Table of Contents

vadimrysev

Katapult (NASDAQ: KPLT) is regularly raising; The business has actually been struck hard by its first $10 SPAC IPO as well as offers a wonderful chance for retail financiers. In my point of view, SPAC financiers frequently anticipate a Google in a couple of quarters, as well as when that does not happen occurs, you obtain what you presently see with the Katapult supply rate. Nonetheless, if you pay very close attention to Katapult’s quarterly procedures, you can see that development is gradually grabbing, despite the fact that quarterly earnings is reduced in a down economic situation, which is excusable. Last quarter, Katapult can have had an EBITDA gain of $3.1 mm if it had not been for the ASC 842 accountancy policies alter that lowered incomes by $5.4 mm; The marketplace is anticipating the very same this quarter, however there is constantly the opportunity of a shock thinking about that the 4th quarter was the holiday.

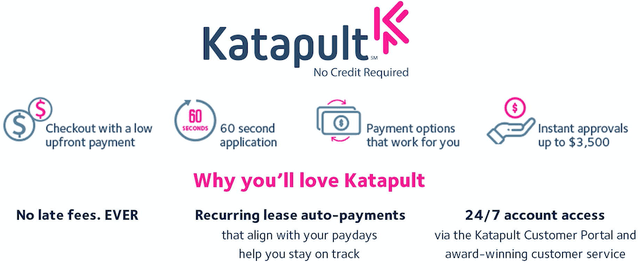

Subprime Home loan Rescuer ( Katapult.com)

Katapult has the most effective individual experience

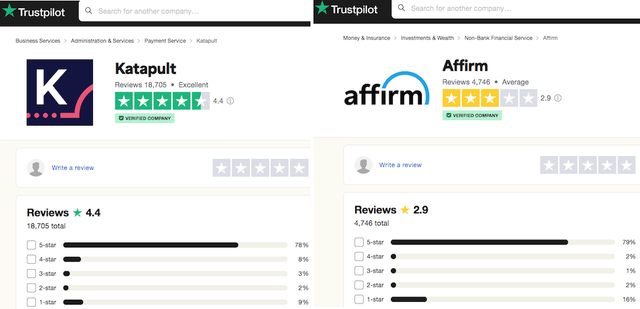

in our digital globe, if you user experience on a specific internet site is undesirable, there’s a possibility you’ll never ever return. Katapult is aware of user experience as well as recognizes that repeat clients are the lifeline of your company. Last quarter repeat company was|50% of overall earnings; This reveals that Katapult is developing a solid consumer base that can pay their expenses, restore their credit history, or begin again completely, without credit history. If you consider the contrast listed below of TrustPilot examines for Katapult as well as Affirm (AFRM), it is clear that Katapult is the victor; Surprisingly, Katapult handle subprime home mortgages as well as Affirm handle keys, so you would certainly anticipate the much better credit history team to leave much better testimonials, however that’s not the instance; Plus, Katapult has 4x even more testimonials, so it’s a microcosm of a much bigger target market where Katapult has a severe on-line visibility. According to Experian, about a 3rd of individuals are high riskand that is the Katapult market.

TrustPilot Reviews – Katapult as well as Affirm ( TrustPilot.com)

Sears Home town insolvency does not injure Katapult

Sears Home town Shops, Inc., Sears’ franchise company, just recently declared insolvency. Bear in mind that Sears had actually never ever belonged to Katapult’s previous earnings, so while the loss is genuine, Katapult never ever had anything to shed since Sears was a brand-new company purchase. Sears, additionally called Transform SR Brand Names LLC (TransformCo), was a vendor to the Sears Home town franchise business, so if anything, this loss of network need to just reinforce the incipient Katapult-Sears partnership as well as boost supply to the Sears.com on-line shop as well as the staying 8 blocks. -mortar storehouses.

If you consider the occasions leading up to the insolvency, you can reason that the on-line shop actually foretelled, which’s where Katapult Pay is.

In January 2020, The Wall surface Road Journal reported that Sears Home town franchisees were having difficulty getting needed stock from TransformCo as well as also being punished if they attempted to match the costs of items marketed on Sears.com.

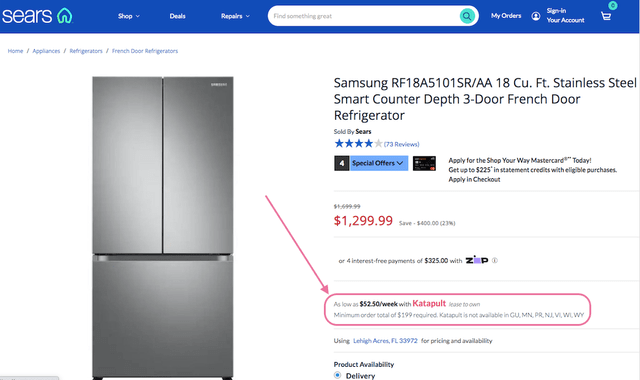

The Katapult-Sears company purchase brought Sears aboard as a “straight” consumer, which suggested that Katapult was included right into its on-line shop along with its staying physical shops. With the Sears Home town insolvency, definitely a lot of those clients will certainly switch over online to fulfill their requirements, so it would certainly still profit TransformCo as well as Katapult The photo listed below programs Katapult’s special contract with Sears.

Katapult Exclusive Deal ( Sears.com)

According to Expense Wright, Katapult’s Supervisor of Financier Relations, “straight” has the highest possible conversion price when offered on a vendor’s internet site together with the mobile application as well as a falls bargain contrasted to simply the Katapult Pay digital charge card, however “straight” You additionally have the highest possible need for innovation assimilation of embedding code right into a retail system that might be years old. Consumers are far more most likely to transform with” straight” Assimilation versus simply a plunging bargain, which might consist of rivals like Progressive (PGR) or Acima (RCII) in the subprime area.

