( Bloomberg Viewpoint)– Numerous flashpoints are arising in credit scores markets after years of extra, from financial institutions stuck to stacks of acquistion financial debt, a pension plan surge in the U.K. and also residential or commercial property problems in China and also South Korea.

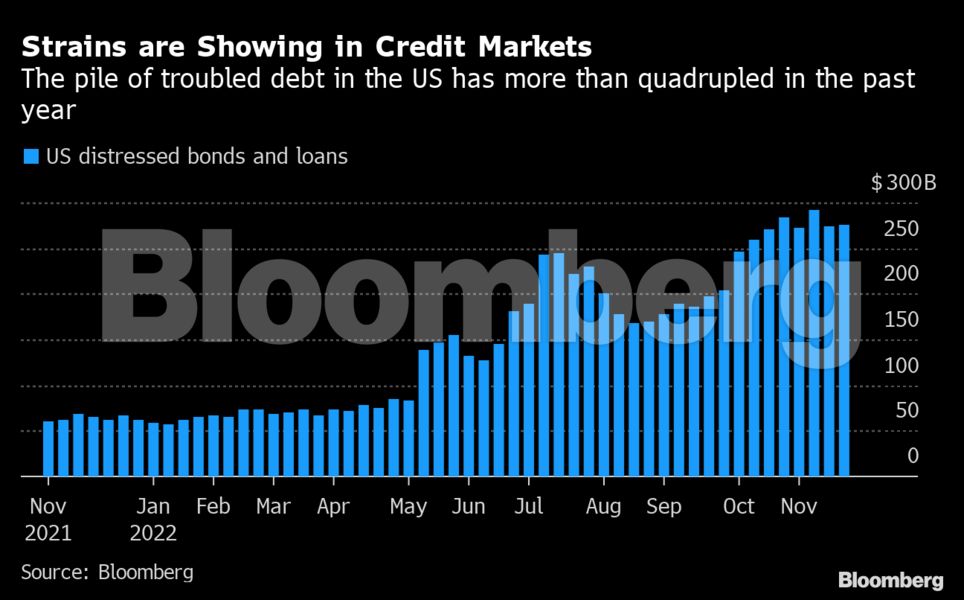

With inexpensive cash coming to be a distant memory, that might simply be the start. In the United States alone, troubled financial debt has actually increased greater than 300% in year, high-yield issuance is even more tough in Europe, and also utilize proportions have actually gotten to a document by some steps.

The stress are greatly linked to hostile price walks by the Federal Get and also reserve banks worldwide, which have actually drastically transformed the financing landscape, interrupted credit scores markets, and also pressed economic situations towards economic downturns, a circumstance that markets have actually not yet valued in.

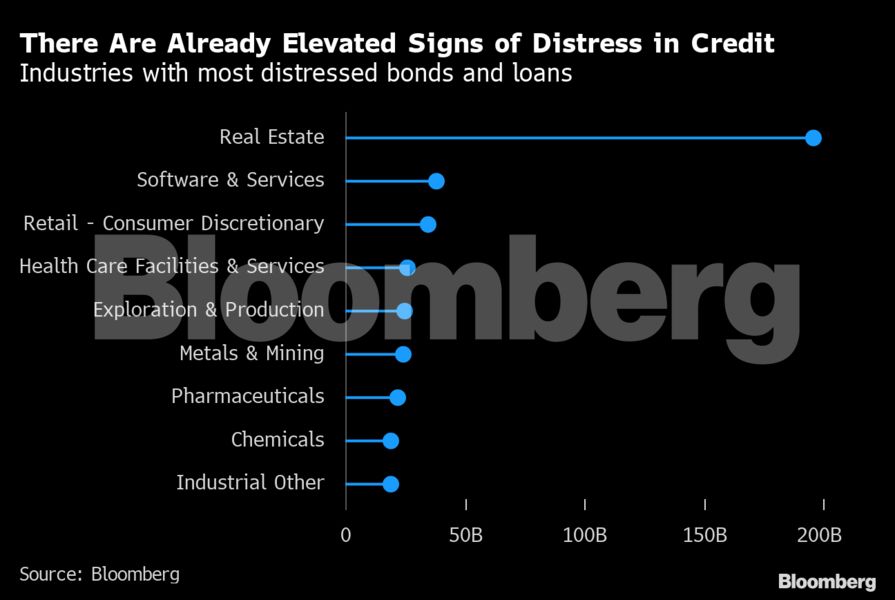

Internationally, virtually $650 billion in bonds and also financings remain in problem, according to information put together by Bloomberg. All of it amounts to the most significant examination of company credit scores toughness considering that the economic situation and also might trigger a wave of defaults.

” Numerous are most likely to be a bit a lot more contented than they ought to be,” stated Will Nicoll, M&G’s primary financial investment police officer for Exclusive and also Alternate Possessions. “It’s extremely difficult to see just how the default cycle will not run its training course, offered the degree of rate of interest.”

