Table of Contents

How Much Universal Credit Will I Get?

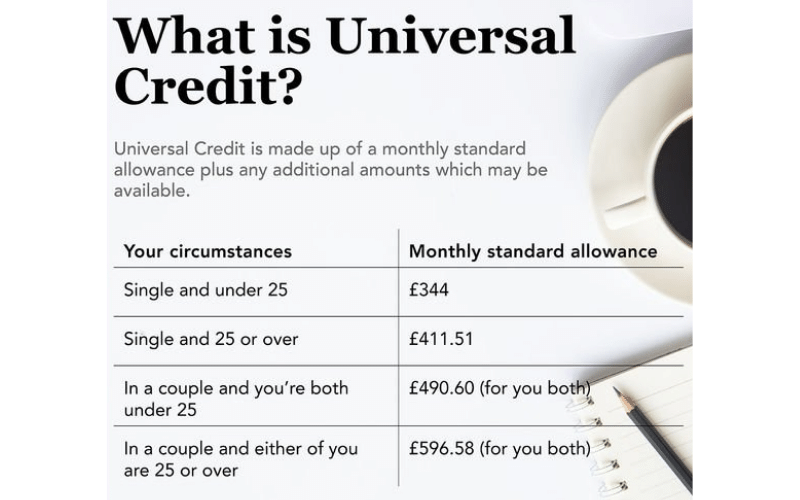

When calculating the Universal Credit you will receive, you must consider your circumstances. The amount of Universal Credit you receive depends on several elements, which are added together to determine the maximum amount you can receive.

The amount of your entitlement will be reduced by any other income or capital you may have, as well as any benefit cap that applies to you. Your standard allowance will also be based on your age and whether you claim as a single person or a couple.

Payments Are Worked Out In 3 Steps

There are three main steps in working out your payments for Universal Credit. Each of these steps will have different implications depending on your circumstances.

Depending on your income type, your payments will be based on this income. The first step is to understand your income and expenditure. Your income and expenditure will affect the amount of Universal Credit you receive.

The next step is to calculate your Universal Credit payments. This can be done by using the Universal Credit calculator. The calculator will work out the amounts due for three different elements.

These elements include the basic payment, the Child Element, and the Disabled Child Element. For those with children, the Child Element will depend on the number of children you have. In most cases, support will be limited to two children.

You must seek advice if you have been claiming tax credits and have already applied for UC. The waiting period for your first payment will take five weeks. You may have to take out an interest-free loan to cover the interest on your existing loan. This can take months to pay off.

Universal Credit has been controversial in its implementation and is a complex process. Many people have received less money than expected, and some have lost their savings.

This new scheme also requires you to wait five weeks to receive your first payment. You might consider applying for an advance loan if you need more time.

The first step is to work out your income. Universal Credit calculates your monthly income based on your actual earnings for the assessment period, not the average for the year.

As you earn more money, your Universal Credit payment will reduce. Every PS1 you earn will reduce your payments by 55 pence. However, some people can earn more than this before the payment for Universal Credit changes.

Earnings

When you claim universal credit, your earnings will be considered. The amount of your claim will depend on how much you earn each month. If you’re married, you can split your earnings equally. Your earnings will be credited toward your total claim if you’re single.

If you earn more than the work allowance, you can apply for an Advance Payment instead. This will enable you to take out more money and not have to keep re-applying for it.

However, earning more than this amount could hurt your benefit. For this reason, it’s vital to seek specialist benefits advice.

You may need to report the extra money to Universal Credit if you earn more than expected monthly. It will ask you about the type of employment you have, the hours you work, and how much you earn.

However, the amount of money you earn will not stop the other elements of your Universal Credit payment from being paid to you.

The DWP will use this information to calculate your universal credit award. This data comes from HMRC’s Real Time Information system. Most employers are required to submit their earnings figures electronically.

If you have multiple employers, you’ll need to provide their PAYE scheme numbers. The DWP should send this information to you automatically each month. If you don’t, you can contact your DWP and explain why you haven’t reported your earnings.

You should also remember to report your earnings on your tax return. Although Universal Credit is not a taxable benefit, some government benefits must be reported on your tax return.

You may be able to keep some of your earnings, even if you earn more than you qualify for. This means your Universal Credit payment will be smaller.

Depending on your work schedule, you may be able to save some money and still make enough to pay your monthly payments.

However, it’s important to remember that Universal Credit payments are not meant to replace the income you earn from your earnings.

The government is facing many challenges ahead. One of them is the UK’s future relationship with the European Union. Another is the aging population.

Child Element

You can apply for the child element of Universal Credit if you’re caring for children who are not your own. This is available if the arrangement is informal or formal and includes a court-appointed legal responsibility. To apply, fill out and submit Form IC1NI(IS).

You’ll get this benefit if you have a child under five. It will be added to your standard allowance and maximum entitlement.

It may be higher or lower than the standard amount, depending on your child’s disability. In addition, you’ll get extra Universal Credit if you adopt a child.

The amount of Universal Credit you’ll receive depends on your circumstances and household income. You’ll receive one standard allowance per household member, plus extra money for your first and second child. For children who are disabled, you may get even more. This amount can vary each month.

You can complete your claim online or over the phone. Make sure to include the name of the person claiming for you. You can also apply for an appointment with the DWP. You can contact them by email or telephone if you don’t have an account with the DWP.

The UC is meant to replace the old benefits like housing benefits. It’s a means-tested benefit. Therefore, you must ensure that you’re better off with Universal Credit before claiming it. You can claim it for yourself or a partner if both are eligible.

The rules of Universal Credit have changed since it was first introduced in 2013. Most of these changes have made it less generous.

The work allowances are lower, the child credit is only available to two children per household, and the family can claim two children’s elements. However, you should know that your payments can increase as circumstances change.

Child Care Costs

Universal credit covers childcare costs up to 85% of the cost. However, the costs cannot be covered in full by the state. You can claim a month’s childcare costs if employed and have children. If you care for someone with severe disabilities, you can also claim a month’s childcare costs.

However, childcare costs can be pretty expensive for some families. For instance, a full-time childcare place in England can cost more than PS1,000 a month. This can tip families over the edge financially. Universal credit aims to help those struggling to make ends meet. However, childcare providers charge parents in advance.

Depending on the type of childcare you need, you can claim up to 75% of the costs. However, you must make sure you choose an approved childcare provider. There are also rules about who can be a childcare provider. Childminders must be state-approved and be willing to accept Universal Credit as a form of payment.

Universal Credit helps cover the cost of childcare for children under 16 years of age. You must apply for the benefit and report all your childcare costs in a journal. The assistance you receive will be paid to you monthly, in arrears, so you must report the costs monthly.

HMRC has a childcare costs calculator that you can use to calculate the cost of childcare. This calculator is helpful for new claims and changes in your circumstances. You should print out the results and keep them somewhere safe in case HMRC needs to check your claim at some point.

Universal Credit may cover a portion of child care costs, so you can be sure your child is safe at work. You may need to pay the rest yourself. However, if you find that Universal Credit isn’t covering your childcare costs, you can apply for childcare elsewhere. You should also check with your local government for the rules on childcare costs.