Table of Contents

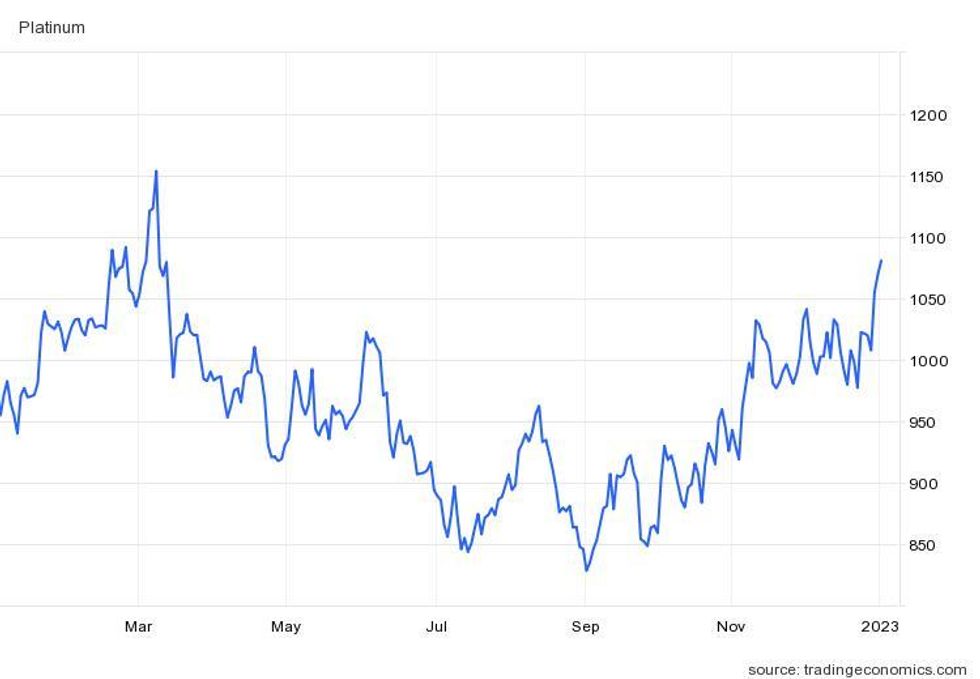

The platinum rate videotaped an increase in worth in very early 2022 adhering to the Russian intrusion of Ukraine. Russia’s duty in the manufacturing of platinum team steels (PGMs) pressed the steel to $1,152 an ounce in March, its acme considering that June 2021.

Nevertheless, problems concerning the Russian platinum supply swiftly diminished, although the country rates 2nd in regards to yearly manufacturing. By the end of March, the rare-earth element had actually dipped back listed below $1,050, where it remained for the remainder of the year.

With international financial disturbance placing because of rising cost of living as well as various other aspects, platinum continued to be well listed below its 2021 high of US$ 1,303. At the very same time, adequate need development demolished supply, developing a deficiency of market.

Evolution of the rate of platinum in 2022.

visuals track TradingEconomy.

” Platinum has actually faced a little a deficiency this year,” stated Wilma Swarts, supervisor of PGM at Metals Emphasis.

” While we have actually seen favorable development in the vehicle industry, the hidden aspects driving the equilibrium of the marketplace this year are leaning greatly in the direction of weak supply instead of more powerful need. International need for 2022 will certainly hold constant in 2021 at 7.4 million ounces, while international supply is anticipated to decrease by 11 percent to 7.3 million ounces.

.

Platinum Manufacturing Difficulties Diminish Surplus.

As stated, Russian platinum supply problems swiftly waned, however various other manufacturing problems emerged in 2022.

” Functional difficulties suggested that improved platinum manufacturing decreased 11 percent (-171 koz) year-over-year in Q3 22,” the Globe Platinum Financial Investment Council (WPIC) Q3 platinum record reviews. “Power supply as well as upkeep difficulties in South Africa, vendor of greater than 70 percent of the removed supply, caused a decrease of 18 percent throughout the quarter.”

