Table of Contents

Wolterk

Introduction

We covered General Mills, Inc. (NYSE: SIG) on September 22 of this year, released the firm’s convincing initial quarter outcome. Shares increased to brand-new high up on the information and also we suggest capitalists to stay for a very long time. shares despite the fact that the firm’s evaluation goes to the high-end of its array. Given that we composed that post, the supply has actually climbed over $6 a share or over 8% and also is currently simply listed below the $87 degree.

Development was the major motif in the initial quarter (in both natural internet sales and also operating revenue), bring about a rise in modified gross margin and also operating revenue margin. This energy motivated administration to increase its full-year support for top-line income and also incomes per share. Suffice to state, by increasing down on what’s been functioning (continual development, branding at range, and so on) and also unloading from possessions that do not line up with its “Increase” campaign, administration thinks there are much more advantages to activity. cost. Interior fads relating to publication worth and also cost-free capital development likewise indicate even more gains on the cards below for this supply.

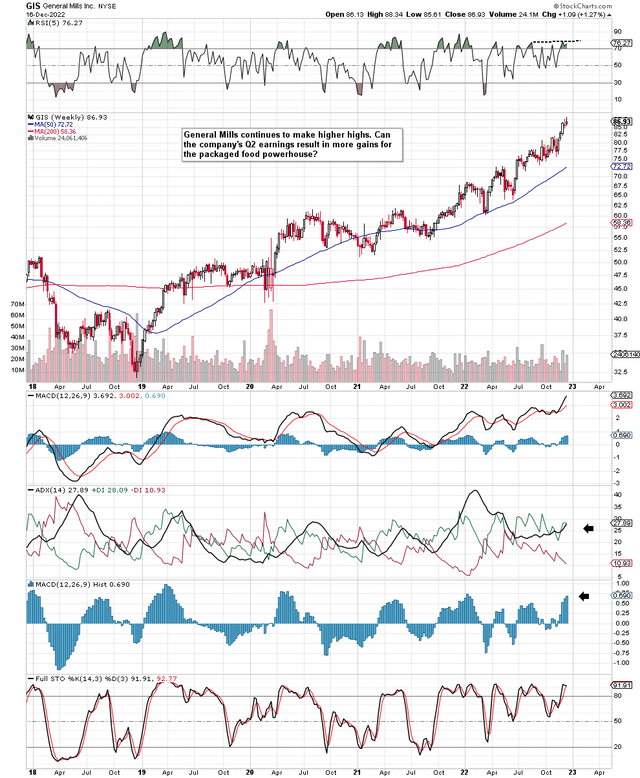

Taking a look at General Mills’ technological graph, we see that the supply remains to strike greater highs in spite of General Mills’ evaluation going to the high-end of its array (20.69 ahead GAAP several). Nonetheless, the greatest pattern relocates constantly occur from market highs and also not market lows, so do not be stunned if GIS remains to make greater highs. As a matter of fact, there are no substantial aberrations on the technological graph presently, as we can see from the MACD pie chart and also the RSI energy indication. On the other hand, the bull run in GIS has actually sped up in the 2022 schedule.

General Mills Technical Team ( Stockcharts.com)

General Mills Secondly Quarter Incomes Preview

General Mills is anticipated to reveal its financial 2nd quarter numbers on the 20th of this month, where $1.06 per share is the last GAAP quote for the quarter for sale of $5.19 billion. While binary occasions such as incomes news commonly offer the factor for a continual turnaround, we would certainly be extremely careful regarding holding brief deltas in GIS in advance of the firm’s second-quarter numbers launch. In the previous 12 quarters, GIS has actually reported 10 leading incomes and also simply 2 quarters that missed out on agreement assumptions. Additionally, among those quarters remained in the 2nd quarter of in 2015 when administration reported incomes of $0.99 per share that wound up fizzling by $0.06 per share. So from a market belief perspective, the favorable pattern below immediately is the development contour (7.5% development anticipated) as we have a $0.07 pillow to the benefit in between the lower line reported in the 2nd quarter of in 2015 ($ 0.99 per share) and also the anticipated analysis this year ($ 1.06 anticipated in the 2nd quarter of this ).