Banks claim their wider financing versions are verifying noise until now, yet they have actually begun alloting even more cash for late repayments, information put together by Bloomberg programs.

Provisions for credit scores losses at systemically essential financial institutions enhanced 75% in the 3rd quarter contrasted to a year earlier, a clear sign that they are planning for settlement troubles and also defaults.

A lot of financial experts anticipate a modest decrease over the following year. Nevertheless, a deep economic crisis can create substantial credit scores troubles due to the fact that the international economic system is “badly overleveraged,” according to Paul Vocalist’s Elliott Monitoring Corp.

Right currently, the potential customers for financial development are reason for problem. Moving economic downturns are most likely worldwide following year, with the United States most likely to fall under one by the center of following year, Citigroup Inc. financial experts composed in a note.

The very first fifty percent of 2023 will certainly be “rough” and also “defined by greater volatility for longer,” Sue Trinh, co-head of international macro method at Manulife Financial investment, stated on Bloomberg Tv. “There is a little means to enter regards to the general international economic crisis threat evaluation,” she stated, including that economic problems are most likely to boost in the 2nd fifty percent of the year.

Mike Scott, profile supervisor at Male GLG, stated that “the marketplaces appear to be awaiting a soft touchdown in the United States which might not take place. The leveraged financing market is something we are additionally keeping an eye on.”

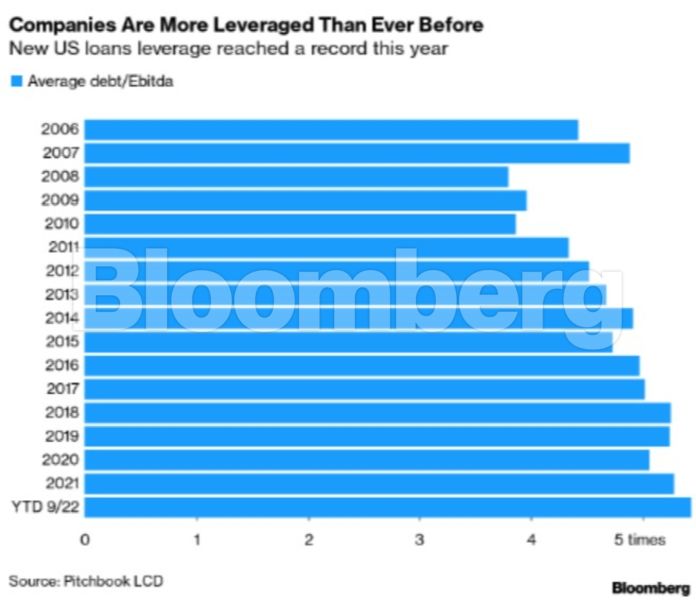

That market has actually blown up over the last few years. $834 million in leveraged financings were provided in the United States in 2014, greater than double the price in 2007 prior to the economic situation struck.

As the need expanded, so did the threat. In this year’s brand-new United States financing bargains, complete utilize degrees go to a document versus revenues, information put together by Pitchbook LCD programs. A profits economic crisis is impending there, also, advised Morgan Stanley planner Michael Wilson.

Leveraged financings have actually seen the “highest possible accumulation of excess or lower-quality credit scores,” according to UBS planner Matt Mish. Default prices can climb to 9% following year if the Fed remains on its hostile course of financial plan, he stated. It hasn’t been this high considering that the economic situation.

Limiting Rates

Many capitalists might have been entraped by the Federal Get this year. They have constantly wager that the hazard of an economic downturn would certainly require the reserve bank to kick back, just to have actually repetitively been melted by severe words and also severe activities.

While the speed of walks has actually reduced, Chairman Jerome Powell has actually additionally made it clear that prices have yet to climb and also will certainly remain high for time.

The over night assured financing price, a buck standard for prices, has to do with 430 basis factors, a rise of 8,500% considering that the start of the year.

And also in this brand-new globe of greater rate of interest and also enhanced threat hostility, there is currently stress on international financial institutions, which have actually been compelled to saddle around $40 billion in acquiring financial debt varying from Twitter Inc. Also automobile components manufacturer Tenneco Inc. Lenders had actually intended to swiftly dump bonds and also financings connected to the purchases, yet were not able to do so when cravings for dangerous possessions plunged as loaning expenses climbed.

There is one more reason for problem. The look for return throughout measurable easing was so determined that debtors had the ability to kick back financier securities, referred to as commitments, indicating capitalists are far more subjected to run the risk of.

As an example, greater than 90% of leveraged financings provided in 2020 and also very early 2021 have actually restricted constraints on what debtors can do with the cash, according to Armen Panossian and also Danielle Poli of Oaktree Resources Monitoring LP.

With markets swamped with money, even more business resorted to inexpensive financings that had couple of commitments, distressing annual report.

