Table of Contents

Bobbie DeHerrera/Getty Images News

Investing in recipients of transformational fads that can take on financial unpredictability is one method to defeat the marketplace throughout unsure times. One more method is to buy firms with solid affordable moats. Raytheon (NYSE: RTX) remains in the wonderful place of getting both. To start with, it is a protection producer, as well as need for its merchandises will likely substantially enhance. Even more than that, however, the battleground success of its tools symbolizes a broader shift to a various sort of war. Nation-states aiming to overhaul their protection will certainly desire right stuff that viciously whipped the globe’s second-most effective army pressure.

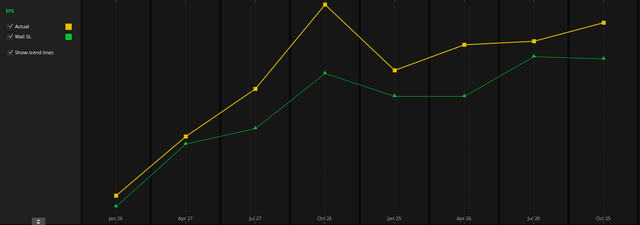

Second of all, there’s no industrial moat like an oligopoly or syndicate. Raytheon Technologies is a significantly crucial participant of the United States Protection as well as Aerospace oligopoly- its negotiating power with its key consumer has actually enhanced substantially. Regardless of a few of one of the most extensive headwinds in current background, the firm has actually constantly surpassed Wall surface Road’s assumptions. We anticipate the experienced as well as battle-tested administration to mainly proceed this pattern.

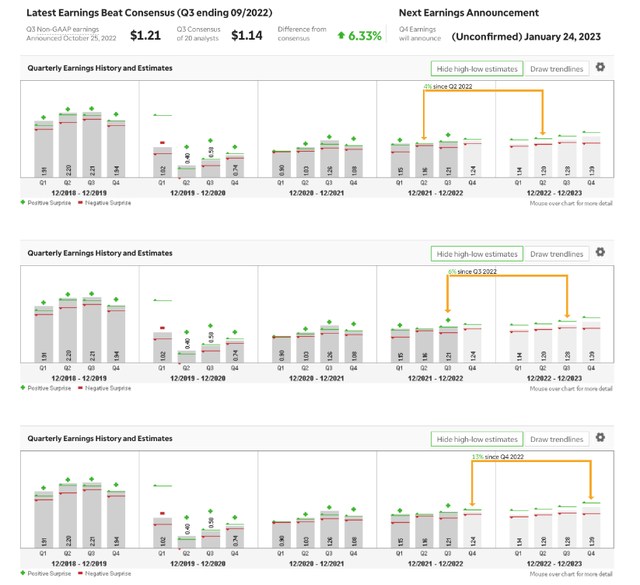

Thinkorswim, RTX real incomes vs. expected

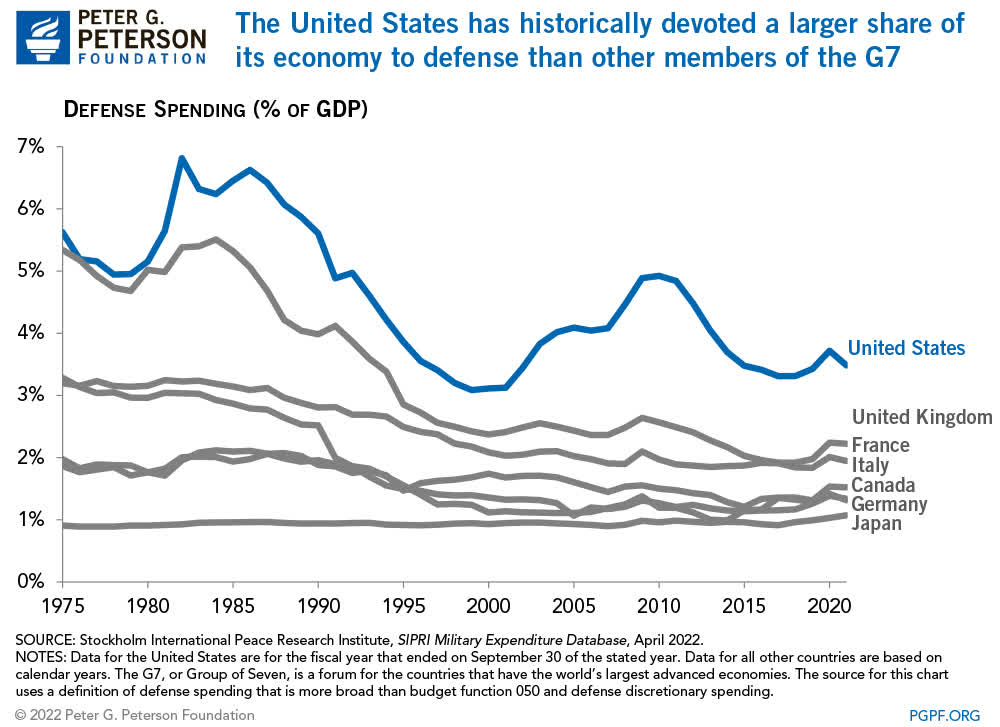

Not just that, however its key consumer can likewise be an effective benefactor when it intends to be. Uncle Sam will certainly be taking wonderful discomforts to assist make certain Raytheon is humming to the advantage of the totally free globe as well as simultaneously to the company’s investors. United States Protection top priorities rely on Raytheon having adequate resources to properly perform the arduous, high-touch R&D the market needs. There’s a great deal of unpredictability in 2023. Still, something you can most likely establish your watch on is that, on a nonreligious basis, as geopolitical threat as well as great-power battle boosts, protection investing of the United States as well as its allies will certainly get to a greater percentage of GDP than in current years.