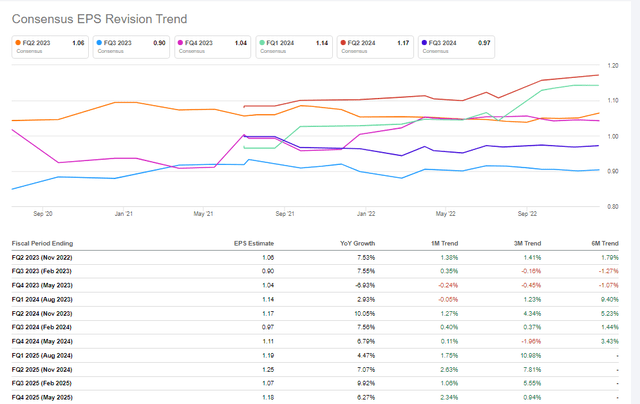

Additionally, as we can see in the quarterly agreement incomes alterations listed below, experts following this supply have actually remained to press price quotes greater in current months. As a matter of fact, there have actually been 13 upwards alterations in the last 3 months contrasted to just 3 down alterations. Consequently, the higher fads relating to margins and also incomes that we experienced in the initial quarter for General Mills show up to remain to make headway. The recession-resistant nature of this sector once more appears to be playing out below where GIS stays concentrated on providing customers what they desire, whether it be worth in the shop or ease on the “in the house” front.

Agreement GIS EPS Modifications ( Searching For Alpha)

Strategy

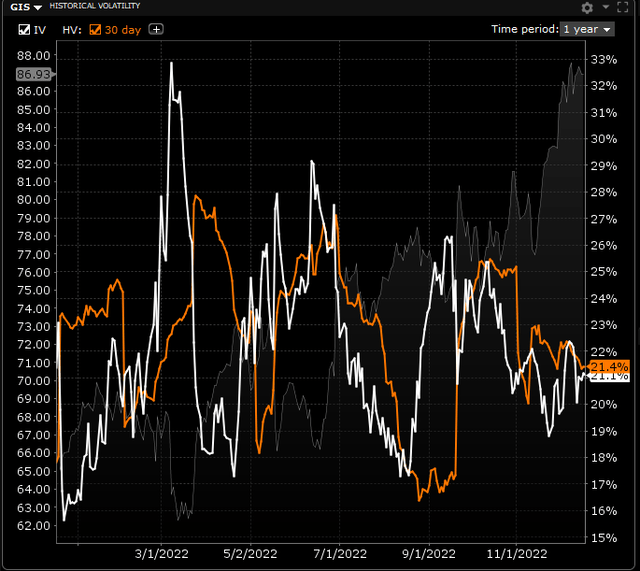

From an approach perspective, we can see from the General Mills suggested volatility graph that the marketplace anticipates a reduced post-earnings share cost contrasted to previous quarters. What this basically implies is that capitalists might not experience the exact same degree of gain from future quarterly incomes modifications as they performed in the past. This makes good sense from an evaluation perspective, as the firm’s incomes, as kept in mind over, remain to trade well over ordinary multiples (5-year GAAP incomes multiple of 16.58 contrasted to an anticipated multiple of 20.69 this year).

Consequently, an excellent technique moving forward (particularly if supplies remain to increase up until completion of the fiscal year) to lower danger would certainly be to utilize clinically depressed suggested volatility (which is likewise obvious in later expiry cycles) to transform existing supply placements in lengthy placements. outdated phone call alternatives or jump agreements. The $62.50 January 2024 phone call alternative, as an example, is presently trading at regarding $27 per phone call and also has a delta of 0.90. This technique enables the financier to take part in even more GIS advantages, minimize the danger of loss since there is a lot less resources at risk, and also can utilize that added resources to buy various other names with reduced appraisals and also greater returns returns.

General Mills Implied Volatility ( Interactive brokers)

Conclution

So, to summarize, General Mills launches its 2nd quarter numbers on the 20th of this month, where $1.06 is the anticipated GAAP number. The chances are more than 50/50 that we will certainly witness an additional heart beat in the quarter, however present IV degrees reveal that the resulting relocate supply cost might not be comparable to anticipated. The jump technique defined over enables capitalists to take cash off the table in GIS if, as a matter of fact, the supply’s evaluation remains to increase. We eagerly anticipate proceeding insurance coverage.

.