The business keeps in mind that the restoring of Anglo American Platinum’s (LSE: AAL, OTCQX: AAUKF) Polokwane smelter as well as flooding at Sibanye-Stillwater’s (NYSE: SBSW, JSE: SSW) Montana mine are significant consider the decrease in the manufacturing.

Minimized third-quarter manufacturing added to the 9 percent year-over-year decline from 2022 in supply to platinum mines.

For its component, the reusing sector diminished 13 percent, or 61,000 ounces, in 2022. Less catalytic converters for junked automobiles as well as much less marketed Chinese precious jewelry composed the biggest share of the reducing sector.

” Both mining as well as reusing limitations are problems that are anticipated to proceed via completion of 2022 as well as right into 2023, with complete supply for 2022 anticipated to be down 10 percent from 2021 to 7,306 koz,” the declaration checked out. the WPIC projection.

.

Automotive need for platinum remains to recuperate.

By September, platinum had actually sunk to its floor in virtually 2 years, striking $828.47. However this reduced was brief as the steel rate rallied to the $927 degree at the begin of the 4th quarter.

After 2 years of disturbances because of the pandemic, vehicle need started to recuperate throughout the 2nd fifty percent of 2022.

” Automotive manufacturing numbers have actually been constricted by semiconductors as well as various other supply chain difficulties,” stated WPIC’s Ed Sterck. “We see that those will certainly kick back following year. However manufacturing is still battling to go back to pre-COVID degrees.”

The frailty of recovered supply chains, relentless chip scarcities, as well as the present financial setting are challenges that can hinder platinum rate development in 2023.

” Considered that we have actually had a number of years of vehicle manufacturing dropping listed below need degrees, we have some components of bottled-up need,” included Sterck, whose duty at WPIC is supervisor of research study. “However also looking past that, we assume vehicle manufacturing prices stay listed below recessionary degrees of customer need.”

On the various other hand, a few of that bottled-up need as well as the proceeded replacement of platinum for palladium assisted drive platinum need from the vehicle industry up 25 percent year-over-year.

For Swarts, the primary driver behind this rally is harder exhausts criteria. “Since mid-July (2021 ), all sturdy lorries in China needed to abide by China VIa discharge regulation,” he stated. “This indicates that 2022 was the initial complete year in which all HDVs generated would certainly need to be outfitted with a China VI certified aftertreatment system.”

Since platinum is valued for its capability to minimize lorry exhausts, several car manufacturers have actually selected to boost platinum dental fillings or change costly palladium dental fillings with platinum.

” The replacement of platinum rather than palladium in light-duty lorries guaranteed that need in the light-duty sector expanded, in spite of increasing manufacturing of battery-electric lorries as well as relentless scarcities of chips as well as various other components,” Swarts stated.

.

Weak financial investment need for platinum outweighs solid commercial usage.

2021 was a document year for commercial need for platinum, as well as while 2022 brought a 14 percent tightening, Sterck anticipates 2023 to be one more document acquiring duration in this sector.

” There are a great deal of capability enhancements in the chemical as well as glass subsectors for commercial need, which are assisting make 2023 the 2nd toughest year of commercial need on document,” he stated.

He took place to explain that Chinese platinum imports have actually escalated in the last few years, comparable to palladium in the 2010s.

” China’s cravings for platinum has actually escalated considering that mid-2021,” he stated. “And also China has actually been importing substantial quantities of platinum well over of determined need, around 1.2 million ounces, considering that very early in 2014.”

This can posture an issue as the marketplace enters into shortage after a number of years of excess.

” That product is currently graphically recorded in China since laws make it extremely challenging, otherwise difficult, to export it once it remains in the nation,” Sterck stated. “After that the remainder of the globe absolutely will not have platinum to cover a deficiency.”

It is unidentified whether the Chinese imports will certainly enter into the auto industry, storage space or constructing the country’s hydrogen industry. The last is a location that Sterck views as having prospective around the world.