Peter G. Peterson Foundation

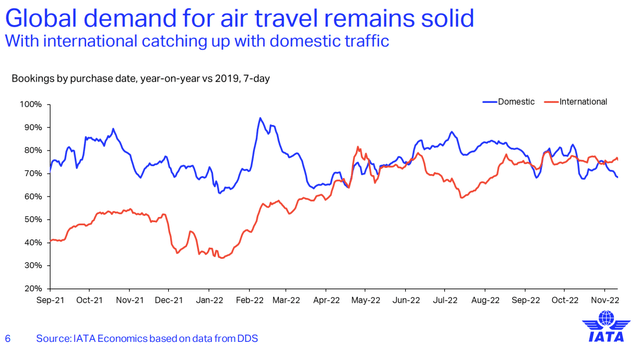

One of the factors the protection market can be thought about protective is that it is shielded from financial cyclicality given that it is so depending on federal government expenses. Raytheon is much less protective than its peers due to the fact that it has a bigger share of the industrial aerospace service than any type of huge men besides Boeing. They are hence extra revealed to basic financial task than their peers.

IATA

Raytheon (RTX) has actually obtained headings for creating a few of one of the most effective tool systems that ravaged the Russian army performance, like the Stinger as well as the Javelin. The Russian Military has actually been lacking containers given that Might, as well as the comprehensive permissions have actually maimed their protection market’s ability to change them as well as various other crucial systems. Absolutely nothing markets an item like wrecking success, as awful as this certain “promotion” might be.

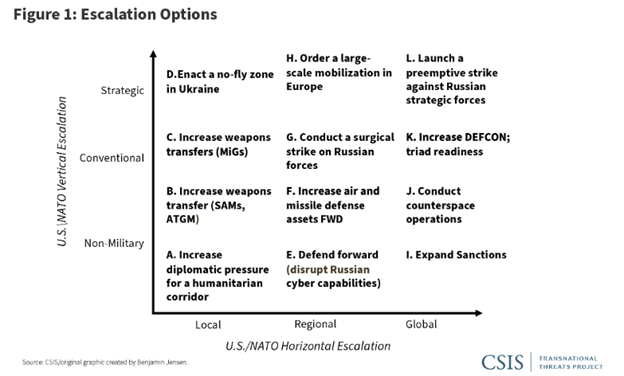

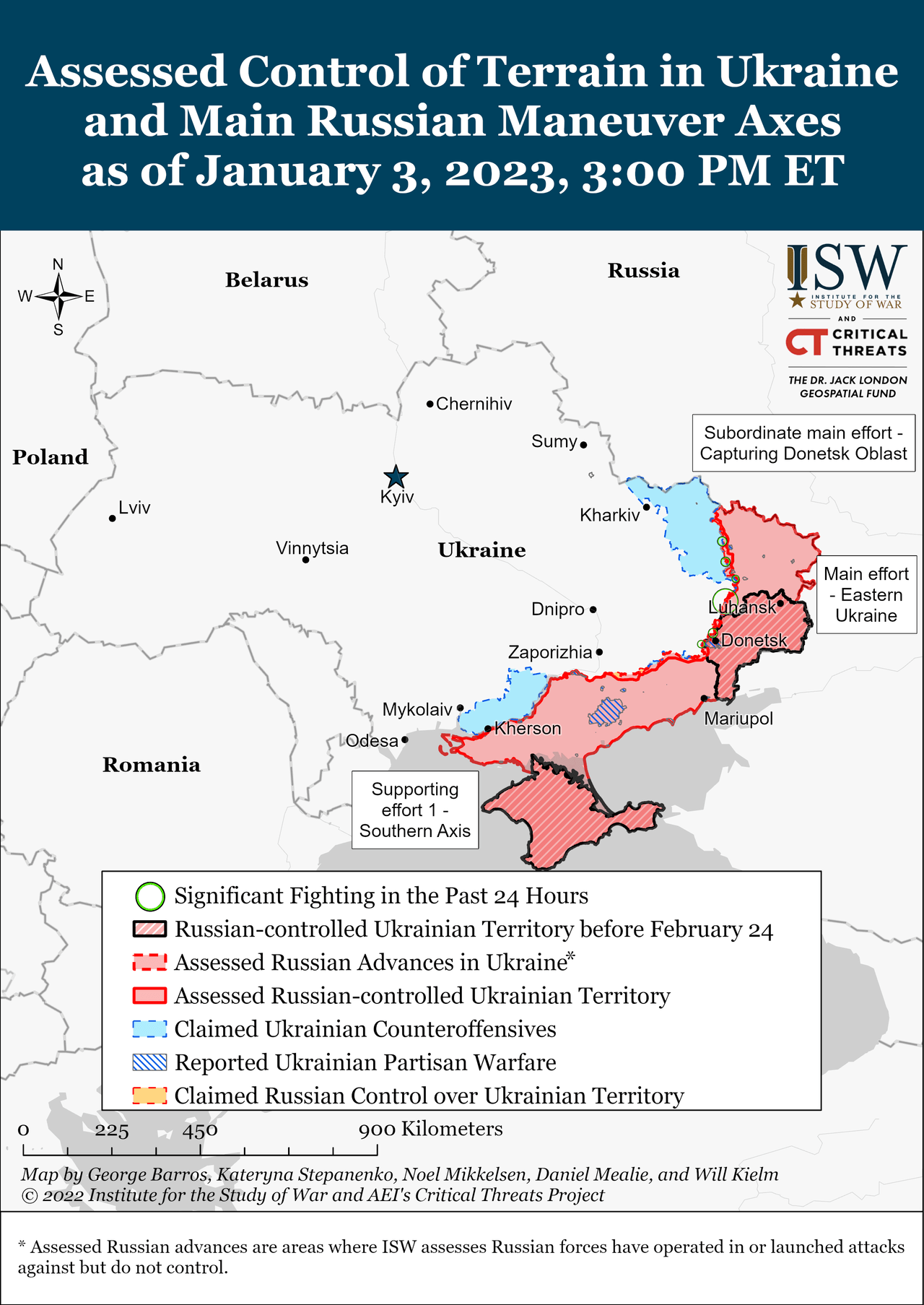

The Dispute in Ukraine Likely Remains To Intensify in 2023 to the Advantage of Big Defense

While any type of affordable individual ought to expect an end to such a terrible problem (200,000 army casualties in 11 months), the background of war recommends that the present battle is most likely to grind on as well as possibly also increase. As an example, towards the start of the First Globe Battle (very early 1915), individuals were stunned that half a million soldiers had actually been eliminated. Nonetheless, this was much less than 5% of those that would eventually die from 1915 to November 1918 in the Great Battle. Regrettably, the present personality of the battle in Ukraine recommends those that have actually until now died, as well as the damage until now functioned is most likely just a plain portion of what is ahead.

