transportation gigantic #FedEx it is anticipated to release its financial 2023 2nd quarter results on Tuesday (12/20), after the marketplace shuts. The firm formerly introduced cost-cutting actions, consisting of strategies to give up employees as well as fly aircrafts over the holiday. The incomes phone call to be launched will certainly be the 2nd telephone call led by Raj Subramaniam considering that his visit as president in March.

It will certainly be the initial considering that FedEx introduced strategies in September to reduce expenses in between $2.2 billion as well as $2.7 billion this after a frustrating first-quarter incomes record. The firm’s most current quarterly incomes record was released on Thursday, September 22. The delivery firm published incomes per share of $3.44 for the quarter, the firm’s income can be found in at $23.2 billion. FedEx had an internet margin of 3.79% as well as a return on equity of 20.95%. Contrasted to the exact same quarter of the previous year, the firm’s quarterly income enhanced by 5.4%. Business produced $4.37 in EPS throughout the exact same duration in 2015.

FedEx has actually introduced numerous cost-cutting actions in current months, consisting of furloughing FedEx Products staff members in November to satisfy reduced need. Various other current actions the firm has actually taken consist of shutting some FedEx Ground arranging centers as well as readjusting the FedEx Express trip network. Of cuts of roughly $2.2 billion to $2.7 billion this , FedEx anticipates to conserve $1.5 billion to $1.7 billion at FedEx Express, $350 million to $500 million at FedEx Ground as well as $350 million to $500 million in various other overhanging expenses. FedEx pointed out the worldwide financial decline as one of the factors behind its frustrating first-quarter outcomes.

The incomes record to be launched will certainly demonstrate how FedEx done throughout the height holiday. FedEx shares dove in September after the ground as well as air distribution solution cautioned of dropping need in the United States as well as Asia as well as solution troubles in Europe.

FedEx is anticipated to publish incomes of $ 2.77 per share, which stands for a modification of -42.7% of the quarter of the previous year. The zacks The agreement quote has actually altered -3.3% Throughout the last thirty day. The agreement incomes quote for $ 14.18 for the existing reveals a year-over-year adjustment of -31.2% . This quote has actually altered -1.1% Throughout the last thirty day. For the upcoming , the agreement incomes quote for $ 17.06 reveals a modification of +20.3% than FedEx was anticipated to report a year earlier. In the last month, the projection has actually altered -0.1%

FedEx shares have actually dived greater than 33% in 2022, this number was reduced after the gains in October as well as November. Still zacks provides FedEx a # 3 (hold) certification.

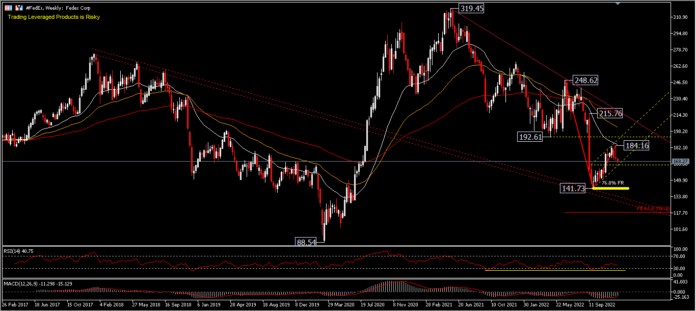

Technical analysis

Shipping gigantic shares #FedEx tipped over 21.4% after the firm introduced frustrating outcomes for the current quarter, mentioning weak point in worldwide delivery quantities, as well as the marketplace devalued the supply. CEO Raj Subramaniam He claimed he anticipates the economic climate to go into a “worldwide economic crisis.” #FedEx was trading at $ 171.71 since December 15. concerning the previous 52 weeks duration, the supply has actually dropped roughly 33% . Considering that these returns are normally unfavorable, lasting investors are most likely to be a little bit dissatisfied with this incomes launch. Trading on Monday (12/19) saw the share worth autumn by greater than 1% once again as well as trades near the assistance of $ 167.11.

The most affordable cost videotaped remained in $ 141.73 at the 76.8% retracement degree (from $ 88.54 Y $ 319.45 detractions). The noticeable wave framework continues to be mainly bearish, listed below the 26-week EMA. The down forecast is evaluated FE61.8% (from the 248.62-141.73 recoil as well as $ 184.16 in $ 118.10). Nonetheless, practically, capitalists are most likely to take into consideration the $ 141.73 degree considering that the wave of decrease has actually gotten in the fifth wave of elliot. While a step over the small resistance of $ 184.16 would certainly verify a near-term base in $ 141.73 as well as the supply cost can show $ 192.61 as well as past $ 215.76 (200 week EMA). The RSI remains in 40.78 as well as it is most likely to go into the oversold degree for the umpteenth time, while the MACD is still in the sell area with a signal clipping on the pie chart that has a tendency to show failing of the rally in the modification wave.

JPMorgan Chase & Co. reduced their target cost on FedEx from $ 192.00 to $184.00 in a research study note on Thursday, December 8. ISI Evercore reduced its target cost for FedEx supply from $ 243.00 to $225.00 in a research study note on Friday, September 23. Jefferies Economic Group develop a “hold” score as well as a $ 170.00 target cost berenberg bank to develop a $ 190.00 target cost on FedEx in a research study record on Monday, September 26. BMO Resources Markets reduced its target cost on FedEx from $ 215.00 to $190.00 in a record on Friday, September 23. Twelve Experts have actually ranked the supply a hold score as well as eleven have actually provided a purchase score of the firm’s shares. According to MarketBeat.com, the supply presently has an agreement score of ” Hold” as well as an agreement cost target of $ 204.52.

Click here to gain access to our Financial Calendar

Ady Fangestu

Market Expert– HF Education And Learning Workplace– Indonesia

Disclaimer: This product is supplied as a basic advertising and marketing interaction for informative objectives just as well as does not make up independent financial investment study. Absolutely nothing in this interaction consists of, or must be regarded to have, financial investment suggestions or financial investment referral or a solicitation for the objective of acquiring or offering any type of economic tool. All details supplied is assembled from respectable resources as well as any type of details which contains a sign of previous efficiency is not an assurance or a trustworthy sign of future efficiency. Individuals recognize that any type of financial investment in Leveraged Products is identified by a particular level of unpredictability which any type of financial investment of this nature entails a high degree of threat for which individuals are exclusively liable. We do not think any type of duty for any type of loss emerging from any type of financial investment made based upon the details supplied in this interaction. This interaction might not be duplicated or dispersed without our previous written authorization.

.