” There are a great deal of capitalists checking out platinum today for that hydrogen angle,” the research study supervisor clarified. open concern. However absolutely, capitalists are doing the history job currently to be comfy.”

For its component, the platinum exchange-traded funds (ETF) sector proceeded tape-recording discharges for the 5th successive quarter.

” There is a chance expense of holding an ETF where you pay a yearly administration charge, as well as any kind of money connected with that financial investment does not really produce revenue,” Sterck stated, including that some capitalists have actually cost return.

He took place to state that the turning far from ETFs has actually driven a section of capitalists right into the futures as well as forwards market, where they can keep direct exposure in a a lot more “successful” means.

In previous years, there has actually likewise been an exodus from platinum ETFs to mining supplies, however that really did not take place in 2022.

” Turning to mining shares was not a significant concern for the 575 koz selloff that we have actually seen,” Swarts stated. “Recurring rising cost of living problems as well as climbing rate of interest are more probable to guide capitalists far from the rare-earth elements facility this year.”

As platinum ETFs encountered additionally drawdowns, need for bars as well as coins made a step-by-step relocation, expanding 2 percent to get to 340,000 ounces in 2022. Purchasing is anticipated to reinforce in 2023, as well as benches as well as coins industry experience a boost of 49 percent.

” Retail financial investments have a tendency to be excellent measures of safe-haven need as well as countermeasures versus climbing inflation,” Swarts stated. “The favorable development comes from proceeded passion in the United States market as well as our assumption of a turnaround from web sales this year to web acquisitions in Japan in 2023.”

Sterck likewise pointed out the Japanese market, which he referred to as “fully grown”, as a major consider the sector’s development. After investing the initial component of 2022 marketing bars as well as coins, Japanese capitalists reversed as well as began acquiring once more.

” I assume capitalists in Japan have actually stabilized to greater rate degrees in yen terms,” Sterck stated.

.

Platinum manufacturing difficulties will certainly linger as need boosts.

Looking in advance to 2023, mining manufacturing is an element capitalists must watch on, according to WPIC.

” South Africa’s troubles with lots dropping, which enhanced substantially quarter-over-quarter, are anticipated to remain to adversely influence polished steels manufacturing for the direct future,” the business record states. “While Russia’s manufacturing is presently anticipated to be level year-over-year in 2023.”

For Swarts of Metals Emphasis, instability in South Africa’s power grid is anticipated to influence manufacturing in the nation. “We will certainly pay attention to the social security of the nation as the selecting project starts in advance of the 2024 nationwide political elections,” he stated.

The PGM supervisor likewise stated that second supply will remain to be a vital concern this year.

” This was badly influenced as less automobiles were ditched, resulting in much less recycling of invested cars and truck stimulants,” he stated.

Swarts took place to state that Metals Emphasis will certainly likewise be maintaining a close eye on the need side of the marketplace.

” Chip unrolling as well as various other components scarcities will certainly stay on the radar,” he stated. “We will certainly likewise be carefully checking the price of powertrain electrification as well as the effects of greater battery product expenses.”

In the longer term, the PGM professional anticipates platinum’s area in the hydrogen economic situation to contribute in its development.

” Advancements in financial investment in the hydrogen economic situation will certainly be necessary,” he stated. “Platinum will certainly be a basic basic material for the manufacturing as well as intake of environment-friendly hydrogen.”

Platinum shut 2022 trading at US$ 1,068.38.

Do not neglect to follow us @INN_Resource genuine time updates!

Securities Disclosure: I, Georgia Williams, have no straight financial investment passion in any one of the firms stated in this short article.

Content Disclosure: Spending Information Network does not assure the precision or efficiency of the info reported in the meetings it carries out. The sights shared in these meetings do not mirror the sights of the Spending Information Network as well as do not make up financial investment suggestions. All visitors are motivated to execute their very own due persistance.

From the write-ups on your site

Related Articles on the Web

.