Center for Strategic International Studies

The battling is pricey, as well as gains are restricted with the exception of a couple of successes in Kherson as well as to the East of Kharkiv. However, the math of pressure is difficult to compute as well as depends equally as much on those running the tools as the tools itself. Among the factors that Western assistance maintains rising is due to the fact that the Ukrainians show they can do it properly. Our Vietnamese, Iraqi, as well as Afghani allies did refrain from doing as a lot, as well as they got degrees of assistance that fade in contrast to what’s been offered to Ukrainians.

Institute For the Research study of War

Let’s take, as an example, the Republic of South Vietnam. The USA considered that unfortunate country army help, making what it has actually offered Ukraine resemble a spit in the sea. It likewise, obviously, straight involved their communist enemies in the North. It went down extra artilleries on Vietnam as well as nearby nations than all the artilleries used up in The second world war, as well as still, success was not achieved.

The USA invested an awesome trillion each in Afghanistan as well as Iraq attempting to beat Islamist revolts that typically appeared like arranged criminal activity organizations greater than arranged militaries as well as experienced loss. We have actually offered the Ukrainians $22 billion well worth of largely used tools, as well as they have actually damaged the Russian routine military as an efficient offending pressure in much less than a year.

This is a main factor the arms will certainly maintain moving- they’re sensible, as well as our allies require them to make it through. While there are some loud political rumblings concerning Ukraine, the majority of participants of Congress enjoy to see the Russians dropped in Ukraine as well as are important to the expanding danger of an increasing China. Nonetheless, those counting Russia out so early might be also confident.

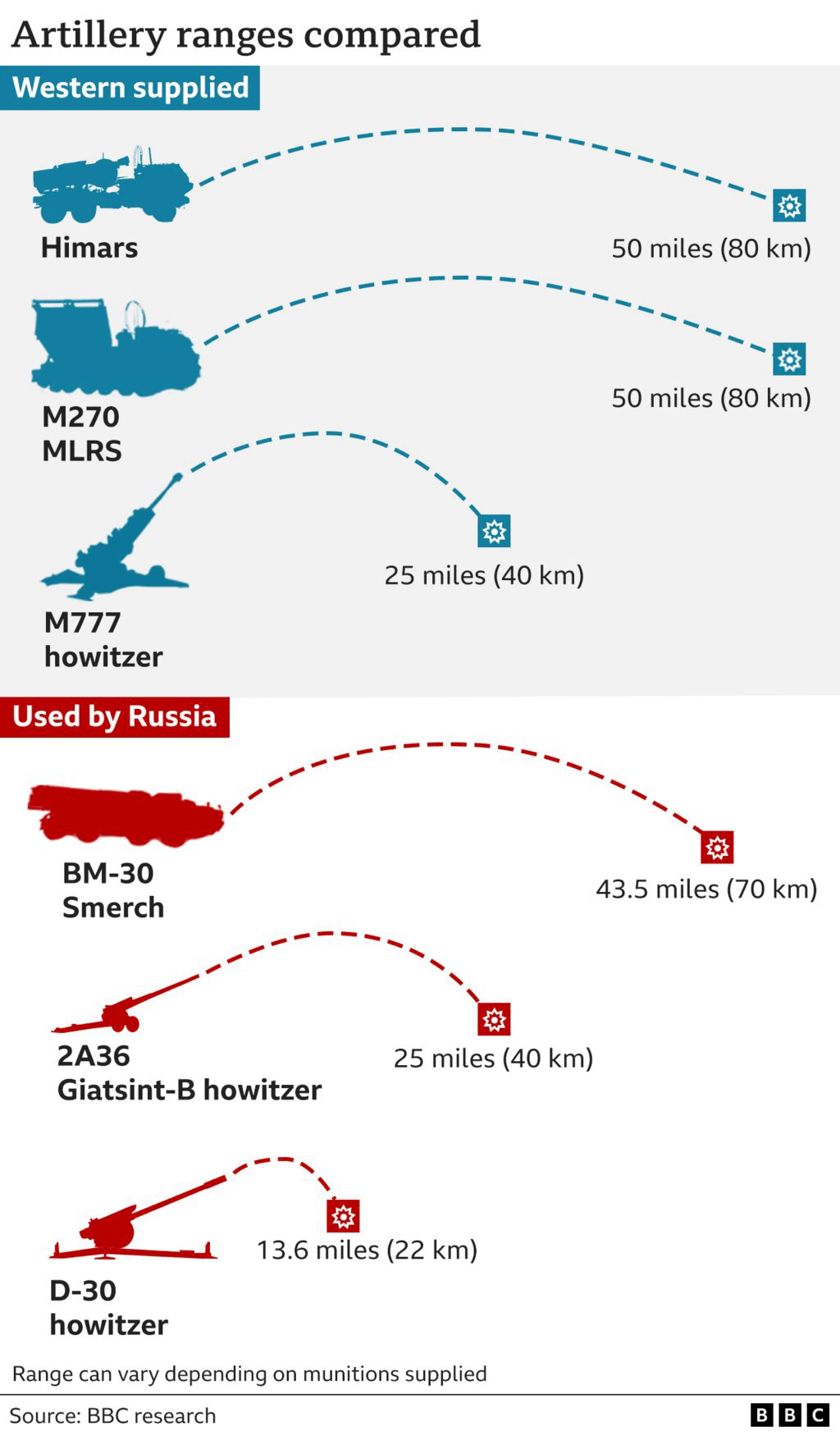

Bear in mind that beginning a battle with painful army beats is basically foregone conclusion of the Russians. Still, they have a historical endurance as well as ferocity that should not be undervalued. It’s likewise why rise proceeds; as the Russians adjust by bringing valuable properties out of array, the Ukrainians will certainly require artilleries that can go even more, like the longer-ranged ATACMs rockets that can enhance the series of the really efficiently released HIMARS system.

