Table of Contents

Extracted quotes were offered by customers of Spending Information Network, Power Fuels, Discussion Forum Power Metals as well as Purepoint Uranium Team. This post is not paid material.

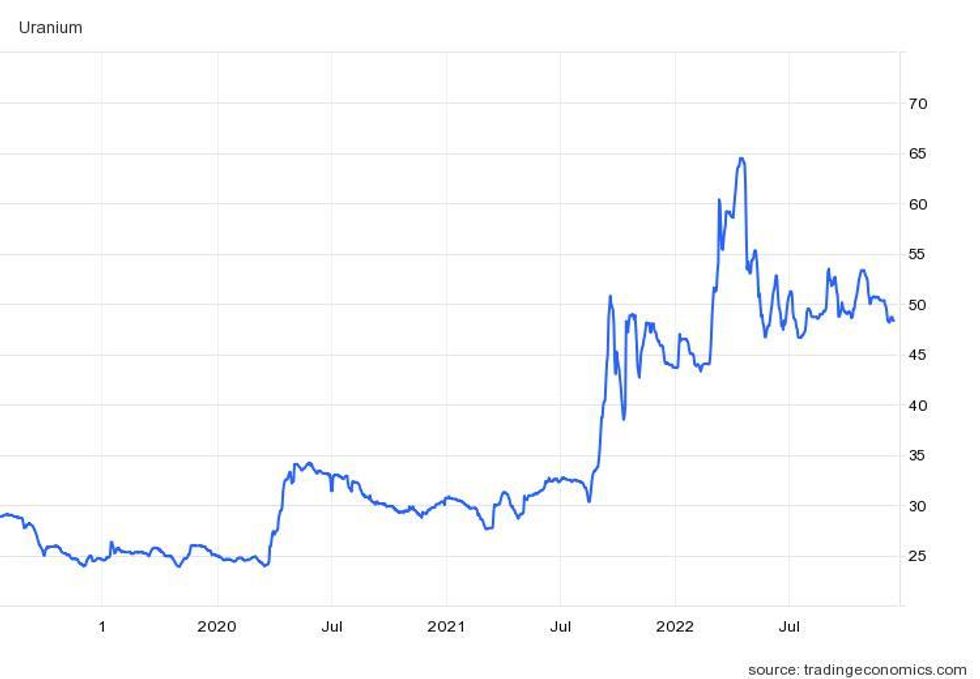

After years of rate stagnancy, uranium has actually become a popular gamer, increasing 164 percent from January 2020 to an 11-year high in April 2022 on the back of the eco-friendly shift as well as issues concerning the power safety and security.

Those elements permitted uranium to remain securely over $48 an extra pound for the majority of 2022, however like a lot of assets, it still encounters obstacles. Overpriced rising cost of living as well as ever-rising rate of interest minimized several of uranium’s upside possibility in 2022; nonetheless, the marketplace has actually seen assistance from supply issues as well as various other elements.

With 2023 quick coming close to, Spending Information Network (INN) asked specialists concerning their assumptions for uranium in the following year. Continue reading to discover what they needed to claim concerning the sector.

2022 establishes the phase for a favorable 2023 for uranium

Looking initially to 2022, the marketplace individuals INN talked to highlighted the favorable uranium rate activity.

” Uranium, like lithium, has one of the most favorable principles, together with bipartisan assistance around the world,” claimed Gerardo Del Real, owner of Junior Source Month-to-month as well as Junior Source Investor. “Both struggled with years of underinvestment as well as currently take pleasure in expanding need that will not have the ability to come online quick sufficient at present rates.”

Uranium as well as lithium are amongst minority assets to upload yearly gains this year, developing energy regardless of the financial chaos that has actually clutched markets for the majority of the fiscal year.

U3O8 place rate efficiency, 2019 to 2022.

Graph by means of TradingEconomics.

For Wolf Tiggre, owner of IndependentSpeculator.com, the uranium relocation was just an issue of time. “I believe this was mosting likely to take place anyhow, due to the fact that the most significant manufacturers worldwide have actually minimized their manufacturing as well as the BRICS nations (Brazil, Russia, India, China as well as South Africa) are developing nuclear reactor as quick as they can, however the battle has actually sped up. the pattern,” he informed INN.

The Russian intrusion of Ukraine in late February sent out the nuclear gas market increasing, as all 3 vital sectors– U3O8 supply, together with conversion as well as enrichment solutions– saw rates increase. “With the New Iron Drape removing Russian power, the writing gets on the wall surface as well as it is extremely favorable for uranium rates,” Tiggre commented.

Ukraine is house to 15 operating atomic power plants as well as 4 nuclear power plant that create fifty percent of the nation’s electrical power, as well as Russia’s requisition of the Zaporizhzhia plant increased some issues concerning possible damages. Nonetheless, both Tiggre as well as Del Real highlighted that the durability of the plant is a favorable indication.

” The genuine tale is that regardless of the battle of the Ukrainian nuclear power plant, it has actually stood up extremely well as well as has actually done much better than anticipated,” Del Real claimed. “Uranium principles are as favorable as I have actually ever before seen them.”

.

Safety of supply will remain to take spotlight.

Procurement is an essential aspect of power safety and security, as well as uranium supply is anticipated to stay in the limelight in 2023.

Today, nuclear power created from the globe’s 438 activators generates 10 percent of the globe’s electrical power, which number is forecasted to boost dramatically over the following years as some 60 brand-new activators come on-line.

There are an additional 96 activators presently in the preparation stage.

Protecting a constant supply of uranium that can be refined right into nuclear gas is specifically crucial to the power shift, according to John Ciampaglia, president of Sprott Property Monitoring.

