According to Preqin’s 2020 Exclusive Equity & Financial Backing Report, there are currently greater than 18,000 exclusive equity funds, with possessions under monitoring going beyond $4 trillion. A mix of elements has actually brought about stunning development: the reduced rate of interest setting experienced from 2008 to 2021; the possibility for PE to boost profile returns from an illiquidity threat costs; reducing public markets, particularly for little supplies (the Sarbanes-Oxley Act of 2002 considerably raised the expenses of being a public firm, triggering lots of to remain exclusive much longer; there are less public firms than 40 years back, and also today the checklists get on ordinary much bigger than twenty years ago); and also alpha possibility with energetic choice and also aid to firms not obtainable in public markets.

For every one of these factors, PE companies are promoting a location in specified payment (DC) retirement.

Investors utilizing exclusive equity think that the advantages exceed one-of-a-kind obstacles not discovered in openly traded possessions, such as framework intricacy, funding telephone calls, illiquidity, absence of openness, and also high expenses. The truth is that lots of profile firms held by exclusive equity acquistion funds would certainly be defined as small-cap worth supplies if they were openly traded. The decrease in public listings and also PE development over the previous 20 years stands for a change in the capacity of retail capitalists to branch out, as buy-and-growth PE funds significantly concentrate on ingenious firms In medical care and also innovation, capitalists agree to take the best threat. you can obtain direct exposure to fields that use possibly greater returns.

Gregory Brown, Keith Crouch, Andra Ghent, Robert Harris, Yael Hochberg, Tim Jenkinson, Steven Kaplan, Richard Maxwell, and also David Robinson, writers of the research study “Should Specified Payment Strategies Include Private Equity Investments? ,” released in the 4th quarter 2022 concern of the Financial Experts Magazine, considered the advantages and disadvantages. While his evaluation concentrated mainly on PE acquistion funds, a lot of his qualitative evaluation uses just as to various other kinds, such as property, framework, natural deposits, equity capital, and also exclusive credit rating.

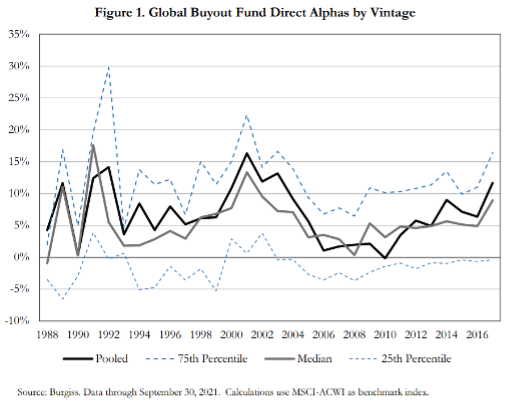

They started by taking a look at the efficiency of the 2,399 buy funds in the Burgiss cosmos of supervisors with classic years from 1987 to 2017. The number listed below stories the quartile cutoffs along with the pooled quote of all funds utilizing the MSCI All Nation Globe Index (ACWI). as a criteria. Alpha declared for the average and also merged price quotes (strong lines) for mostly all plant years. Nevertheless, the rushed line reveals that the most affordable executing quartile of funds usually had adverse alpha in a normal traditional year. By comparison, funds in the greatest executing quartile have straight alphas higher than 10%. There has actually been significant cross-sectional variant in fund efficiency, recommending that capitalists might require to hold lots of funds to branch out threat which there might be distinctions in market threat degrees in between buy-out funds and also indices. more comprehensive public markets.

Note that the alpha below is not changed for threat, it is just contrasted to the MSCI-ACWI index. Those threats consist of not just its illiquidity, however additionally its high utilize, betas more than the marketplace, high volatility of returns (the common discrepancy of exclusive equity goes beyond one hundred percent).) , and also severe crookedness in returns: the ordinary return on exclusive equity is a lot less than the ordinary return (the math standard). Their reasonably high ordinary return shows the little opportunity of a really outstanding return integrated with the much greater likelihood of an extra moderate or adverse return. Basically, exclusive equity financial investments resemble alternatives (or lotto tickets), providing a tiny opportunity of a large payment however a much greater opportunity of a below-average return.

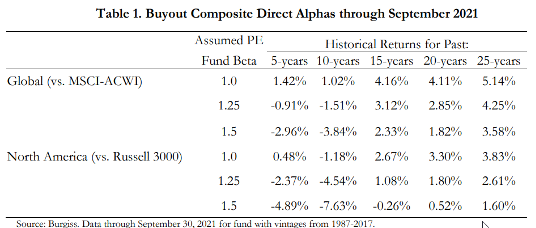

With these distinctions in threat in mind, the writers additionally reported alphas, thinking betas of 1.25 and also 1.5. Its criteria for North American funds was the Russell 3000 Index, and also the criteria for international funds was the MSCI-ACWI.