BBC Research

There are expanding rumblings in Western knowledge neighborhoods that Russia will certainly be preparing a big offensive. Current embarrassments make Russian disengagement much less most likely too. Some fear it will certainly duplicate the press on the resources as well as be especially ruthless as well as unplanned. Russia’s despicable use pressure on private framework as well as battle criminal activities have actually made escalatory assistance that appeared unimaginable previously in the battle crucial.

Unfortunately, I believe this pattern will certainly proceed. While I hope tranquility comes quickly, I assume this is not likely. We have actually currently gone from used tools to the United States armed force’s most sophisticated anti-aircraft system, the Patriot projectile battery. This tool is normally scheduled for just close United States allies as well as has symbolic as well as army worth.

Likewise, Ukraine likely has purposes to perform what will likely be a pricey as well as drawn-out initiative to take back the Crimean Peninsula. Such an initiative can result in rise by Russia, however it absolutely does not bode well for the problem to finish quickly or for the pressing demand for sources to allow up. If anything, it’s most likely that the fatalities, sources being taken in, as well as tools systems being offered will certainly all enhance greater than we ‘d presently visualize in 2023.

However, also in a best-case situation, which would likely be a cessation of hostilities as well as some icy problem area comparable to the 38th parallel, nationwide protection expenses are still most likely to climb substantially (perhaps even greater than if Russia is roundly beat). Certainly, some Protection professionals suppose that NATO protection investing would certainly have been greater had Russia’s containers surrendered Ukraine like Czechoslovakia in 1968.

Yet despite that, the globe is for life transformed. The battle genie runs out the container. Prior to Russia attacked Ukraine, it was fashionable to state that disputes in between globalized states were not likely as a result of financial connection, however not any longer. Once individuals are passing away on the range that they remain in Ukraine, long-existing settings can transform promptly. Also, as the scenario on the battleground develops, the demand of Ukraine for assistance from its crucial ally will transform. As Russia adapts to the most up to date tools, brand-new ones will certainly be called for to preserve energy.

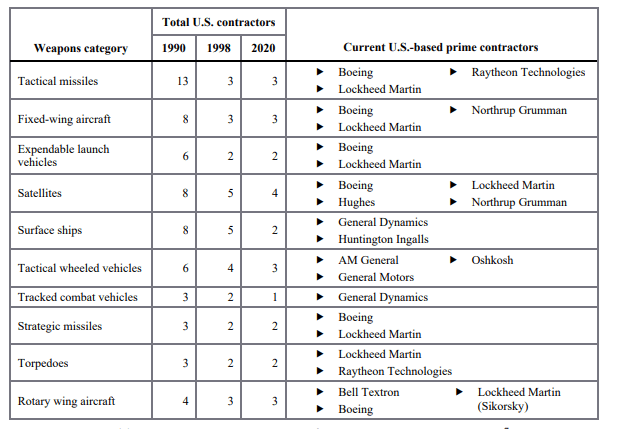

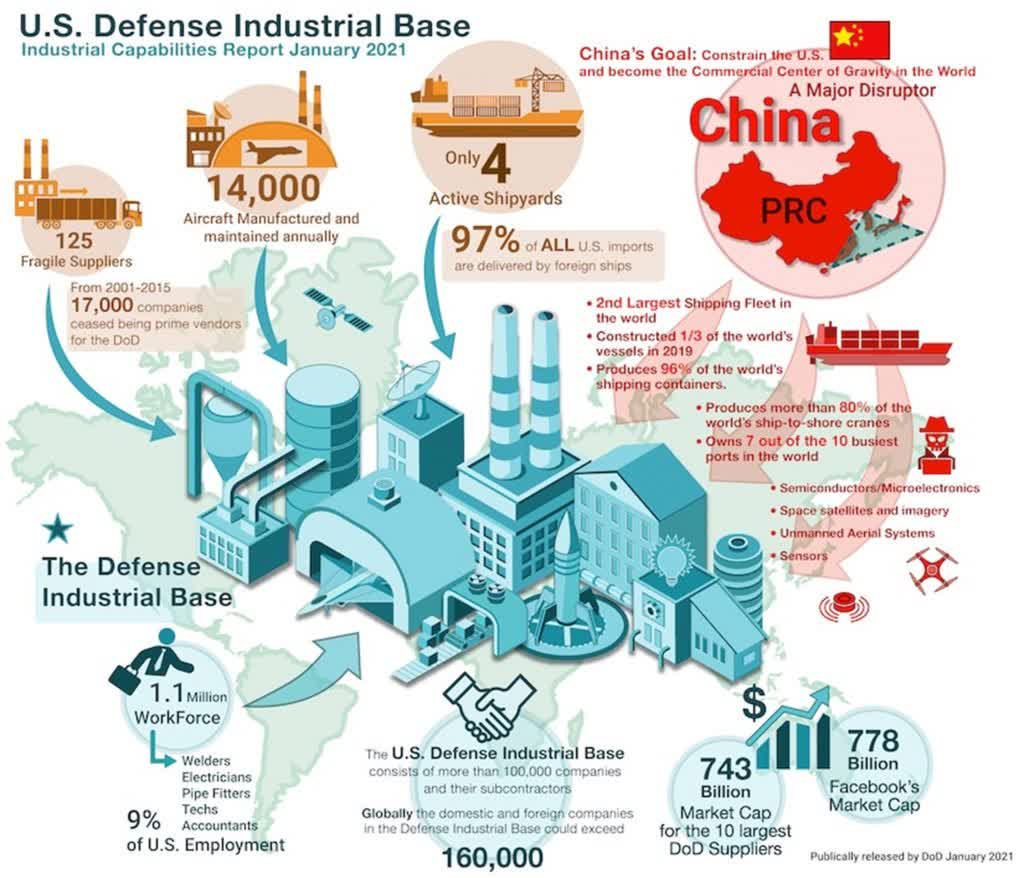

The United States Protection Sector is Consolidated as well as Highly Depending On State Spending

