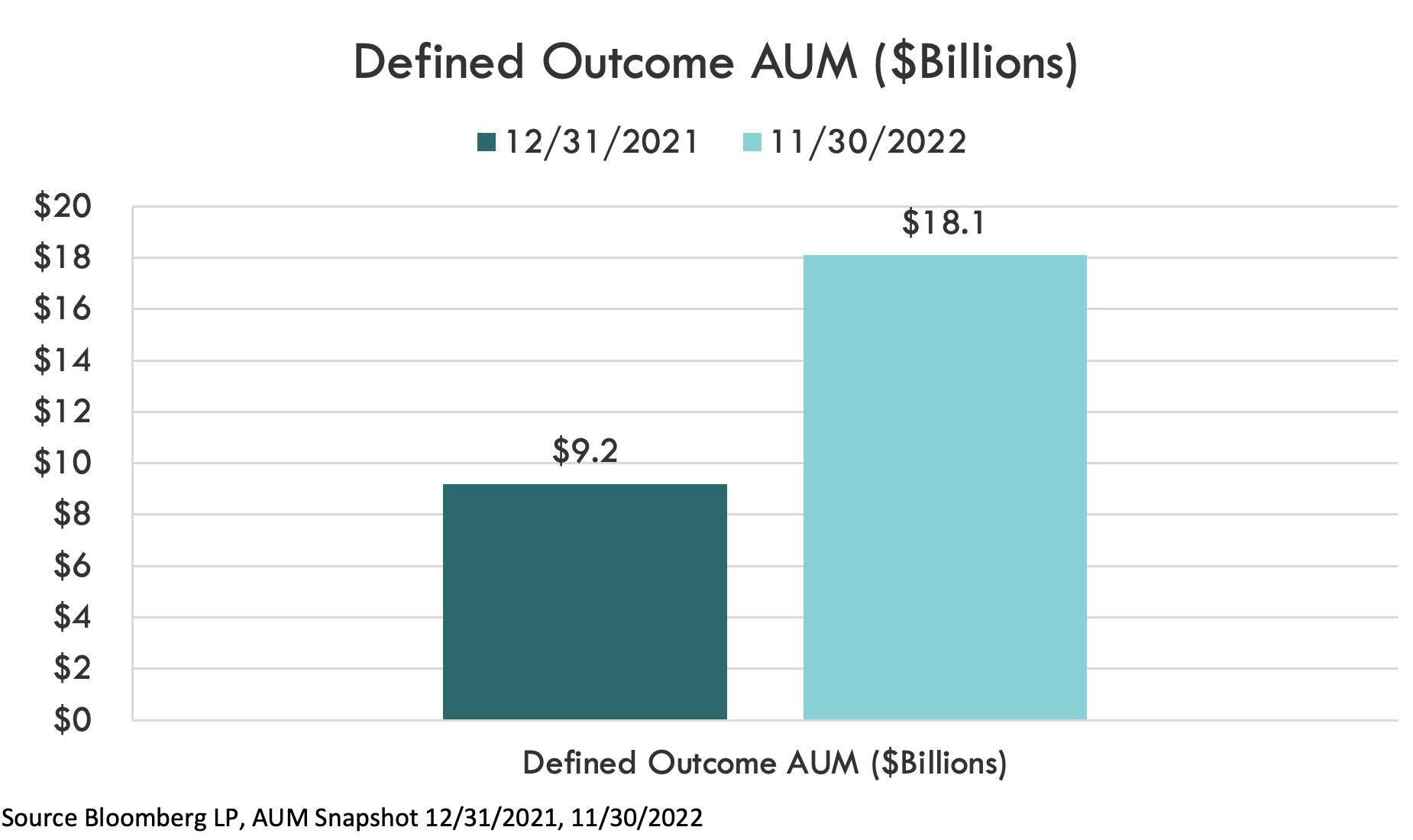

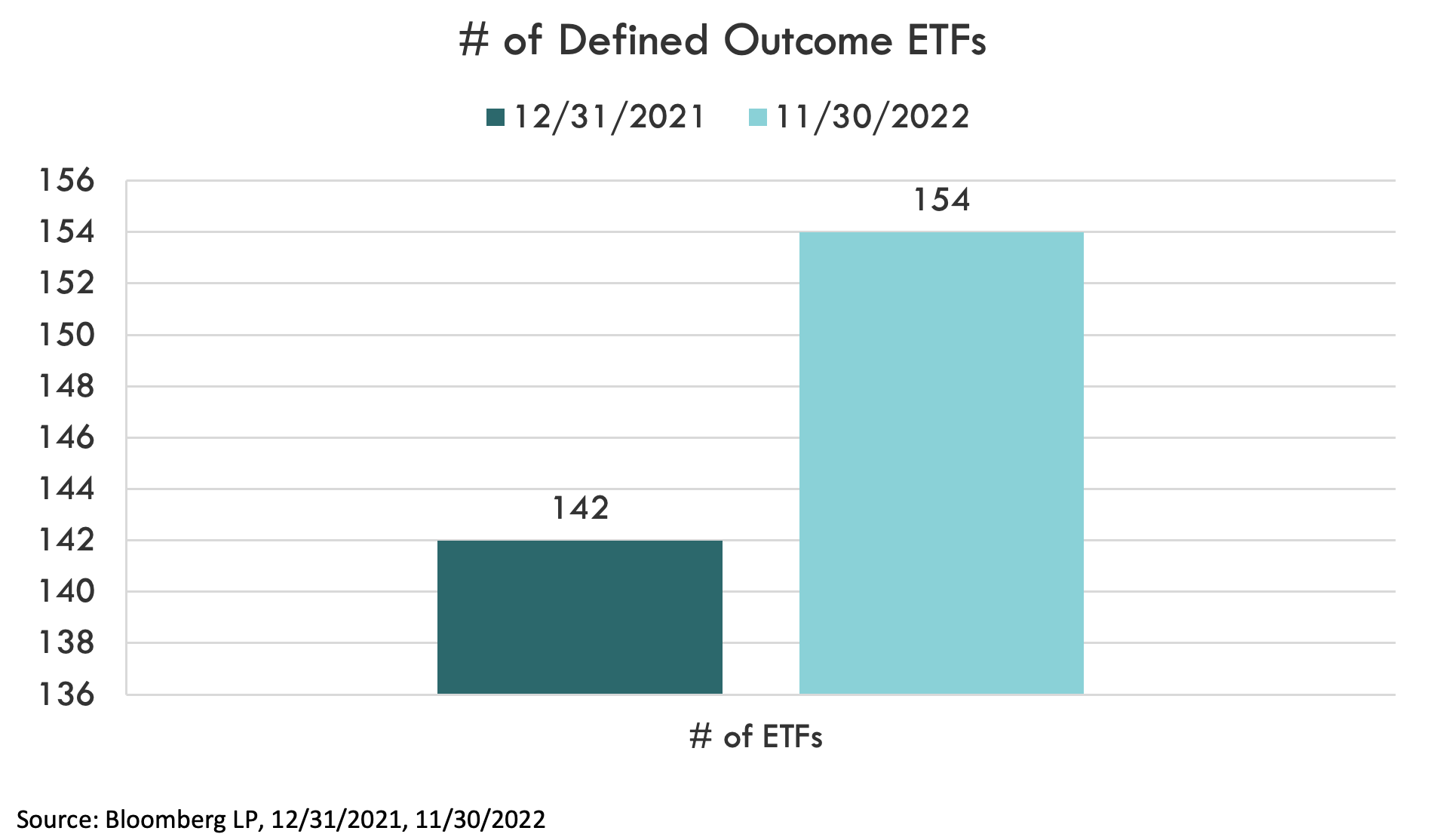

In a year in which supplies and also bonds dropped greatly, among the leading investing fads of 2022 was the fast development of defined-return ETFs and also their fostering by economic consultants. With greater than $9 billion in internet circulations with November to the around 150 ETFs from 5 fund enrollers, properties in the classification virtually increased to $18 billion. While accessibility to ETFs stays restricted at a number of significant nationwide broker/dealers, use amongst authorized financial investment consultants (RIAs) has been solid and also increased in 2022.

What are Specified Outcome ETFs?

Defined End result ETF attempt to offer capitalists with well-known varieties of future financial investment returns prior to spending. These option-based progressive financial investment techniques offer capitalists with direct exposure to a criteria with a recognized series of benefit and also disadvantage development capacity, consisting of danger reduction functions such as a “barrier” or flooring versus losses, throughout a predefined amount of time called the “results duration”. Specified Outcomes ETFs reset yearly or quarterly and also can be held forever. They resemble tradition organized items, yet the wrapper ETF supplies tax obligation performance, openness, and also liquidity while negating the debt danger that structured items can lug.

