MarsBars

Many retail financiers like to choose their very own supplies, as well as when done right, it can be a winning approach. Nonetheless, in some cases you might require to defend against prospective bad moves or profile focus on a couple of supplies with varied ETFs that give prompt advantages. large diversity.

This brings me to the Lead Returns Gratitude ETF (NYSEARCA: VIG), which can act as an excellent option to the S&P 500 (SPY). In this post, I’m highlighting why VIG is an excellent option for financiers concentrated on overall return, so allow’s start.

Why VIG?

The Lead Returns Gratitude ETF looks for to track the efficiency of a basket of large ordinaries shares that have a background of raising rewards gradually. Its objective is to track the efficiency of the S&P United States Returns Growers Index.

VIG’s concentrate on dividend-paying firms has actually offered financiers well. As revealed listed below, VIG’s 3-year overall return return of 28% has actually exceeded the S&P 500’s 24% return.

VIG 3-Year Complete Return ( Searching For Alpha)

Also, unlike the S&P 500, VIG is not controlled by no-dividend or low-dividend-paying firms like Tesla (TSLA), Amazon.com (AMZN), Google (GOOG) (GOOGL), as well as Apple (AAPL). These previously mentioned firms have a significant impact on the S&P 500 as a result of their enormous market capitalizations, as well as the loss in their supply costs over the previous one year has actually had a destructive impact on the S&P 500.

In relative terms, VIG’s wide diversity right into returns manufacturers offers it extra security versus drawbacks. As revealed listed below, VIG has actually much exceeded the S&P 500 over the previous one year, down simply 10% contrasted to the S&P 500’s 19% decline.

VIG 1 Year Complete Return ( Searching For Alpha)

VIG’s leading 10 holdings are comprised of returns aristocrats as well as high-dividend manufacturers such as UnitedHealth Team (UNH) as well as Visa (V). UNH as well as Visa have outstanding 5-year returns CAGRs of 17% as well as 18%, specifically. In addition, as revealed listed below, no supply besides UNH represent greater than 4% of VIG’s overall holdings.

VIG’s Leading 10 Access ( Searching For Alpha)

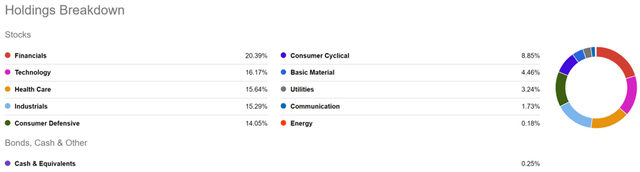

Risks for VIG consist of the possibility for an economic crisis as it has substantial direct exposure to monetary supplies, which as revealed listed below, VIG’s biggest sector consists of 20% of the total amount. Nonetheless, lots of economic experts are forecasting a light economic crisis, if any kind of, as well as lots of financial institutions are better exploited with more secure operating versions as a result of policies originating from the Great Financial Dilemma.

VIG Holdings Malfunction ( Searching For Alpha)

In truth, among VIG’s leading 10 holdings, JPMorgan Chase (JPM), is well exploited with a CET1 proportion of 12.5% as well as administration is targeting a 13% proportion for the initial quarter of this year. On top of that, JPM chief executive officer Jamie Dimon highlighted his preparedness with CECL (Existing Expected Debt Loss) gets as well as his capability to enhance them if required, as kept in mind throughout a current teleconference:

CECL currently integrates a percent of what our company believe the damaging repercussions may be. However certainly, if the atmosphere intensifies, we will certainly need to enhance the gets. And/or if we transform our expectation, implying our company believe the likelihood of damaging occasions is greater, we will certainly transform our bookings.

Bear in mind if joblessness increases to 5% or 6%, you’re most likely speaking about $5 billion or $6 billion throughout a number of quarters. Once again, simple to take care of, not a large offer. It simply does not influence funding a little bit.

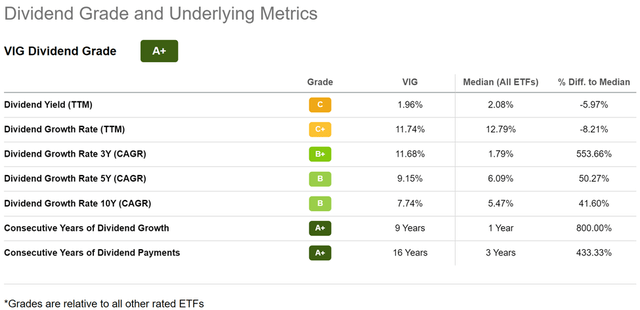

On the other hand, real to Lead type, VIG preserves among the most affordable expenditure proportions in the ETF sector, at simply 0.06%, well listed below the average of 0.40% throughout all ETFs. On top of that, VIG gains an A+ returns score, sustained by 9 years of successive development as well as a 3-year returns CAGR of 11.7%.

VIG Returns Qualities ( Searching For Alpha)

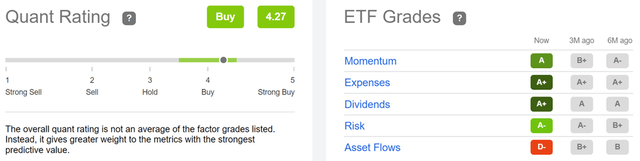

Finally, Looking for Alpha’s Quant score appoints VIG a Buy score with a rating of 4.3 out of 5. As revealed listed below, VIG gains A scores for energy, expenditure, returns, as well as danger.

Measurable category of VIG ( Searching For Alpha)

Investor Takeaway

The Lead Returns Gratitude ETF uses financiers an eye-catching alternative for overall returns as well as a greater returns return than the S&P 500. It has actually exceeded the S&P 500 for the previous one as well as 3 years, as a result of its reduced direct exposure to supplies with enormous market capitalizations. This offers VIG financiers extra security versus loss. Last but not least, I see VIG as a strong alternative at the existing rate of $151 for prompt diversity as well as possibly solid lasting returns.

.