Department of Defense

The United States Protection market has actually settled over the last years. Whereas there utilized to be a great deal even more competitors, currently a couple of huge gamers control one of the most profitable as well as vast agreements from Uncle Sam. It’s uncommon to obtain 3 proposals for huge ticket products. Raytheon is among couple of firms able to bid on the expensive products as well as has a specific overlap in its items with what has actually been most significant in quiting the Russian assault. It is likewise incorporated right into spiritual cow jobs, like the F-35, for which it develops the engine.

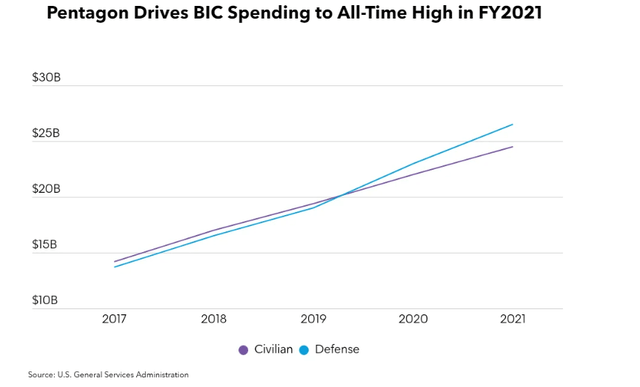

Competitors in between protection titans is not such as competitors for regular firms. Yet Raytheon is a junkyard pet when taking on competitors. When Lockheed Martin wished to purchase a crucial distributor of rocket engines (among one of the most considerable present supply chain thorns for Raytheon), the group at RTX played a main duty in obtaining antitrust regulatory authorities to scuttle the recommended tie-up. Raytheon remains in an excellent setting of having actually gone through among the biggest current protection mergings right prior to antitrust examination on the market started to enhance. It has the benefit twist of recouping industrial aerospace need. The best-in-class (BIC) agreements the firm concentrates on are coming to be extra important to the purchase procedure.

United States General Providers Admin.

The firm has actually gotten brand-new orders for its Stinger as well as Javelin system after these tools systems’ straight-out success in Ukraine. This success has yet to add to considerable industrial gains. Still, I assume these loom in a large method over the following couple of years in spite of the severe present trouble brought on by the supply-chain interruption.

Raytheon is a worldwide firm with 13,000 distributors; just concerning 3% are bothersome. Uncle Sam has actually recognized the issue as well as is sending out in the mounties to assist. There is a great deal of area to enhance the procedure for international arms sales that will certainly assist Raytheon’s margins. I likewise assume the far more pricey Patriot Rocket system will likely show its’ guts in Ukraine as well as improve need for the next-generation version Raytheon is establishing. This can cause a considerable as well as prolonged enhancement to a currently healthy and balanced stockpile. The rate of this system implies purposeful top-line development.

Raytheon Is a Great Financial Investment for the Uncertain Atmosphere of Early 2023; The Business Has Stuck to 2025 Targets

2023 is an unsure year as well as apart from the several threats irritating markets in the much shorter term, one significant modification that will certainly make its effect understood for many years ahead is the ruining of the global order that happened when Russia attacked Ukraine. For several years, the pattern in war had actually been towards lower-intensity disputes where ammo expense was reduced as well as basic requirements were much much less source extensive than the high-intensity slugfest taking place in Ukraine where 10s, or perhaps hundreds, of hundreds of coverings, are terminated everyday.

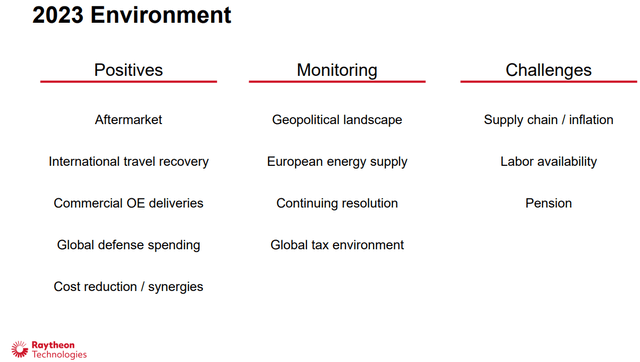

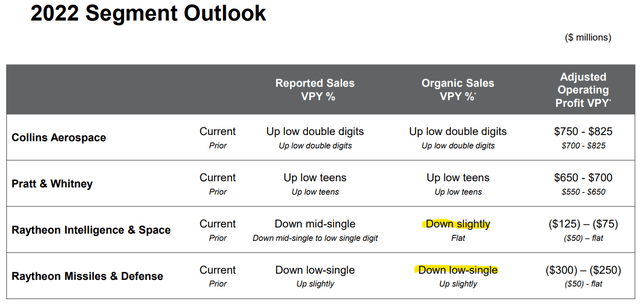

Company Records Q322

Generally, there is a great deal of threat encountering markets entering into the year. We assume securing a setting to the most likely result of a once-in-a-generation increase in protection investing assists reduce the effect of significant threat encountering the marketplace in 2023. Protection as well as Aerospace is an essential location that must be shielded from the several threats to equities as the year starts. Raytheon is a leading Protection specialist as well as likewise has direct exposure to a better-than-expected financial result as a result of its considerable private airplane sector.

- Firstly, the Federal Get might call for harder activity than markets prepare for.

