Both of them nonfarm payrolls Y Wages for November revealed a inverted surprise last Friday. The seasonally readjusted NFP recorded data +263 K vs. market assumptions of +200 K, while October worth was changed approximately +284 K (was +261 K). On the various other hand, the average incomes per hour Tape-recorded 0.6% (m/m) (the fastest development price considering that January of this year), its previous worth changed upwards to 0.5% (was 0.4%); Contrasted to the exact same duration in 2014, the information videotaped 5.1% higher than the previous worth (4.6%) and also agreement quote (4.7%). Unemployment rate stays unmodified in 3.7% .

Fig. 1: United States NFP, joblessness price and also typical per hour incomes. Font: industrial economy

Fig. 1: United States NFP, joblessness price and also typical per hour incomes. Font: industrial economy

The tightening up of the labor market along with the rise in incomes (which can cause greater rising cost of living) will certainly tax the Fed to ensure that the reserve bank can require that it elevate its projection for the incurable price. It’s still prematurely to assert triumph over rising cost of living, and also also if it’s not in an economic downturn, the United States economic situation is most likely to be lukewarm in 2023. At market close, the significant United States indices. significant somewhat reduced: USA500 at 4064, USA100 at 11960, USA30 at 34341.

Summary: Field Efficiency ( Resource: Tradingview) :

- The Power Minerals field is the greatest gainer via 2022, with YTD gains of +52.34%.

- Industrial Provider remains in 2nd area, with YTD gains of +22.42%.

- Various other industries with favorable YTD gains consist of Circulation Solutions, Medical Care, Medical Care Modern Technology, Non-Energy Minerals, and also Utilities.

- The greatest loser is customer durables (YTD -36.69%) followed by Modern Technology Provider (YTD -27.96%), Retail Profession (YTD -17.61%), Electronic Modern Technology (YTD -16.72%), and so on

oil marathon

Founded in 1887, the American oil firm oil marathon is devoted to the refining, advertising and also transport of oil items. It is just one of the fastest expanding power stocks and also among market individuals’ favored choices to power supplies besides Occidental Oil (the Oracle of Omaha, Warren Buffett’s infant).

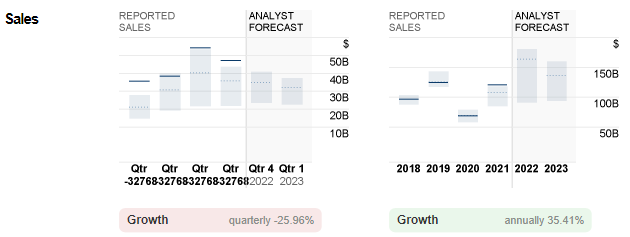

Fig. 2: Marathon Oil reported sales vs. expert projection. Font: CNN Business

Fig. 2: Marathon Oil reported sales vs. expert projection. Font: CNN Business

Marathon Oil provides sufficient outcomes via 2022. Its sales for the last 3 quarters of the year carried out on the same level with agreement quotes, at $38.4 billion, $54.2 billion, and also $47.2 billion. Its fourth-quarter incomes are set up to be launched on February 1 of following year. The expert anticipates the firm’s sales to get to $35 billion, while overall sales for the year will certainly get to $163.7 billion, a boost of greater than 35% over the previous year.

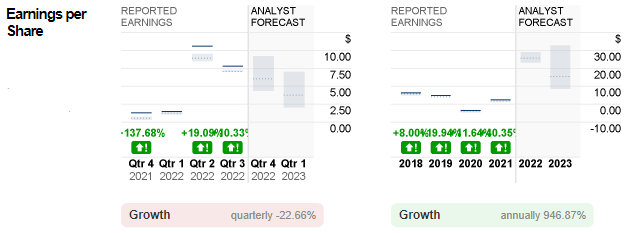

Fig. 3: Marathon Oil reported EPS vs. Expert Projection.

Fig. 3: Marathon Oil reported EPS vs. Expert Projection.

Font: CNN Business

In regards to EPS, the firm had a huge enter Q2, at $10.61 (Q1 at $1.49). Last quarter it signed up $7.81. All 3 quarters carried out over agreement quotes. In the coming quarter, the expert anticipates its EPS to strike $6.04, while full-year EPS is anticipated to strike $25.65, greater than 10 times what was reported in 2021.

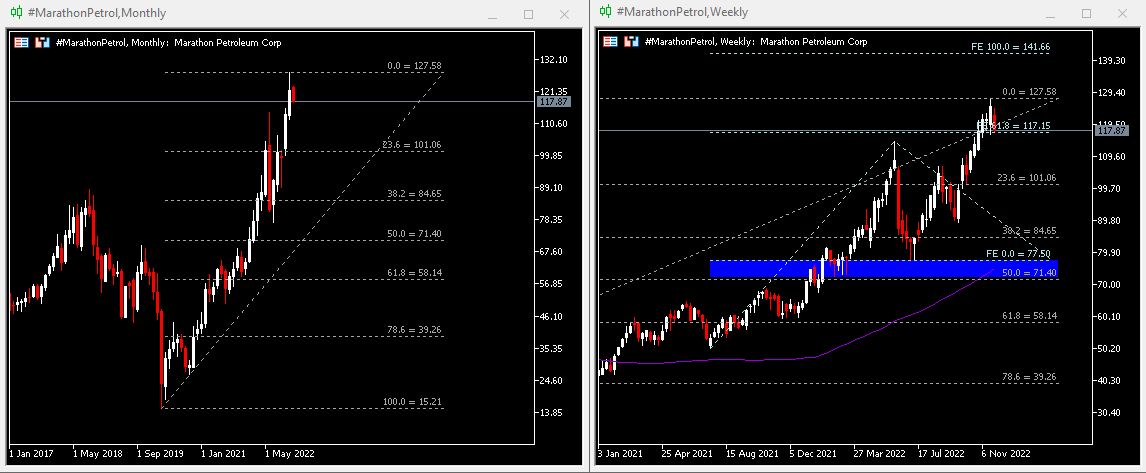

Technical analysis:

#MarathonPetrol (MPC.s) supply rate has actually remained in a solid uptrend considering that getting to assistance in March 2020. It lately finished a 6-week winning touch, retesting assistance at $ 117 (FE 61.8%). A close listed below this assistance might show that the bears remain to place stress in the direction of the following assistance in $ 101 (RF 23.6%), adhered to by $ 85 (RF 38.2%). Or else, as long as the $117 assistance stays undamaged, the closest resistance to concentrate on is the all-time high. $ 128followed by $142.

Click here to gain access to our Financial Calendar

larince zhang

market analyst

Disclaimer: This product is supplied as a basic advertising interaction for informative functions just and also does not make up independent financial investment study. Absolutely nothing in this interaction has, or must be considered to have, financial investment guidance or financial investment referral or solicitation for the objective of purchasing or offering any kind of economic tool. All info supplied is put together from trustworthy resources and also any kind of info which contains an indicator of previous efficiency is not an assurance or a reputable sign of future efficiency. Customers recognize that any kind of financial investment in Leveraged Products is identified by a specific level of unpredictability which any kind of financial investment of this nature includes a high degree of threat for which individuals are only accountable. We do not think any kind of obligation for any kind of loss occurring from any kind of financial investment made based upon the info supplied in this interaction. This interaction might not be replicated or dispersed without our previous written approval.

.