not directly own them, they are professionally managed and can provide investors with a great degree of diversification.

As such, the income the fund earns will reflect the mix of bonds in the fund and may vary from month to month.

A bond fund is similar to a mutual fund but is dedicated to investing in bonds. Bond funds are a much more efficient investment than buying individual bonds.

A bond fund is not subject to the risk of default or other problems associated with equity investments.

In addition, unlike individual bonds, a bond fund has no maturity date. Instead, investors can benefit from monthly passive income from coupons, thanks to the diverse mix of bonds in the fund.

While investing in a bond fund can help you diversify your portfolio, it’s essential to understand the risks and rewards of the investment. Bonds are considered conservative investments and typically have lower volatility than equities.

But it’s important to remember that investors should not time the market. Instead, focus on achieving their long-term investment goals.

Buying Individual Bonds

Buying individual bonds in investing requires a significant amount of research. Because thousands of individual bonds are available, it is difficult to determine the creditworthiness of each one.

While many investors hire a financial advisor to buy these bonds, they can also do it through most brokerage accounts. While the amount of research required varies, some common factors can help you make a wise decision.

First, there are two main types of bonds: municipal and federal. Municipal bonds are issued by state or county governments. These bonds are not traded on exchanges but can be purchased directly from the issuer.

Older bonds are typically traded through secondary market brokers. Because they are not traded on an exchange, their transaction costs are higher than those of buying and selling stocks. Additionally, they typically carry a more extensive spread than stocks.

While individuals can purchase individual bonds, bond funds are a better option for most investors. Bond funds have lower costs and diversification. Furthermore, bond funds pay dividends every month and can be reinvested automatically. In addition, bond funds are much more liquid than individual bond issues.

When investing in individual bonds, make sure to do your homework. You should consider the credit rating of the issuer. You should also look at the bond’s duration. While investing in individual bonds, you can also avoid paying unnecessary brokerage fees. Furthermore, buying individual bonds can be a passive and diversified investment method.

You should remember that the cost per bond may be higher than the cost of a bond fund. This is because you will have to pay a commission on each bond. In addition, bond funds are typically more volatile than individual bonds, which may lead to higher fluctuations in their price.