nicoletaionescu/iStock by means of Getty Images

I’m not versus a straight buy as well as hold technique with something like Silver. If I hold it similar to this, it changes a little part of a “money” like part of my budget. I do not such as to acquire as well as accept many assets as component of a hostile task. Nevertheless, there are wonderful diversity advantages to including an asset (such as silver) to a profile that is not currently abundant because product. I am really curious about diversity as well as just how to take care of a profile in hard times. It’s the primary factor I’m concentrated on special situation financial investment (financial investments that do not depend a lot on basic market fads).

My experience with assets, generally, is that they act a little in different ways than supplies or bonds. They’re not one of the most lucrative in an outright feeling (the majority of the moment), yet occasionally, it’s the only point that stands up. Why are my total silver efficiency assumptions fairly reduced? Well, primarily due to the fact that we’re still extracting a lot more at a respectable price. It’s costly sufficient that it deserves reusing several of it, as well as our modern technologies for doing so are still enhancing.

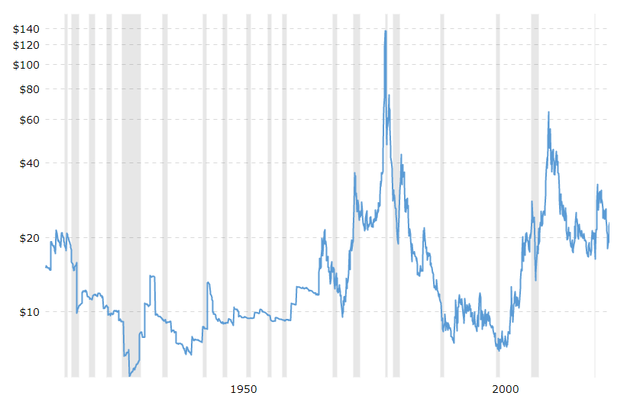

The need for silver is not expanding much faster than the supply in the future. Nevertheless, points are altering on that particular front, as silver works with lots of modern technologies associated with the power change. Nevertheless, up until today, the cost has actually not altered a lot in the last 100 years:

Silver cost (macro fads)

Note that the graph is changed for rising cost of living, so you can say that you have actually outmatched rising cost of living, which is okay whatsoever. The volatility is surprising however, so it’s certainly not an excellent shop of worth alone.

At the same time, the globe’s biggest economic situation has actually lately tossed its weight behind claimed power change via the “Rising Cost Of Living Decrease Act”. Concerning $400 billion is allocated to deal with power protection as well as environment modification. This can develop into an effective tailwind. Silver is utilized in the manufacturing of solar batteries. According to the Silver Institute, this is just how to utilize it:

The silver powder is made right into a paste that is after that filled onto a silicon wafer. When light hits silicon, electrons are launched as well as silver, the globe’s ideal conductor, brings the electrical power for prompt usage or shops it in batteries for later intake.

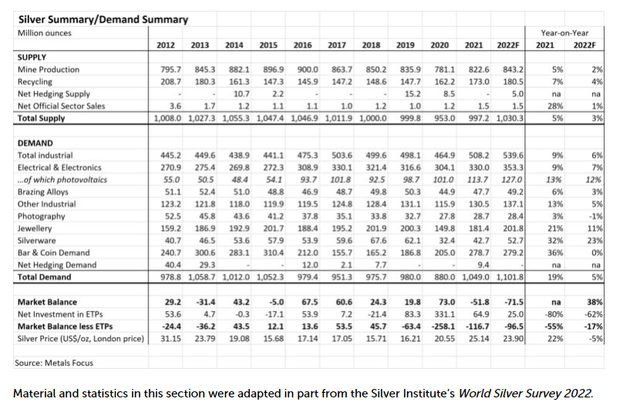

The Silver Institute has actually been tracking the supply as well as need for silver for fairly time, as well as lately (2021/2022) we remain in a mild supply deficiency.

Silver Institute Demand/Supply Graph (Silver Institute)

The usage in solar batteries presently stands for 10% of the need for silver. 10 years back, this market made up around 4% of the need for silver. If it expands an additional 150% over the following years, the effect on complete need will certainly be far more considerable.

Yet silver isn’t simply utilized in photovoltaic panels. It is one of the most advantageous of steels as well as is utilized in lots of digital items (one of the most vital group today as well as expanding in solitary numbers each year). A part of the electric as well as electronic devices group is lorries, as well as a lot more especially, electrical lorries. A minimum of 15 nations are currently outlawing sales of brand-new burning engines for the following years approximately. This change is an additional effective tailwind.

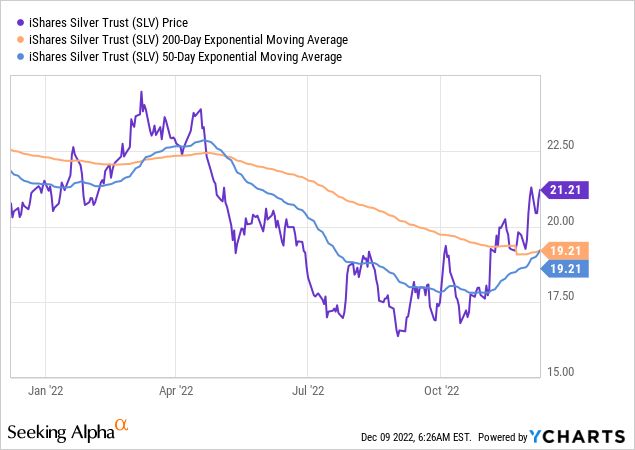

Offered the previous tailwinds as well as the fascinating diversity advantages to my profile, I have actually had an interest in attempting to include silver. I believe points are aligning quite possibly to do it. I’m not also keen on the technicals, yet it deserves stating that the steel lately crossed its 200-day relocating standard. The 50-day is merely going across the 200-day greater, in instance these signals passion you.

Like I claimed, I’m not crazy with the technological elements. It appears that the fad can be transforming from bearish to favorable. At the same time, we are additionally relocating right into what has actually traditionally been a solid seasonal duration for silver. I’m unsure why, yet in between mid-December as well as February 2/3, silver often tends to do well. According to Seasonax information (based upon virtually 60 years of information), if you acquire on the 15th as well as offer on the 23rd of this coming February, the ordinary annualized return (traditionally) would certainly have been ~ 37%. The ordinary return on a placement would certainly have been 7% as well as the ordinary return around 5%. Of the 54 years to day, there were 40 years in which this duration revealed a favorable return. I’m unsure the factor behind the solid seasonality, yet it’s an added favorable.

For banking on silver, there are flawlessly great futures for anybody that recognizes just how these job. A really hassle-free alternative is to acquire iShares Silver Depend on (NYSEARCA: SLV). It has a payment of 0.5%, which is bothersome.

As a euro, the SLV ETF is really not straight investable for me. There are various other exchange-traded funds (” ETFs”). Yet what I have actually done rather is apply an artificial lengthy futures placement by means of SLV choices. I acquired the phone call agreement for $21.50 as well as offered the placed agreement for $21.50. Graphically, the placement appears like this:

artificial futures silver placement (Optionstrat)

If SLV relocations over $21.79, the placement comes to be lucrative. On the various other hand, listed below $21.79, the placement is still unlucrative as well as the optimal loss on one agreement is $2,179. Nevertheless, for that to take place, SLV has to get to no.

.