Table of Contents

Personal Financial Planning Templates

The process of developing a personal financial plan can be time-consuming and complicated. It takes patience and persistence to develop an effective plan. Everyone’s finances are unique and may require adjustments and setbacks.

This means that personal financial planning templates should be personalized to meet each person’s needs. Once developed, the plan should be revisited regularly and tracked to ensure it meets its goals.

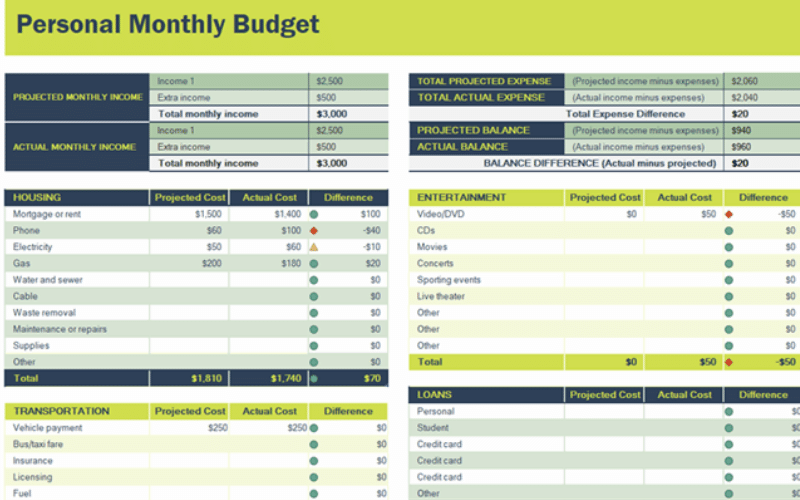

The Budget Excel Template Compares Projected and Actual Income and Expenses

A budget Excel template helps compare projected and actual income and expenses. It allows you to enter projected and actual income amounts and includes a series of subcategories you can customize.

The monthly budget sheets will show your actual income, expenses, and total net income. The budget template comes with a Menu sheet, which contains two green cells and five blue buttons that take you to the specific sheet you are interested in.

Budget Excel templates can help you create budgets for businesses. A budget spreadsheet helps a business plan by forecasting expenses for a fiscal year. It also helps track spending against savings. It also helps increase accountability by displaying real-time budget status and alerts when costs are approaching the bottom line.

This template includes three sheets. The actual, forecast, and actual sheets share similar formulas. For example, the Forecast sheet contains sample data and lists revenue and expenses categories in column A.

The actual sheet is similar to the Forecast sheet, but the formula in the Actual sheet checks for the number of revenue entries in row 11.

By comparing projected and actual income and expenses, the spreadsheet helps to create a balanced budget.

A budget that has a surplus allows the organization to expand or save money, while a budget that is in deficit means a company must find more money or cut expenses.

Creating a Debt Reduction Strategy is an Important Part of Your Financial Plan

A crucial part of creating a financial plan is to find a way to reduce debt. Debt consolidation can help you pay off your bills more quickly and more efficiently by bundling multiple debts into one low monthly payment.

It can also reduce your interest rate, which can make your payments easier to make. Debt consolidation can also help you eliminate high-interest credit card bills by putting you on a debt management plan.

Once you’ve established a strategy for debt reduction, you’ll need to assess your debt balance and spending habits.

If you owe money on medical bills, auto loans, or mortgages, you may be able to negotiate a reduced payment or get your loan refinanced.

If you have multiple credit card accounts, you may be able to consolidate them into one account.

First, you’ll need to make a list of all your debts. This list should include each debt’s current balance, credit limit, minimum payment, and interest rate.

It should also include how much you spend on each debt each month. Once you have this list, you can prioritize your expenses.

Another helpful strategy is the snowball method. By paying down your smallest debt first, you’ll build momentum.

The goal is to lower your debt-to-income ratio, giving you more money to spend on your plans.

This method is a good choice if you’re looking for an effective way to reduce debt. It will also enable you to see progress quickly.

Once you’ve identified all your debts, the next step is determining how much each one is worth. The amount of each debt will determine how long it takes you to pay off.

Set a time limit so you can stick to it. Without a clear schedule, you’ll be unable to keep up and may even lose motivation. You’ll also risk paying more interest on your debt than you’re planning to pay.

A debt reduction strategy is a vital part of your financial plan. Paying off debt can be difficult and get in the way of your other financial goals. A focused approach will allow you to manage debt better in the long run. Understanding debt can make it easier to make a strategy that works for you.

A good strategy for paying off debt should also include setting up an emergency fund that covers three to six months of your expenses. This emergency fund can help you avoid paying for unexpected expenses.

Whether a car repair or a medical bill, unexpected expenses can hurt your efforts to pay off your debt. This emergency fund will give you the financial flexibility you need to manage short-term expenses.

You should consider using a debt snowball method for reducing your debt. This strategy allows you to pay off smaller debts in the fastest time possible. It helps you to manage your monthly payments and keep them low.

The snowball method allows you to prioritize your debts by reducing the highest-interest debt. By paying off one debt at a time, you’ll free up cash to pay off other debts.

Creating an Estate Plan is an Important Part of Your Financial Plan

An estate plan is an essential part of any financial plan. It helps ensure that the assets left behind by a loved one are handled the way you want.

It can help you designate how you would like your estate to be divided and who would be responsible for your children. It can also help prevent family strife and fights.

Creating an estate plan can be a complex process, so it’s best to seek the help of a professional who can help you navigate the process.

For example, you can hire a lawyer to draft a simple will for a flat fee. However, depending on your legal assistance level, this will cost you a few hundred dollars or more. It’s also a good idea to consult with a financial professional to help you inventory your financial assets.

As your career and assets change, you may need to make changes to your estate plan. It might have started simple, with just a will and life insurance, but as your career grows, you’ll have more assets and need more fine-grained decisions. For example, you might have children who need trust to be given a portion of your assets.

An estate plan also helps minimize taxes. Proper planning can avoid the dreaded probate process and pass assets without hefty taxes. It’s also important to name guardians for minor children. Otherwise, the courts will select someone to take care of them.

Estate planning is a good idea for everyone. It’s imperative if you have considerable assets and dependent family members.

A well-written estate plan will ensure that your wishes are carried out and that your loved ones know what to do after you die.

It’s an integral part of your financial plan, but many people put it off because they assume they’ll always have money.

A trust is a legal arrangement that allows you to choose a trustee to manage your assets after you die. A trust is an excellent way to keep financial information out of the probate process and ensure your loved ones’ financial security without interfering with your freedom. Trusts also avoid taxation on certain types of assets.

Creating an estate plan is a critical part of your financial plan. You need to consider who you’d like to leave your assets to and who would be the best person to help you with the process.

It’s important to consider who will inherit your assets and how much each beneficiary will receive after you pass on. Discussing these issues with your family is essential to ensure your loved ones are taken care of.