While historic buy fund returns for 15-, 20-, and also 25-year perspectives were far better than the general public criteria by roughly 2 to 4 percent factors annually, efficiency for the most current 5- and also 10-year durations was listed below the leveraged criteria. This searching for follows those of the writers of the 2017 file “How relentless is the return on exclusive equity? Deal-level information evidence“, that wrapped up: “Total, the proof we provide recommends that the perseverance of efficiency has actually mostly gone away as the PE market has actually developed and also ended up being a lot more affordable.”

The writers keep in mind that there is one more prospective advantage for retail capitalists that are susceptible to behavior mistakes: “Exactly due to the fact that exclusive funds are illiquid, institutional constraints on profile redemptions might stop some capitalists from stressing throughout a worldwide decline.” market”. One more prospective advantage they mention is that the incorporation of PE funds in DC strategies might have a favorable effect on liquidity in the second market that would certainly profit all individuals; PE funds in the second market featured considerable cost discount rates: A boost in capitalist task in CD strategies might aid relieve the cost discount rate.

However there are prospective drawbacks

- Lack of liquidity, and also the requirement for liquidity back-up.

- High costs about public markets. Along with their greater cost proportions and also efficiency costs, exclusive financial investments need extra due persistance, along with even more facility interior audit and also monitoring. While these expenses can properly be contracted out to an expert fund-of-funds or supervisor, they still inevitably need to be birthed by capitalists. Excess returns in PE are not assured to cover extra expenses.

- The flooding of funding right into the market has actually raised competitors and also might have increased purchase rates, lowering future returns.

- Research has actually discovered that institutional capitalists show “neighborhood prejudice” which these neighborhood financial investments have a tendency to underperform.

- The charge of quarterly liquidity needs and also maybe various other liquidity arrangements might produce expenses for liquidity warranties or compelled list price results.

- Plan carriers should manage the timing and also unpredictability of funding telephone calls from the fund: when funding is dedicated, an enough fluid setting should be preserved to make funding telephone calls. That suggests that the real go back to the retail capitalist might wind up integrating reduced cash-like returns with returns from PE funds, leading to a reduced return account. Liquidity expenses might counter the PE illiquidity costs.

- Another issue is performing rebalancing of the DC strategy profile as a result of illiquidity of the second fund market, particularly in times of big market motions when real PE allotments might surpass benchmark allotments: having protections without liquidity in DC strategies protects against strategy individuals and also enrollers from quickly rebalancing their portfolios

- PE funds commonly give quarterly price quotes of their web property worths. These price quotes are given with a lag and also are not ideal for greater regularity coverage of worths. Any type of organized prejudice in worth coverage has the prospective to profit one strategy individual over one more.

- Plan carriers would certainly require a means to manage profile revenue circulations as individuals take out from the strategy (as they carry out in cut-off funds, for instance).

- Educating capitalists concerning the threats of buying PE will certainly boost the expenses of the strategy, and also capitalists will certainly birth those expenses.

- For efficient PE diversity, crucial with high volatility and also manipulated returns, supervisor choice will certainly be important. Once more, expenses will certainly be included. As well as smaller sized strategies are not likely to have accessibility to the best-performing funds.

.

.

.

.

.

.

.

.

.

.

.

Investor Conclusions

There are some advantages to permitting DC strategies to buy exclusive funds. As PE ends up being a raising part of the more comprehensive economic climate, retail capitalists might require accessibility to this market to completely branch out. Exclusive funds might be the only means for retail capitalists to obtain considerable direct exposure to higher-yielding possessions that are significantly near to them, consisting of development firms in innovation and also medical care, along with small-value firms. Also if the greater returns are simply reasonable payment for the greater threat (as opposed to excess risk-adjusted return), PE funds can still give higher diversity to the strategy individual.

Nevertheless, evaluate the prospective advantages versus the lots of obstacles and also expenses that occur from producing this more comprehensive accessibility to exclusive funds. The challenging framework and also unpredictability around giving the needed liquidity sustains can cause greater costs, which can negate the advantage of greater returns and also hence the motivation to consist of the strategies.

Lastly, strategy managers, enrollers, and also consultants ought to guarantee that retail capitalists comprehend the threats of exclusive fund financial investments and also develop proper frameworks and also rewards for strategy carriers despite lawsuits or various other unanticipated threats. It’s unclear that lots of backers locate the advantages worth it.

Larry Swedroe is head of monetary and also financial research study at Buckingham Wide range Allies.

All viewpoints revealed are entirely their viewpoints and also do not mirror the viewpoints of Buckingham Strategic Wide range or its associates. This info is attended to basic info functions just and also ought to not be interpreted as monetary, tax obligation or lawful guidance.

.