To checked out over the weekend break, Ivan Martchev, financial investment planner at Navellier & Associates, uses the list below remark:

Over extended periods of time, gold can be viewed as the “anti-dollar” or, much more extensively, as the “anti-paper cash”, yet in the intermediate term (3-5 years) its rate pattern can be a little bit much more difficult..

Q3 2022 letters from hedge funds, meetings and also more

Guy Spier and also Mohnish Pabrai: Concepts for Producing Riches and also Wisdom

Last month, fund supervisors and also worth capitalists Person Spier and also Mohnish Pabrai joined an online conversation and also question-and-answer session with the Helvetian Financial Investment Club. The title of the session was “Concepts for developing riches and also knowledge.” Among the basic concepts to produce riches is to have a circle of capability and also Review more

Last month, fund supervisors and also worth capitalists Person Spier and also Mohnish Pabrai joined an online conversation and also question-and-answer session with the Helvetian Financial Investment Club. The title of the session was “Concepts for developing riches and also knowledge.” Among the basic concepts to produce riches is to have a circle of capability and also Review more

Find a professional monetary adviser

Finding a certified monetary advisor does not need to be hard. SmartAsset’s totally free device matches you with approximately 3 fiduciary monetary consultants in your location in 5 mins.

Each expert has actually been vetted by SmartAsset and also is held to a fiduciary criterion to act in your benefit.

If you prepare to get in touch with neighborhood consultants that can assist you attain your monetary objectives, get going currently.

In the last 5 years, we have actually gone from durations where gold was plainly vice versa associated to the buck, and after that distinctly favorably associated. The last such favorable connection was from late 2021 to very early 2022. From mid-2022 previously, gold has actually been vice versa associated with the United States buck. The even more the buck climbed, the even more gold dropped and also the other way around.

In the last autumn of the buck, gold started its last run.

Inverse Connection of Gold to the United States Dollar

Here are 2 vital reasons this inverted connection is most likely to proceed.

# 1: I believe gold bullion and also the buck are seeing completion of the Fed tightening up cycle and also the start of the ECB price trek cycle.

Considering that the ECB lags the Fed, the rate of interest differential in between the buck and also the euro is most likely to slim, which will certainly sustain the euro and also taxed the buck, leading capitalists to the euro versus the buck.

What can thwart this liquidation is any kind of sharp rise of the Ukrainian dispute or contamination to various other nations, which is difficult to anticipate, and also I all the best wish it will certainly not take place.

Considered that all return contour procedures are deeply upside down, I believe the Fed must have introduced a time out at its conference on Wednesday, yet offered Powell’s irregular habits on FOMC communicators, this was difficult to anticipate. However, I believe that the gold market is looking past the FOMC conference today and also concentrating on what is most likely to take place in 2023.

# 2: Rising cost of living must go down dramatically in 2023.

Raised budget deficit throughout COVID created existing rising cost of living. The USA invested as much cash on COVID as it did throughout every one of The Second World War, about the dimension of the American economic climate.

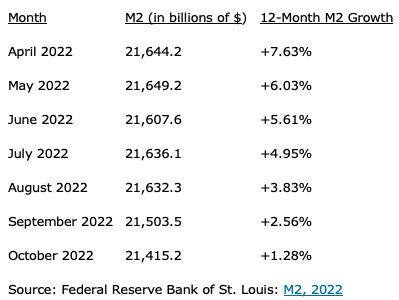

The issue is that costs on The second world war lasted for 5 years, whereas this time around we did it in one year. That $6 trillion in COVID costs created a rise in the M2 cash supply of 26.9% in February 2021. Finally matter (and also this is regular monthly information), the year-over-year development price in M2 is simply 1, 3%.

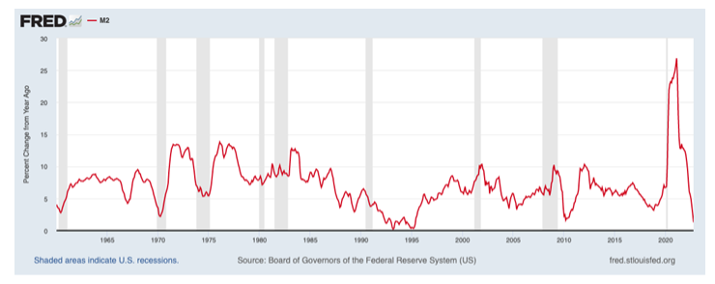

The much shorter three-month and also six-month annualized currency exchange rate are adverse. Based upon the graph below, we saw the largest surge and also largest decrease in M2 development in 65 years (as for I can obtain M2 development information).

In March 1993, M2 development got to 0.23%. 2 years later on, it dipped to 0.31%, after Greenspan’s Fed crafted the only soft touchdown in current memory in the mid-1990s. Still, with the fastest rate-raising cycle in background About the base where it began, and also a return contour that is one of the most upside down considering that the very early 1980s, M2 development is most likely to transform adverse.

This is what the M2 year-over-year development numbers appear like considering that April, as M2 is gradually decreasing.

As you can see, the price has actually been dropping greater than 1% each month, generally, considering that April, so with the return contour obtaining an increasing number of upside down and also with some lag, we can transform adverse by the end of 2022, when information for November and also December are offered, or in very early 2023.

A dramatically upside down return contour– and also it is readied to invert additionally on Wednesday after an additional 50 basis factor Fed price trek– limits the circulation of credit history, moistening M2 development.

This is since the United States monetary system’s preferred concept to “obtain brief” quits working when temporary prices are over lasting prices. I believe we will witness the very first dip in M2 development in current background.

.