- Second of all, financial experts as well as several companies are expecting an economic crisis of differing extent that will normally prevent financial task, the majority of really in intermittent locations of the economic situation.

- Finally, geopolitical unpredictability goes to the highest degree in years. Raytheon advantages straight from this 3rd threat.

- Finally, given that a considerable section of earnings is originated from the United States federal government’s protection expenses, as well as all signs are that these will certainly climb towards greater degrees in coming years, it is much better shielded from the initial 2 threats than several supplies.

In a time of wonderful unpredictability like we’re presently encountering, it’s helpful to chain your spending potential customers to fads that can weather the setting in case of favorable or adverse end results impacting crucial threats.

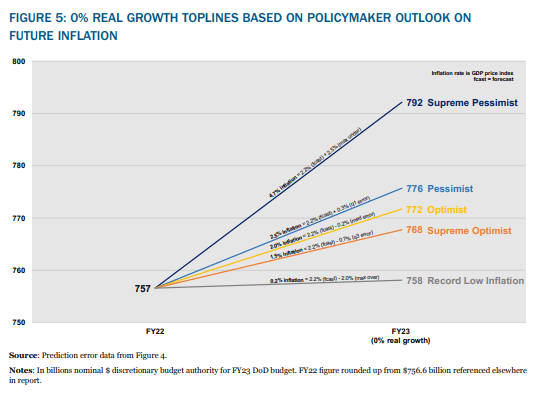

The increasing geopolitical threat in a number of areas globally as well as the unfavorable problem in Ukraine implies that there will certainly likely be a nonreligious increase in protection investing despite what the Federal Get does as well as whether there’s an economic crisis, serious or moderate. The degree of rising cost of living will certainly likewise substantially impact the course of future protection investing. It is approximated that the DoD can shed as much as $110 billion in acquiring power from current increases.

National Protection Industrial Organization, “HOW RISING COST OF LIVING INJURES AMERICA’S NATIONAL PROTECTION AND ALSO WHAT WE CONTAINER DO ABOUT IT”

The transforming geopolitical setting implies that the share of GDP the United States as well as important allies invest in protection is approaching degrees last seen in the 1980s when big-power competitors last controlled protection investing. Currently the degree of army sales authorized by the United States federal government to NATO participants has actually virtually increased. Germany, that had lengthy rejected army initiatives, is progressively sending out sophisticated tools as well as taking an extra aggressive duty in NATO. Japan likewise kept just a skeletal army pressure as well as introduced strategies to increase its investing this month. I believe this is just the start of a significant ramp-up in international army investing.

The Equilibrium of Power In Between the Federal Government as well as Huge Protection Has Actually Changed Positively, United States Arms Sector Likely Gains at Russia’s Expense

“We invest a great deal of cash on some splendid huge systems, as well as we do not invest as much on the artilleries essential to sustain those.” Gregory J. Hayes, Raytheon CEO

The needs of this problem as well as the raising necessary to challenge army accumulations by various other significant powers will certainly stress the present protection commercial base. Raytheon has curved over in reverse to reboot the Stinger assembly line, however it made certain the federal government recognized it was a trouble. Normally, Raytheon’s negotiating setting with the Feds is getting to an extra durable degree than it’s been given that the World War on Fear.

For instance, the Feds have actually moved on enabling extra multi-year agreements to continue, enabling professionals to prepare far better. Handling Uncle Sam as your key consumer can be quite difficult. Simply ask a great deal of physicians why they no more approve Medicare. Structure weapons as well as rockets for Uncle Sam undergoes a number of the very same corrupt rewards. Nonetheless, the Protection Sector has actually gone from a current setting of being greatly looked at as well as collared right into agreements that it could need to consume the expense overruns of to Uncle Sam asking what they can do to make jobs much easier as well as manufacturing greater. This hasn’t appeared yet in incomes, however it likely will in the coming quarters.

Company Records, Q322

While this pressure requires to be managed as well as enhanced, all-and-all, this will largely profit the huge protection professionals like Raytheon (RTX). Raytheon, particularly, will certainly have the ability to depend on subsidization from the United States Federal government to safeguard supply chains. Friend-shoring, on-shoring, as well as supply chain setting will certainly all need to happen. Still, offered the generational costs on the product or services Raytheon markets, it’s not mosting likely to be one the suffering to complete the de-globalization as well as solidifying of the United States protection commercial base.