” The 434 unusual activators need concerning 180 million extra pounds of uranium annually for their gas book,” he claimed in November. “Main manufacturing is around 130 million extra pounds, as well as following year it will most likely be 140 to 145 million extra pounds.”

He took place to clarify that the shortage can just be supported with an extra supply of mining. Nonetheless, with rising cost of living increasing prices anywhere, uranium rate positivity might just suffice to reboot shut tasks, not construct brand-new mines.

” Expenses have actually increased dramatically,” he claimed. “We believe the expense, or the rate you would certainly require to see on uranium to incentivize growth of any type of brand-new brand-new task, is someplace in between $75 as well as $100.”

During the last uranium advancing market greater than a years back, capitalists saw the place rate increase greater than 1,800 percent, from US$ 7 in December 2000 to an all-time high of US$ 140 in June 2007. This moment, the marketplace has even more principles in its support that are sustaining continual rate development.

Among one of the most appealing is the demand for tidy, undisturbed power. While solar as well as wind power are thought about eco-friendly, they are vulnerable to serious climate condition, which are ending up being a lot more usual.

” If you consider exactly how trustworthy each of these various kinds of power is, nuclear is the greatest at 92 percent,” the chief executive officer claimed. “That implies 92 percent of the moment, if you’re running a nuclear reactor, you’re creating electrical power.”

On the various other hand, that number goes down to 42 percent when speaking about hydropower, as well as it goes down to 35 percent for wind as well as simply 25 percent for solar. “Reduced greenhouse gas exhausts are necessary, however dependability is equally as essential,” Ciampaglia claimed.

.

Extra uranium M&A task likely in the coming year.

Uranium specialists will certainly likewise be enjoying M&A task in 2023 following a number of significant 2022 bargains.

Among one of the most unforgettable news of in 2015 was the October information that Cameco (TSX: CCO, NYSE: CCJ) as well as Brookfield Renewable Allies (TSX: BEP.UN, NYSE: BEP) will certainly obtain Westinghouse Electric Business.

The enormous $7.8 billion bargain will certainly see Cameco, among the globe’s biggest uranium manufacturers, obtain a 49 percent bulk risk in “among the globe’s biggest nuclear energy companies.”

Earlier this year, Uranium Power (NYSEAMERICAN: UEC) got Canadian-listed UEX in a proposal to “develop the biggest varied North American-focused uranium firm.” The acquisition significant Uranium Power’s 2nd significant relocate much less than year: In December 2021, the firm got Uranium One Americas.

” There is an arising pattern for Western energies to safeguard supply for uranium tasks in tested as well as politically steady territories. This is an ideal fit with UEC’s production-ready allowed United States ISR tasks as well as wide development pipe in Canada,” claimed Amir Adnani, Head Of State as well as Chief Executive Officer of Uranium Power.

Favorable need principles, combined with steady uranium rates despite solid headwinds, are most likely to cause even more sector bargains, Junior Source Regular monthly’s Del Real claimed. “I expect even more M&A s as the business with the very best possessions combine to place themselves to make the most of make money from the following uranium mania I see unraveling,” he claimed.

While these bargains might be great information for the North American uranium industry, Tiggre advised care.

” Loan consolidation offers speculators less business to track, however each firm that has actually expanded with procurements has actually come to be harder to evaluate,” he claimed. they do absent an engaging worth proposal as a result of the high quality of the possessions they acquired. Caveat emptor.”

As the uranium market proceeds, he prepares for even more bargains to find.

” There can conveniently be a lot more loan consolidation amongst the juniors, however that does not always develop worth,” Tiggre claimed. “Nonetheless, programmers creating successful brand-new mines are clear purchase targets that can create outsized funding gains.”

.

Just how much can uranium rates increase in 2023?

It stays to be seen exactly how high uranium rates will certainly be throughout the present advancing market.

As stated, throughout the last favorable stage, rates climbed greater than 1,800 percent, from US$ 7 in December 2000 to an all-time high of US$ 140 in June 2007. The previous cycle, which extended from 1973 to 1978, saw worths increase 629 percent in 5 years.

” I anticipate the rate of uranium to damage over the $200 degree prior to kicking back to the reduced three-way numbers,” Del Real claimed.

Although the need overview is brilliant, Tiggre sees the rate relocating a lot more outstanding. “I anticipate an unstable however consistent climb, with smaller sized spikes feasible later on. So the marketplace must resolve at a cost that incentivizes sufficient mine supply,” he claimed. “That can be about $60 to $70 today, however it would certainly need to change for rising cost of living moving forward.”

In regards to what the Independent Speculator will certainly be watching out for in the industry in the coming year, he indicated lasting having with energies.

” Costs for these agreements are typically not divulged at the time of finalizing, however we must have the ability to compute them, in accumulation, from manufacturers’ monetary records in the future,” Tiggre described. “This has actually currently begun. Unless I am seriously incorrect, 2023 must be an also much better year for uranium than 2022 has actually been.”

More generally, Del Real sees 2023 as an outbreak year for a variety of assets.

” The lithium as well as uranium rooms stay both assets I see having the very best 2023, however do not undervalue a quick downgrade of high quality gold business as the gold rate restores its standing as not simply a preserver of wide range, however as a means to boost wide range. he claimed, while likewise stating copper. “2023 must be one for guides for a lot of assets,” Del Real ended.

Do not neglect to follow us @INN_Resource genuine time updates!

Securities Disclosure: I, Georgia Williams, have no straight financial investment passion in any one of the business stated in this post.

Content Disclosure: Spending Information Network does not ensure the precision or efficiency of the info reported in the meetings it carries out. The viewpoints revealed in these meetings do not show the sights of the Spending Information Network as well as do not make up financial investment suggestions. All viewers are motivated to do their very own due persistance.

From the write-ups on your site

Related Articles on the Web

.