Table of Contents

Originally Published: December 14, 2022, 2:00 pm ET

Updated: December 14, 2022 at 2:48 pm ET

The December Federal Get conference ended with a news from the Federal Get at 2 pm ET. Currently, Fed Chairman Jerome Powell’s real-time remarks at the 2:30 pm ET interview remain in emphasis. Whether you’re trading dime supplies or higher-priced supplies, today’s financial information cycle is most likely to contribute in your choice making. As we found out at the last FOMC conference, the Fed’s declaration lugs weight, yet not as high as what can be stated in the real-time interview that will certainly comply with.

Whether Powell’s remarks are one more time hawkish or transform dovish complying with the current CPI information for November, he makes sure to establish the tone for the remainder of the year. Santa Claus rally or stock exchange accident, investors will certainly utilize information from the December FOMC conference, the price trek choice as well as the Powell interview to design an approach to take advantage of the resulting reaction.

December 2022 Fed Price Walking Announcement

Looking in advance to the December FOMC conference, assumptions are high that the Fed will certainly approve a 50bp walking. Some assumed that this could be out of the home window many thanks to the shock record from PPI. However last month’s customer cost information appeared to have actually relieved near-term problems.

At the same time, the elephant in the space, the tasks information, continues to be a sticky concern for pro-recession financiers seeking factors to begin purchasing worth supplies as well as abandoning development. They will likely obtain even more info on that particular subject later on today when the current round of out of work insurance claims is reported on Thursday.

There has actually been a great deal of chaos sustained by conjecture in advance of the Fed’s price trek choice in December as well as the FOMC conference. Definitely the hopes are that financial plan will certainly relieve as well as markets can obtain some much-needed alleviation heading right into 2023 after a wild 2022.

At the last FOMC conference, the Fed determined to increase the target array for the government funds price from 3-3/4 to 4%. He additionally stated it was ideal to see ongoing boosts in the target array to accomplish “limited adequate” financial plan to return rising cost of living to 2% in time. However a lot. The emphasis throughout the FOMC interview got on the labor market. Task openings continue to be high as well as wages were taken into consideration a “blended” image. Current remarks from Chairman Powell additionally highlight that smaller sized rates of interest walks might be on the perspective as well as can begin as early as December.

” … it makes good sense to relieve the rate of our price enhances as we come close to the degree of reducing that will certainly suffice to lower rising cost of living … The moment to relieve the rate of price boosts might come as quickly as the conference of december”.

Right here is a failure of the warm subjects as well as takeaways from the FOMC news as well as information from the December Fed conference:

December Fed Fulfilling, FOMC Declaration, as well as Rate Of Interest Walking Top 10 Takeaways

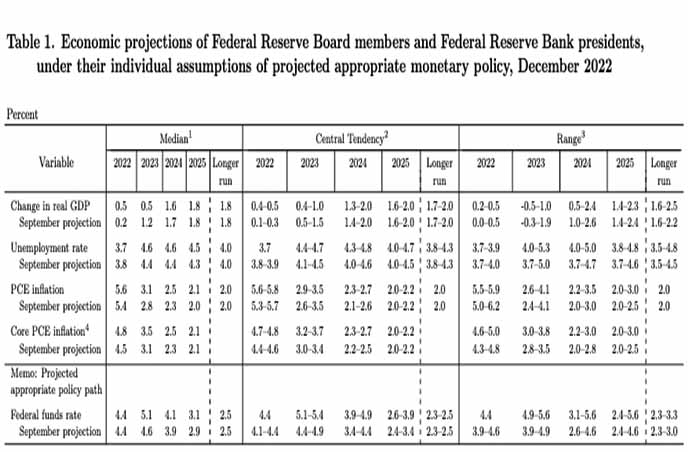

- Target Fed Finances Price of 5.1% in 2023, 41% in 2024, 3.1% in 2025 with a longer regard to 2.5%

- The Board of Governors of the Federal Get System elected all to boost the

interest price paid on get equilibriums at 4.4 percent, efficient December 15, 2022. - In an associated activity, the Board of Governors of the Federal Get System voted

unanimously authorize a 1/2 portion factor rise in the key credit scores price for

4.5 percent, efficient December 15, 2022. - Conduct free market procedures as required to keep the government funds rate

in a target variety of 4-1/4 to 4-1/2 percent. - Participate in over night repo professions with a minimal quote price of

4.5 percent as well as with an accumulation operating limitation of $500 billion; the aggregate

the operating limitation might be briefly raised at the discernment of the Head of state. - Participate in over night reverse repo professions at a deal price of

4.3 percent as well as with a restriction per counterparty of $160 billion each day; the limitation per counterparty might be briefly raised at the discernment of the Head of state. - Reinvest in public auction the quantity of the Federal Get’s major payments

holdings of Treasury safety and securities growing in each schedule month that surpasses one

limit of $60 billion each month. Redeem Treasury voucher safety and securities approximately this

monthly restrict as well as treasury costs to the degree voucher major repayments are

less than the month-to-month cap. - Reinvest in firm mortgage-backed safety and securities (MEGABYTESES) the quantity of principal

payments on firm financial obligation holdings as well as Federal Get firm MBS

received in each schedule month that surpasses a cap of $35 billion each month. - Enable small discrepancies from the quantities established for rollovers, if required to

operational factors. - Join voucher redemption deals as well as buck rolls as required to facilitate

Settlement of the MBS deals of the Federal Get Company.

The stock exchange today after the FOMC conference news as well as price decision

Initially, the wider indices relocated lower with the S&P 500 ETF (NYSE: SPY) as well as the Nasdaq ETF (NASDAQ: QQQ) dropping after an extra hawkish Fed news. Nonetheless, contrasted to previous FOMC conferences, the action was not as hostile (originally) as we have actually seen. The stock exchange might be much more concentrated on what Fed Chairman Jerome Powell states at the 2:30 pm ET interview than anything else. As we have actually seen, view has actually been blended when contrasting what was stated in current interview with what is being reported in real Fed news records.

Emphasizes of Fed Chairman Jerome Powell’s December FOMC press conference

Notable remarks from Fed Chairman Jerome Powell after the December 2022 Fed meeting

- We will certainly go over certain remarks from the November Fed conference interview organized by Fed Chairman Jerome Powell, which starts at 2:30 pm ET. A web link to the video clip variation of that interview is offered over.

- Rate security is the emphasis right now

- The main rates of interest raised to expect ongoing boosts may be ideal to bring rising cost of living back to 2% over time

- The United States economic climate has reduced considerably considering that last year

- Consumer costs development has slowed

- Housing task has damaged considerably

- The labor market continues to be unbalanced

- The complete results of tightening up are not yet being really felt, although the Fed has covered a great deal of ground

- The rising cost of living numbers for October as well as November revealed indications that rising cost of living is boiling down, yet far more proof that rising cost of living is boiling down will be required.

- Also rising cost of living assumptions continue to be secured, currently is not the moment to be complacent

- It requires time for the remainder of the economic climate to overtake the results that have currently been seen by the rates of interest delicate fields, relative to require.

- Choices will be made conference by conference as well as strong steps will be taken concerning inflation

- When will rank walks quit? Responded to: It will certainly depend upon the information as well as the Fed has actually not determined the dimension of the Fed price hike

- The February choice will certainly be made based upon monetary problems, the economic climate as well as the degree of price boosts will certainly depend upon rising cost of living, monetary problems, yet at a specific factor the plan will certainly be limited adequate.

- Predicting slow-moving development yet not a recession