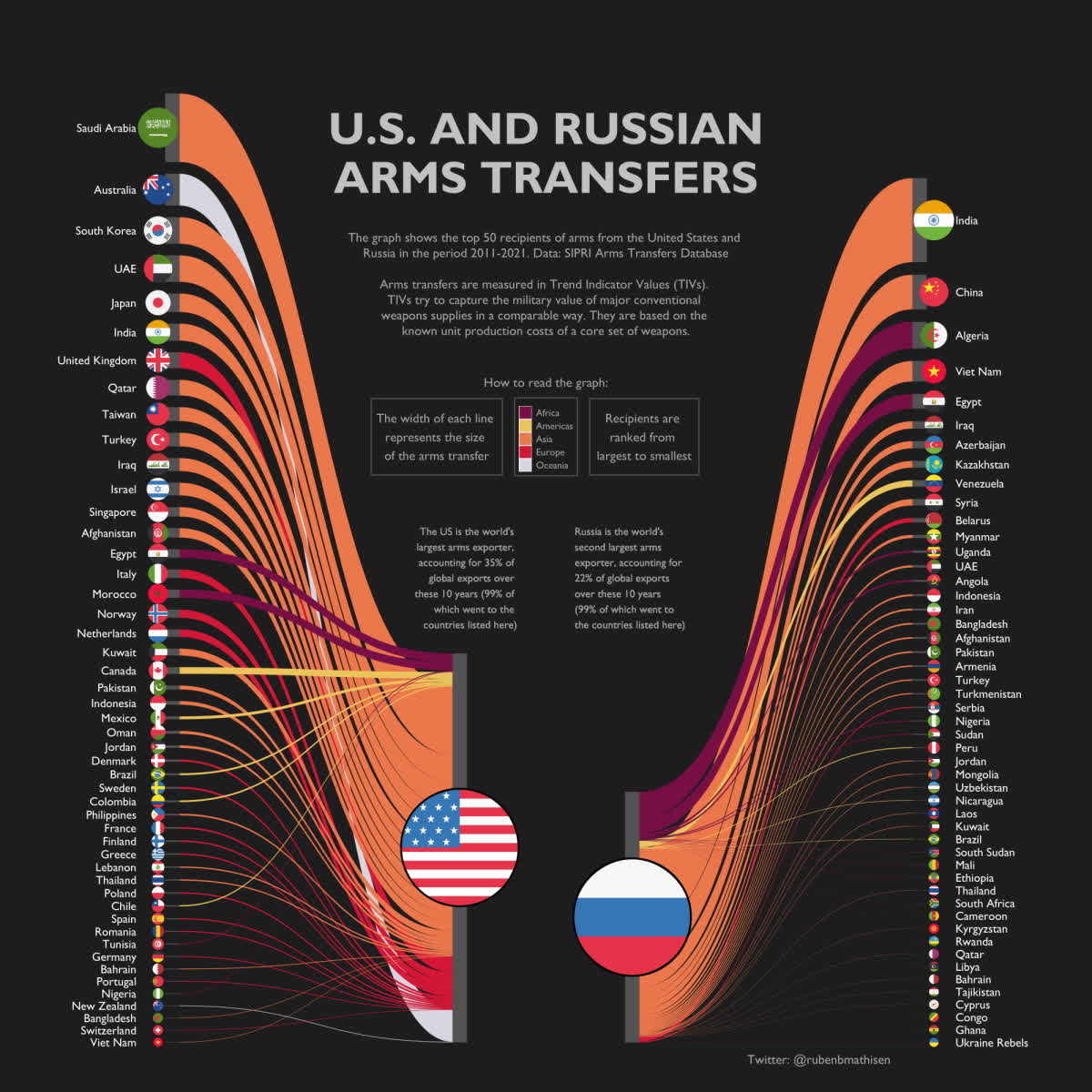

Arms Transfers: united state as well as Russia’s Most significant Trading Companions (visualcapitalist.com)

Another tailwind for Raytheon is that its tool systems might be safeguarding freedom, however they likewise straight weaken an industrial rival: Russia’s progressively threatened arms market. Russia provides 20% of the globe’s army tools, however as we have actually talked about, it no more has the tools to save. It has actually drained pipes shops in Belarus as well as has actually been required to obtain coverings as well as tools from its ne’er succeed allies. Russia’s 4th biggest arms customer, Vietnam, has actually currently started talks with United States arms producers to make a politically tough button. India, Russia’s biggest arms customer, has actually been cozying as much as the USA as well as can not be delighted at the photo of burnt-out T-72s as well as the downing of innovative Russian airplane.

Russia’s market remains in disarray as well as encounters alarming monetary straits. It can not provide its army with appropriate tools, as well as the depressing efficiency of several systems most likely discourages important customers. The United States Protection Sector is scenting a large chance for development. International arms sales to existing as well as brand-new previous Russian customers are an important prospective benefit driver for Raytheon that I assume the marketplace under-appreciates.

Risks to Raytheon as well as My Favorable Thesis

Supply Chain: There is no doubt that Raytheon appreciates a favorable scenario from the need side. Nonetheless, also if need is excellent, if you can not generate what is required, you can not please need. This has actually developed consistent volatility in margins, distributions, as well as costs/profits. This will certainly remain to evaluate on the firm throughout 2023.

Supply-chain problems have actually irritated protection professionals throughout COVID-19. Lengthy gone are the days of an across the country focused protection commercial base. The United States aerospace as well as protection impact simulated the fads in the international economic situation as well as itself globalized as the internationalization of business happened on an extraordinary range.

DoD

” We experienced 6 years of Stingers in 10 months.” -Gregory J. Hayes, Raytheon chief executive officer.

The supplies of Javelins as well as Stingers were promptly tired by the pace of this problem. While the COVID supply chain problems are settling, transforming the supply chain as well as commercial base to sustain even more artilleries manufacturing is one more side of this bothersome coin. As an example, the rocket engines required for a number of the firm’s in-vogue items are a chokepoint that will not be solved in the prompt term. Uncle Sam will certainly be extra energetic in assisting minimize these supply-chain problems. The firm has actually currently taken remarkable actions as well as has situation groups at distributors to assist correct this scenario.

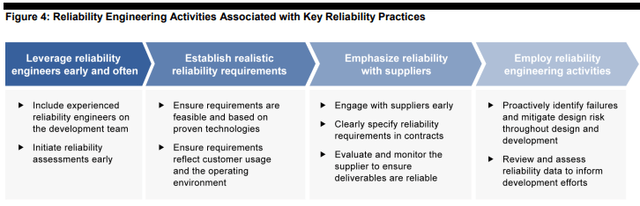

Labor: Labor requires in the Protection as well as Aerospace Sector are not just made complex by the reality that safety and security clearances are required for several vital settings however likewise that there’s simply a lack of essential abilities in several markets. Payment is likewise a big concern. Drowsy production line on their method to purchasing the ranch are unexpectedly of miraculous relevance for the destiny of the totally free globe. Still, enhancing ability is pricey as well as tough due to the fact that it’s progressively tough to locate enough focus of extremely proficient, certified, as well as relied on labor essential to fulfill the requirements of a significantly various international danger setting than that which existed a year earlier.

Government Responsibility Office

” The greatest inflationary effect can be found in settlement. We’re seeing even more stress on settlement, offered what’s taking place in the market today.” – Gregory J. Hayes, Raytheon Chief Executive Officer.