There are a couple of tastes of these funds. Specified Efficiency ETFs consist of Barrier ETFs, Accelerated ETFs, and also Flooring ETFs. Barrier ETFs, which seek to offer the favorable efficiency of wide and also fluid criteria (e.g. SPY, QQQ, IWM, EFA, EEM, TLT) as much as an established restriction, with integrated barriers versus losses. Loss-absorbing techniques with a pillow were the initial to show up in 2018 and also make up most of funds, properties and also moves in the classification.

Cushioning losses from the 2022 bearishness

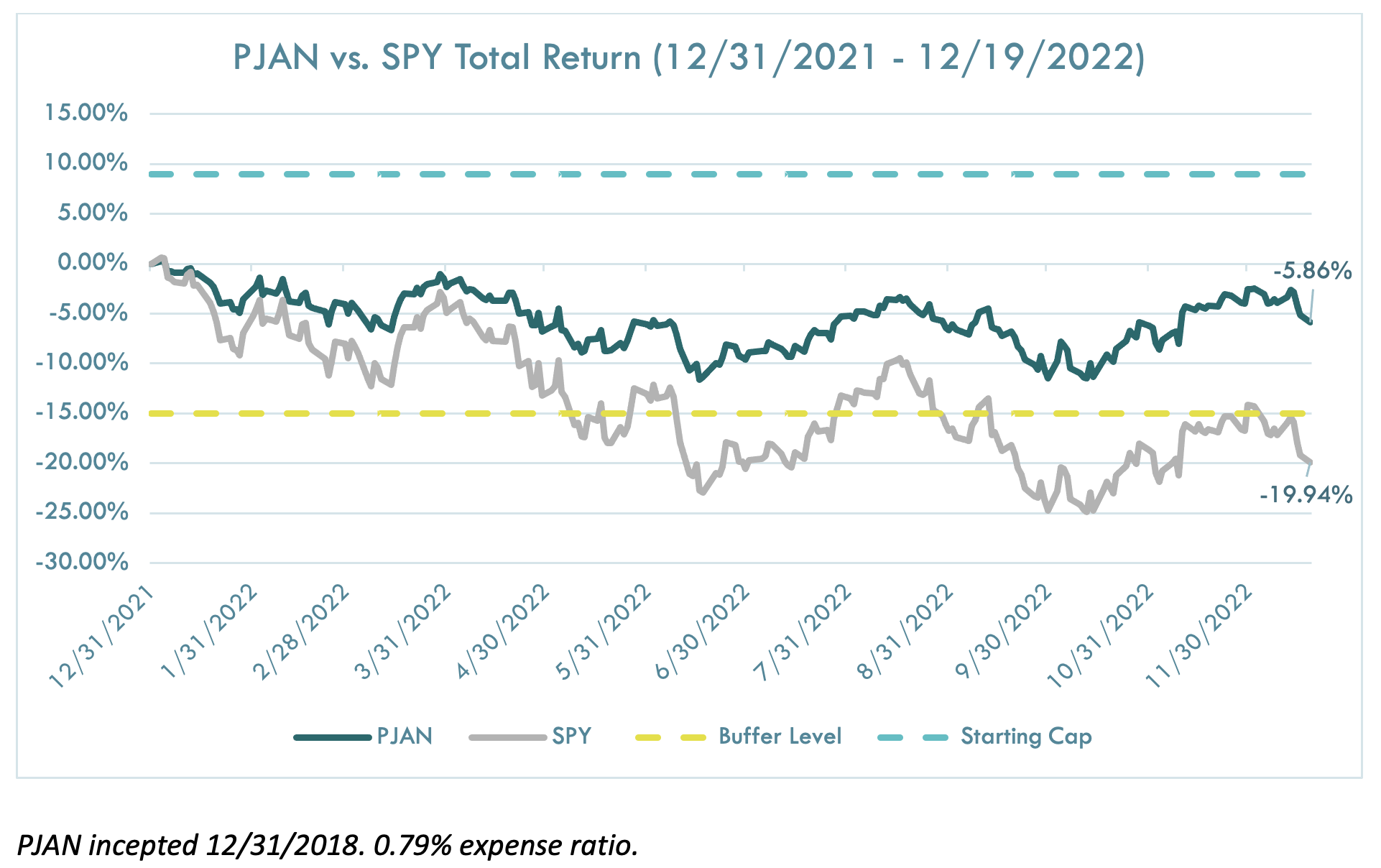

And, as 2022 revealed, the focus consultants have actually paid to Barrier ETFs has actually repaid. Among the biggest Barrier ETFs is my company’s United States Equity Power Barrier ETF (Ticker: PJAN), which looks for to support the initial 15% of losses in SPY over a 12-month duration, gross of costs. Just how was this year? Till Monday, December 19theWith much less than 2 weeks continuing to be in the fund’s efficiency duration, SPY dropped -19.94% while PJAN dropped much less than -6%. As a matter of fact, with the majority of criteria trading substantially at a loss up until now this year, the collection of Barrier ETFs that reset for January have actually hedged versus market losses in their benchmark property with much less volatility when traveling, a circumstance comparable to the July collection.

Using the Specified Result ETF Advisor

With a lot of possible applications, different settlement frameworks, and also benchmark direct exposures in over 150 ETFs traded today, just how do defined-result ETFs be utilized by economic consultants? While it prevails to learn through consultants looking for to lower danger in customers’ equity profiles understanding that they will certainly be safeguarded versus a repaired quantity of loss