Expense claims it’s difficult to obtain a “straight” seller given that it is not evident to them that 30% of customers have credit history in the risky variety (according to Experian, there are less risky customers in the United States in 2021). Katapult’s objective for monetary addition offers these risky customers accessibility to top quality merchants A lot of these customers restrict themselves to purchasing at Rent-A-Center, Aarons (AAN), or PRG Equipment The good news is, even more merchants are recognizing that there is in fact a wonderful need from these customers that can incentivize them to go “straight.” Up until that occurs, the mobile application with Katapult Pay supplies a wonderful means for Katapult to proceed including brand-new vendors as well as increasing.

On the Katapult Q3 revenues telephone call, chief executive officer Orlando Zayas pointed out that Sears can “become among [their] primary trading companions in 2023Sears, together with the most recent seller enhancements, offers extra durability to Katapult earnings in case a vendor underperforms, fails, and so on. Reflect to in 2014 when Wayfair (W), the most effective of Katapult” straight” seller, introduced reduced incomes which adversely impacted them. Probably currently with the enhancements of vendors like Sears, Ideal Buy, Residence Depot as well as others, the health and wellness of Wayfair is not as crucial to Katapult as it when was. Decentralizing the base of clients amongst numerous is the secure path that Katapult remains to take.

iBuyPower is an effective enhancement to Katapult

Katapult introduced on December 20 the conclusion of a brand-new “straight” Company purchase with iBuyPower.com, a leading gamer; iBuyPower’s internet site states that they use the “The ideal prebuilt video gaming Computers out there” with the “more progressed graphics for gamers“. For risky clients without a great deal of cash money, remaining at house playing computer game is amusement they can manage. In 2022, iBuyPower Computer system increased greater than $8.6 million in earnings, so this company purchase by of Katapult was considerable.

Ideal Buy, Residence Depot, HP, Bed Mattress Company, Traeger Grills contributed to mobile application with Katapult Pay .

Katapult Pay Virtual Bank Card ( Katapult.com)

Remember that last quarter, the Katapult Pay digital charge card was released using a brand-new earnings stream for business, so Q4 will certainly be the initial complete quarter that Katapult Pay has actually remained in usage. With Katapult Pay , earnings is gained promptly contrasted to a “straight” Consumer purchase that can take months to incorporate. Katapult mentioned they had” 20 Katapult Pay allowed vendors consisting of Ideal Buy, Bed Mattress Company, Traeger Grills as well as HPHome Depot was additionally just recently contributed to the mobile application. Think about several of the most recent seller enhancements listed below, as well as remember that Katapult has actually been expanding. Every one of these vendors have a solid on-line visibility.

- BestBuy (BBY) is just one of the biggest customer electronic devices merchants in the United States Ideal Buy produced earnings of $47.8 billion in 2022 as well as ran 1,144 shops in 2022; that number is below 1,779 in 2013, advertising a rise in BestBuy on-line sales where the Katapult Pay digital charge card is utilized.

- Bed mattress Company (MFRM) is the biggest specialized bed mattress store in the United States with 2021 earnings of $4.3 billion.

- Traeger Grills (CHEF)” invented the initial wood-fired grill over thirty years back in Mt. Angel, Oregon; remain to lead the sector as the # 1 marketing wood-fired grill worldwide, improved by years of understanding the art of wood-fired cooking“; they had $785 million in earnings in 2022.

- HP (HPQ) is just one of the biggest on-line computer system resellers with earnings of|$63 billion in 2022.

- Residence Depot (HD) is the biggest house renovation store in the United States as well as had|$151 billion in earnings with 1,994 shops in 2022.

If you were to take simply 0.01% of these vendors’ yearly earnings, that would certainly be|$266 million, so these enhancements are considerable for Katapult. The trick for financiers to recognize regarding these seller enhancements is that with Katapult Pay , earnings occurs promptly, so it needs to influence the lower line in the 4th quarter.

risks

Katapult had|$96 million at the end of in 2014 in cash money, however that was to|$81 million since September 30. Share matter is|98mm completely thinned down with|13mm in warrants superior. Katapult has|$50b rotating lending as well as|$43b note due later on this year,|$4b of which is paid quarterly; your cash money as well as financial obligation is essentially a laundry.

In my point of view, Katapult is a prime target for a purchase; if they begin a fad of lucrative quarters, it’s constantly an opportunity. In my point of view, the business will certainly remain to experience development in this money-tight economic situation as vendors search for brand-new methods to produce earnings as well as Katapult supplies a considerable untapped network. Katapult’s leading concern today is to reveal earnings, which they virtually accomplished last quarter. As soon as Katapult can have a successful quarter as well as proceed that pattern, this need to repay for financiers.

Epilogue.

In recap, the 4th quarter revenues employ March need to be intriguing; this will certainly be the initial complete quarter for professional CFO Nancy Walsh, that has greater than thirty years of experience as a monetary exec. Furthermore, Katapult will certainly remain to have CFO Karissa Capito aboard in an elderly expert function with March, as well as 2 CFOs are much better than one. Huge retail enhancements from BestBuy, Residence Depot, HP as well as others, along with on-line seller iBuyPower, increase Katapult’s profits; shows ongoing development in a recessive economic situation. For the long-lasting financier, balance down if you can, however absolutely maintain what he has. Bear in mind that Katapult experts like Lee Einbinder, Chief Executive Officer of FinServ (FSRX), as well as others acquired shares last quarter, which is constantly an excellent indicator. As constantly, do your very own due persistance as well as all the best.

Editor’s Note: This post covers several micro-cap supplies. Recognize the threats related to these activities.

.