Raytheon has substantial as well as fairly specialized labor requirements. As an example, the firm employed 27,000 individuals in the initial 9 months of 2022 as well as requires to employ 10,000 even more. One more issue is that, offered the delicate nature of the job, a lot of the called for labor likewise requires to be able to acquire safety and security clearances.

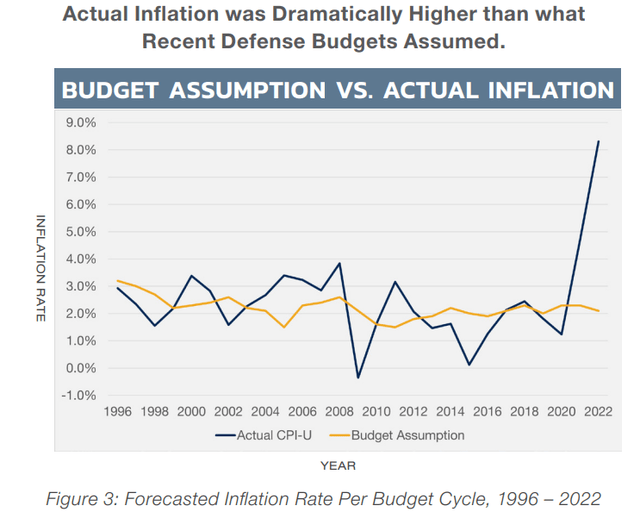

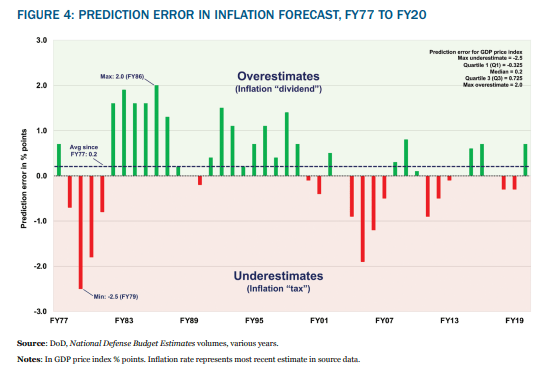

Rising cost of living: People that very closely enjoy markets have actually just lately come to be accustomed with exactly how unfavorable as well as aggravating incorrect rising cost of living assumptions can be. Words “temporal” has actually befalled of style in a large method. Yet the Protection Industrial Complicated has actually continuously been handling the expenses of unreliable rising cost of living estimates.

Facility For Strategic Budgetary Assessments, HOW I DISCOVERED TO BEGIN WORRYING AND ALSO HATE REAL GROWTH

Inflation can be especially bothersome for the Protection Sector. There are currently several relocating components in the having procedure, as well as the rates set in agreements might not constantly mirror the financial fact professionals encounter. The comprehensive supply chains imply that elements as well as product expenses can accumulate promptly throughout such a vast as well as international worth chain. So, the threats for rising cost of living appear, however some concealed advantages could be underappreciated for the unpredictability bordering rising cost of living. Certainly, there’s likewise some feasible benefit if rising cost of living goes down faster than agreement anticipates, which is my base situation for 2023.

Facility for Strategic Budgetary Analysis, HOW I DISCOVERED TO BEGIN WORRYING AND ALSO HATE REAL GROWTH

The predicted degrees of the protection spending plan depend straight upon anticipated rising cost of living. As you can see above, the threat to the spending plan is most likely to the benefit. Nonetheless, offered the swiftly developing safety and security requirements as well as the skyrocketing need, rising cost of living’s straight effect can likely be reduced with expense cuts as well as passing expenses on consumers. The impact of it on the Protection spending plan is most likely to surpass any type of disadvantages from rising cost of living straight. Provided the harmful nature of geopolitical events, it appears that policymakers would certainly rather intend high as opposed to run the risk of burrowing the spending plan at such a risky time.

Political/Tax Threat: There are some tax obligation problems as well as pension plan problems that can create temporary headwinds, however I assume the nonreligious tailwinds will certainly greater than make up for these over the following couple of years. Political threat is likewise increased by the media cycle. Still, I do not assume an extremely singing minority relaxing their disagreements on mainly uncertain premises will certainly have the ability to reverse the smashing as well as unanticipated success of Ukraine as well as Western tactical imperatives to assist it.

Conclusion

Raytheon take advantage of long lasting nonreligious tailwinds for its core earnings motorists as well as an established setting near the top of an effective oligopoly. These are appealing features offered the unpredictability tracking markets in 2023. There are headwinds, however I see them as mainly valued in, whereas the marketplace has actually not completely valued the generational change sought after for the company’s items. The share of GDP invested in protection makes sure to climb throughout much of the West as well as also previous customers of the Russian arms market. Raytheon has a solid administration group that has actually browsed the pandemic very well (staying with post-merge targets in spite of a substantial curveball).

TD Ameritrade

Raytheon’s incomes are anticipated to be around level in the initial quarter of 2023 contrasted to in 2015. Nonetheless, anticipated incomes development increases from the second to fourth quarters. Significantly, this velocity most likely happens as vital supply chain chokepoints minimize. This is main to my choosing Raytheon as an outstanding supply to possess in 2023: the incomes energy is anticipated to enhance throughout the year, as well as the threats are plainly to the benefit offered the increasing need for the firm’s core items as well as assist from the United States federal government throughout the worth chain, consisting of in the kind of subsidization. Strong returns as well as share buybacks have actually declared as well as ought to remain to be, sweetening the pot.

Roger Trinquier, a French Colonel that created an experience-informed guidebook on Counterinsurgency, notoriously stated that a modern-day standard military battling a revolt resembled “attempting to strike a fly with a jackhammer.” There are points that symbolic jackhammers succeed, however, which is what is currently required after a lengthy respite. Russia’s truculence has actually led to several typical pathways as well as tough rocks to damage. Raytheon will certainly flourish in the coming years on the rising problem in Ukraine as well as raising initiatives to respond to China’s army build-up. Incredibly, until now, very little substantial advantage has actually involved the firms from their battleground successes, however it is coming. Rush as well as wait.