over a specific amount of time, or wishing to keep an even more danger account approach As it does not reveal customers to rates of interest run the risk of like mutual fund do, we believe having a look at the information may be valuable. As a result, our profile remedies group assessed their consultatory collaborate with greater than 350 RIAs and also 50 broker-dealers throughout 2022 to reveal essential usage situations, fads, and also understandings.

A devoted padding sleeve

Ease of application goes to the first of advantages that the ETF framework supplies to defined-results capitalists.

Prior to these ETFs existed, consultants commonly required to purchase organized items or deal specific alternatives to tailor comparable techniques. The ETF container opens the opportunity for consultants to a lot more conveniently keep specified efficiency techniques within an enclosing account.

According to quotes from Pioneer’s Profile Solutions group, virtually 70% of profile appropriations were made by taking a pro-rated allotment of 10-30% of existing expert designs or customer accounts. That array indicates that consultants take into consideration defined-return ETFs to be an essential element of customer profiles. The core nature of ETF direct exposures indicates that consultants can replace parts of their core profile appropriations with these defined-outcome ETFs to create a committed holster within their customers’ profiles.

Of those SMA projects, around 20% of consultants asked for that their profile be maximized to decrease danger provided a preferred return target. As a matter of fact, the capability to target a specific degree of danger about the marketplace– one that’s even more lined up with a customer’s danger resistance, as an example– is one more benefit that several consultants gained from in 2022.

