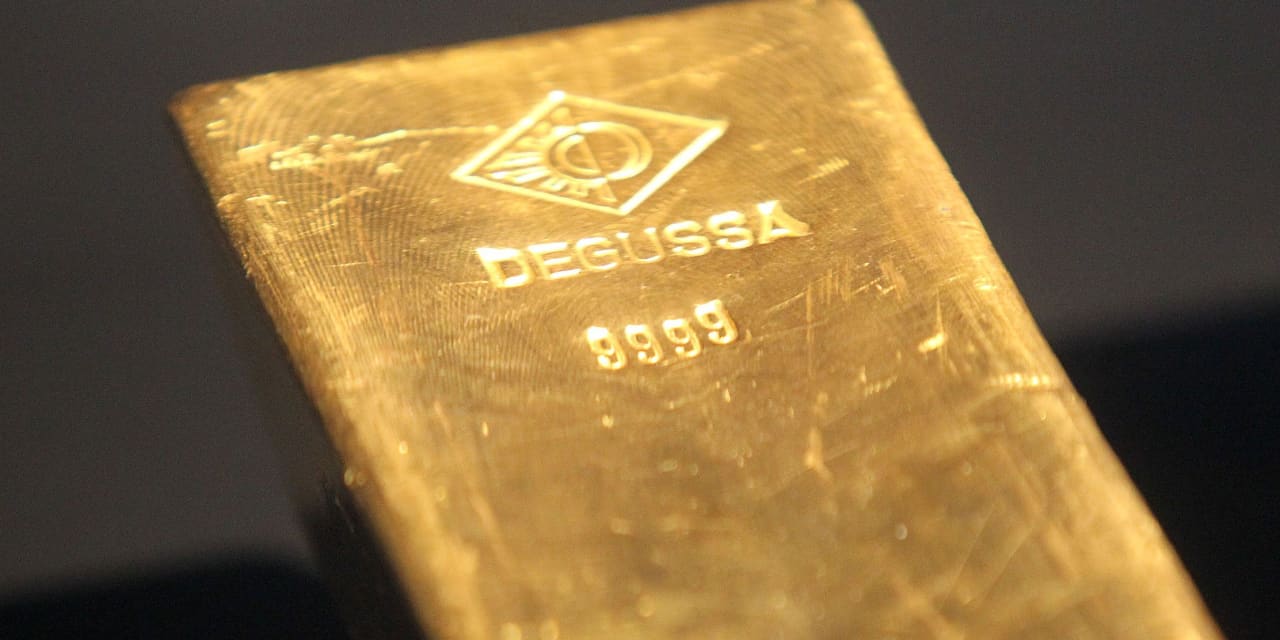

Gold costs opened up the initial trading session of 2023 on Tuesday by striking their highest degree in greater than 6 months, buoyed by reduced bond returns as well as assumptions of even more reserve bank purchasing.

Other rare-earth elements struck significant degrees, consisting of silver, whose most energetic agreement reached its highest possible intraday cost because April, while platinum struck its highest possible intraday degree because March.

price action

-

Gold costs due February GC00,

+1.00% .GCG23,.

+1.00% .

It progressed $19.90, or 1.1%, to shut at $1,846.10 per ounce on Comex. Rates for the most energetic agreement finished the session at their highest degree because June 16, FactSet information programs. - .

Silver equipment SI00,.

+0.75% .SIH23,.

+0.75% .

It climbed 20 cents, or 0.8%, to $24.236 an ounce after an intraday high of $24.775, the highest possible for a much more energetic agreement because mid-April. - .

april platinum PLJ23,.

+1.32% .

It progressed $10.40, or 1%, to $1,093.30 per ounce after a high of $1,108.70, the highest possible intraday cost for a much more energetic agreement because the initial fifty percent of March. The rare-earth element uploaded its largest quarterly gain because 2008 in the 3 months finishing December 31. - .

march PD PAH23,.

-5.59% .

it dropped $105.10, or almost 5.9%, to $1,692.90 per ounce. - .

March Copper HGH23,.

-1.10% .

it shed 4 cents, or almost 1.2%, to $3.7665 an extra pound.

market indicators

” Concern as well as question in the wider economic markets suggest that silver and gold have actually begun 2023 with a common New Year’s increase, drawing in speculative circulations as investors see weak development, high rising cost of living as well as intensifying financial problems. geopolitical leads,” Adrian Ash, supervisor of research study at BullionVault, created in Tuesday’s discourse.

Silver and gold costs struck their highest possible intraday degrees in months on Tuesday as well as the overview for rare-earth elements has actually boosted extremely just recently, experts claimed.

Prices of the rare-earth element rallied in spite of a more powerful United States buck, as investors concentrated rather on reduced Treasury returns, while acquisitions by the Individuals’s Financial institution of China motivated hope amongst investors that some financial institutions Nuclear power plant might raise the percentage of their books alloted to gold.

” Reserve bank acquisitions might be an additional aspect, adhering to records last month that individuals’s Financial institution of China began contributing to its gold books,” claimed Marios Hadjikyriacos, an elderly financial investment expert at XM.

The ICE United States buck DXY index,.

climbed 1% to 104,571, while the 10-year return TMUBMUSD10Y,.

it dropped 8.8 basis indicate 3.789%.

The gains from silver and gold are “unexpected” offered the stamina of the buck, Edward Meir, owner of Asset Study Team, claimed in a discourse composed for Marex. “We believe something will certainly need to give up the uncommon dollar/gold step as well as we presume the buck will certainly drop initially, instead of offering gold, as the United States Treasury market is not as buck pleasant.” on Tuesday. Business.

BullionVault’s Gold Financier Index, which determines the equilibrium of web purchasers over web vendors as a proportion of all BullionVault individuals, was up to an 11-month low of 53.3 in December, while the Silver Financier Index revealed a “all-time collection reduced” of 47.5, according to Ash. That revealed even more vendors than purchasers last month.

Still, in the last 3 months, silver costs have actually increased almost a 3rd versus the buck, as well as got greater than 20% in various other money, Ash claimed, while gold costs struck buck highs of around 7 months.

Precious steels supply a noticeable profession for the stagflation 2023 agreement, Ash claimed. Nevertheless, up until now just by-products have actually revealed inflows, with physical purchasers as well as holdings of exchange-traded funds drawing back at the beginning of the New Year, she claimed.

.