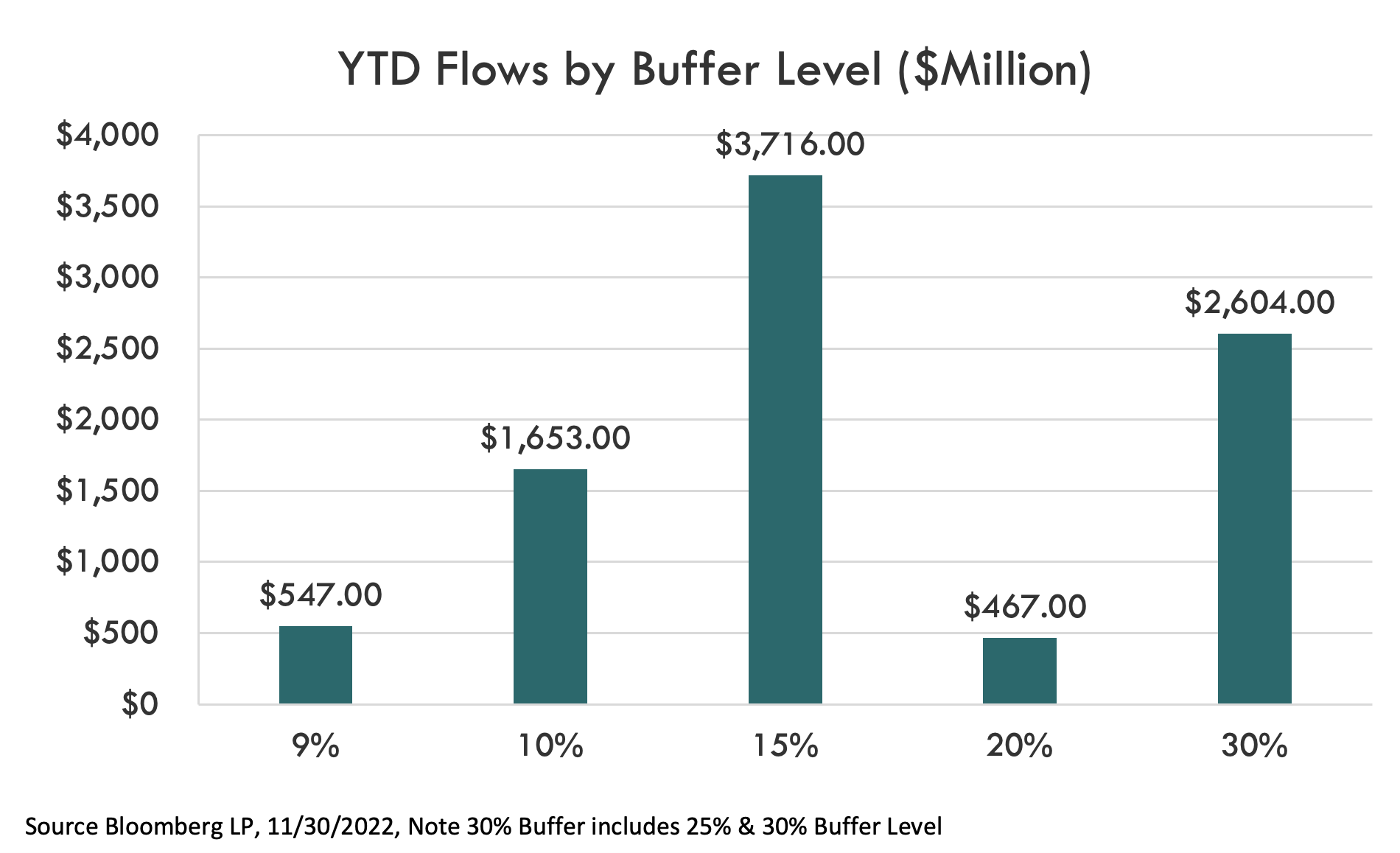

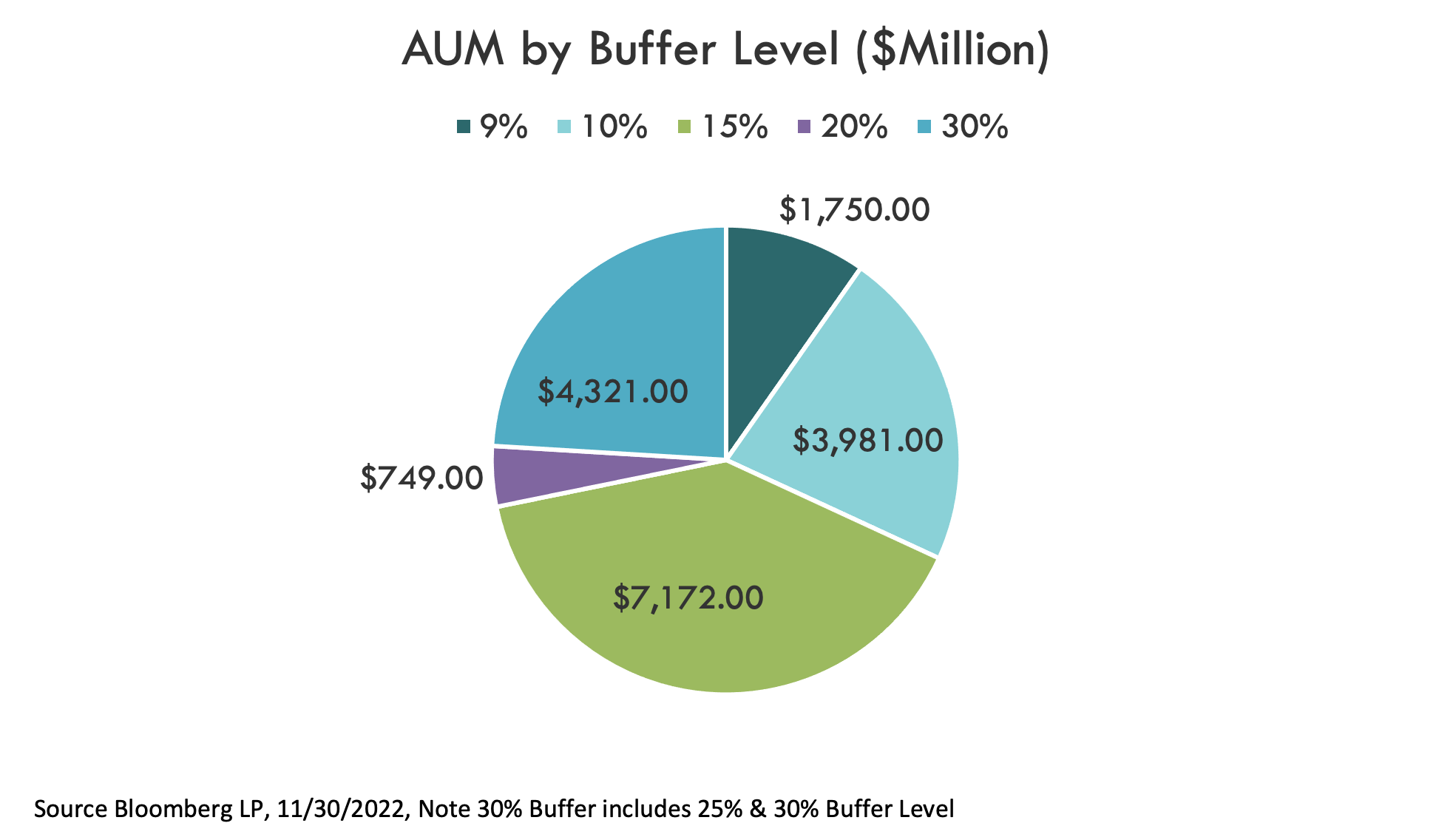

15% barrier was the pleasant area

$ 3.7 billion, or 41% of all internet inflows to the 2022 defined-results ETF sector, entered into techniques that support the initial 15% of losses in an offered criteria property. One feasible factor for the outsized circulations is that the 15% barrier continually saw professions moneyed on both the equity and also set revenue sides of an advisor’s publication. Our Profile Solutions group approximates that 75% of all expert demands consisted of an allowance to Pioneer’s 15% Power Barrier Collection, with funds split uniformly in between existing equity and also set revenue appropriations. Various other Barrier rates saw a lot more focused applications; The 9% Get Allocations were moneyed mainly by Expert Supply Allocations, while the 30% “Ultra Substitute” Yearly Appropriations and also the 20% Quarterly Get Technique were moneyed mainly by Expert Benefit Allocations. the consultants.

Utilizing a traditional barrier approach to profit from cash money, bonds, and also liquidity containers

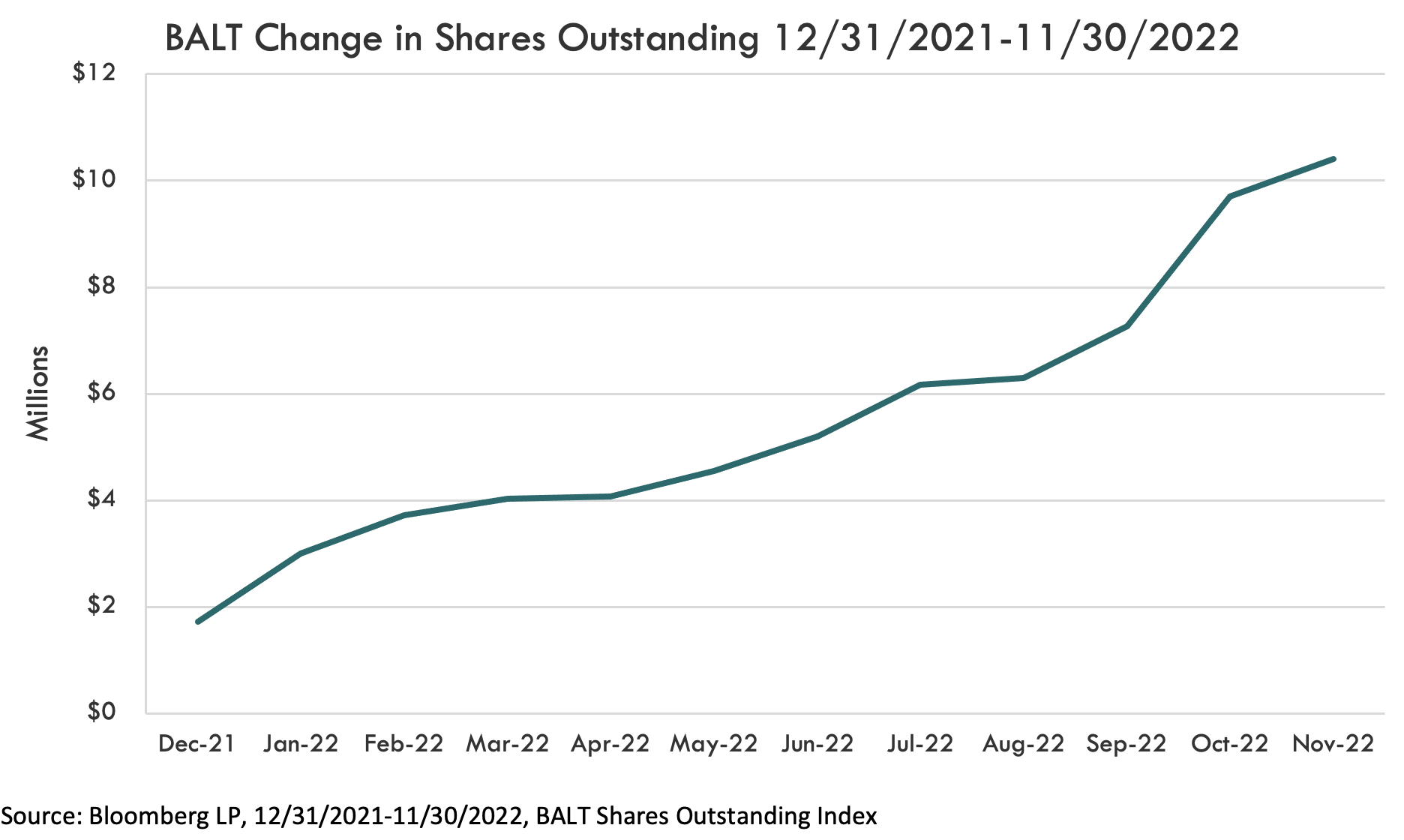

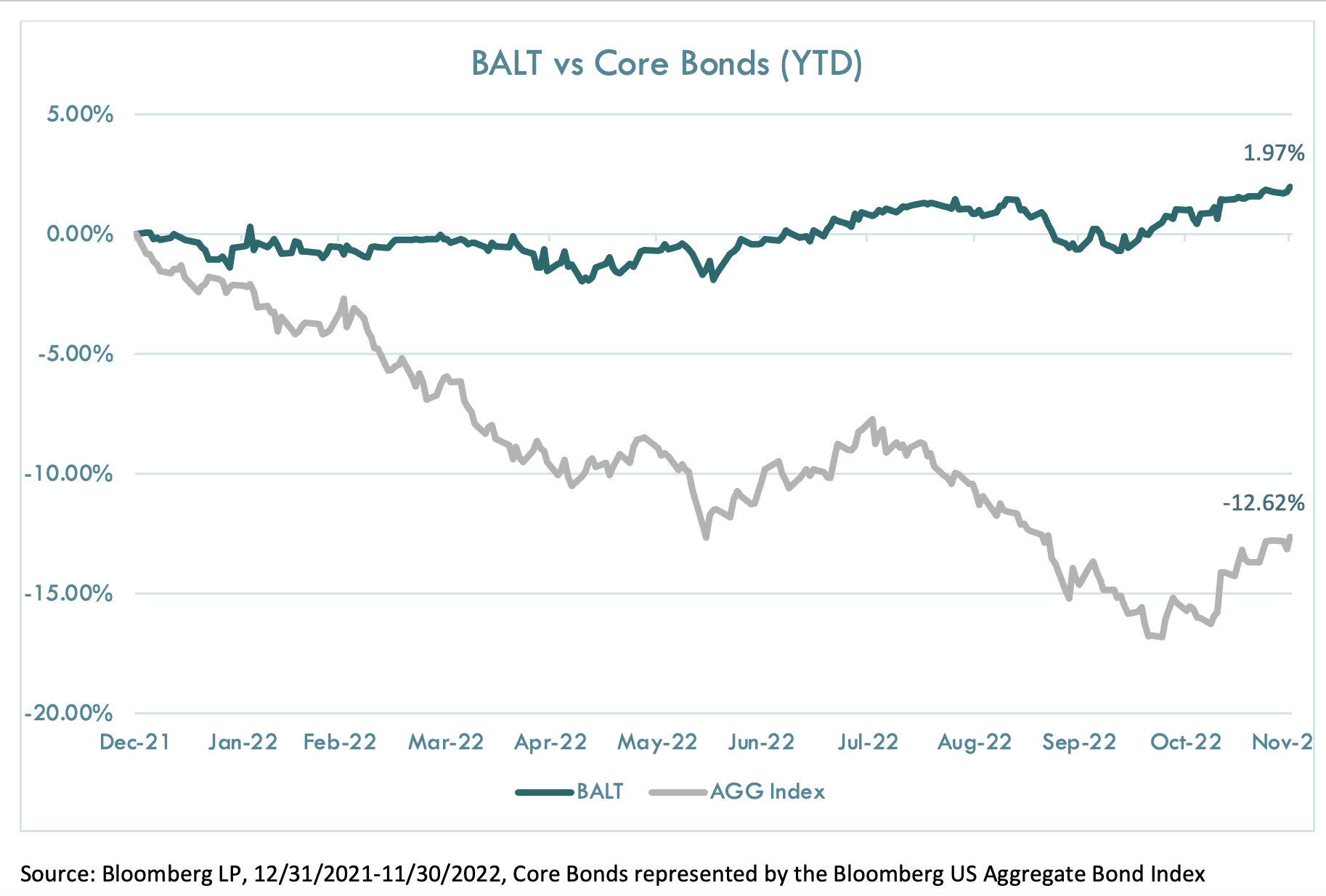

A specified return approach with an extremely conventional danger account that looks for to support quarterly losses in SPY while supplying an action of the upside capacity people equities proliferated in 2022. Shares impressive in the Pioneer Defined ETF Riches Guard (Ticker: BALT) raised by 503%. up until completion of November. BALTs were regularly utilized by consultants to supplement or change core bond placements, provided the protective nature of the 20% quarterly barrier. Various other consultants utilized BALT to aid customers relocate excess squander of margin and also right into the securities market. Both techniques verified useful; With United States large-cap equities down -13% and also the Bloomberg United States Accumulation Bond Index dropping virtually -12.5%, BALT generated a favorable overall return of 2% with completion of November.

Barrier Just Versions and also Consumer Prospecting

A smaller sized percent of firms selected to construct stand-alone designs of specified end result ETFs (

In enhancement, a a great deal of consultants additionally looked for to place the defined-results ETF techniques as an affordable benefit to collaborate with their method in situations where a possibility had actually not yet registered with the business, yet was displeased with the efficiency of their method. existing profile or really felt that your profile was exceedingly dangerous. While the information was not recorded especially on this side, there were lots of such narratives in 2022, as twin drawdowns in supplies and also bonds tested several typical profiles.

What fads will arise in 2023?

With a number of the financial and also market-related difficulties mostly unsolved heading right into the brand-new year (eg rising cost of living, price course, incomes), our company believe unpredictability is very high. Thus, volatility might continue to be raised with uneven markets, and also a number of the DR ETF fads seen in 2022, such as the appeal of barrier ETFs, will certainly proceed right into 2023. With around 10,000 Americans getting to old age daily today, way too many savers have actually simply been struck with a book instance of return danger sequencing, and also consultants that saw bonds as a profile drag They are trying to find choices.

If market dangers and also volatility start to dissipate, we prepare for the development of increased ETFs, which look for to offer a numerous of an offered market’s return, as much as a cap, to recoup. No matter, as hundreds of riches administration companies have actually uncovered, carrying out defined-outcome ETFs in an advising method can not just reduce the effect of drawdowns, yet can additionally aid customers review efficiency assumptions. and also run the risk of resistance degrees. The distinction and also customization it shows need to remain to profit consultants no matter the marketplace environment.

Tim Urbanowicz, CFA, is supervisor of financial investment research study and also approach at Wheaton, IL-based Pioneer ETF, the leader of defined-return ETFs.

.