Historically, business made use of a mix of elderly financings, bonds reduced on the pay range, and also supplies to fund themselves. Nevertheless, over the previous years, the suit has actually permitted business to cross out subordinated financial debt, indicating capitalists are most likely to obtain much less cash if debtors default.

Virtually 75% people providers have just financings in their financial debt funding framework, according to JPMorgan Chase & Co., up from 50% in 2013.

Oaktree Resources Monitoring LP advised that some business are much more prone than formerly assumed due to the fact that they made changes for whatever from harmonies to set you back cuts when determining their utilize proportion. The financial downturn implies that a number of those presumptions most likely have not been verified.

Greater loaning expenses can additionally have an influence on the collateralized financing commitment market, which swimming pools leveraged financings and afterwards securitizes them with variable threat tranches.

Matthew Rees, head of international bond techniques at Legal & General Financial investment Monitoring, states he is worried concerning greater defaults in lower-tier parts of CLOs.

The hidden financings have greater utilize proportions and also weak commitments than in the high-yield market, he stated. “We are much less worried that these defaults” get to the much safer tranches due to the fact that they have actually “overcollateralized degrees that are normally appropriate.”

LGIM, which takes care of $1.6 trillion, does not buy CLOs.

The disintegration of agreement securities additionally implies that CLO owners and also various other capitalists in leveraged financings, such as shared funds, are a lot more prone to losses than in the past. Therefore, recuperation worths can be less than standard when defaults take place, Oaktree stated.

Daniel Miller, primary credit scores police officer at Capra Ibex Advisors, is additionally worried concerning bargains, especially those that prevent lenders’ concern.

” They are feasible time bombs located in the documents,” he stated.

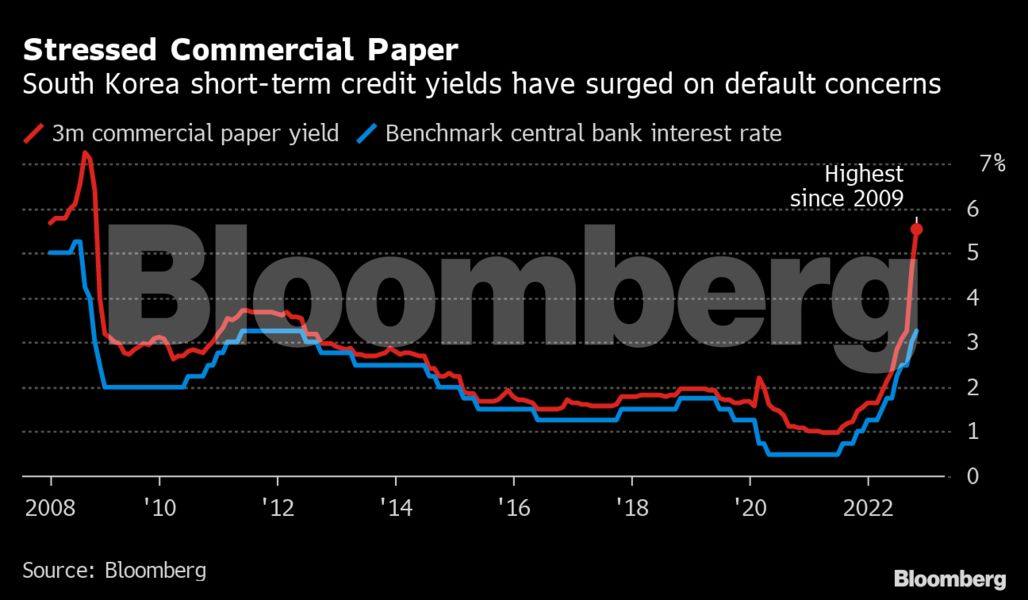

Pockets of volatility are currently arising. In South Korea, credit scores markets came under situation when the programmer of Legoland Korea, whose biggest investor is the neighborhood district, back-pedaled a funding. The repercussions sent out shorter-duration made company infect a 12-year high.

Asia was currently taking care of the after effects from document defaults on Chinese dollar-denominated realty bonds, sending out the country’s scrap notes shedding virtually half their worth.

In spite of federal government initiatives to sustain the marketplace, virus dangers spreading out even more as increasing financial debt repayments placed more stress and anxiety on debtors in Southeast Asia and also India. A Vietnamese legislative board just recently advised concerning settlement problems for some programmers.

The collapse is an indicator that federal governments and also reserve banks will certainly need to walk thoroughly on financial concerns, with market self-confidence so delicate. The UK supplies one more instance of just how swiftly points can fail.

Federal government bond returns rose after the nation’s totally free mini-budget in September, triggering massive losses in market price for pension plans making use of supposed liability-driven financial investment techniques. The mayhem implied that the Financial institution of England needed to action in to secure economic security.

Variants in these styles are most likely to be duplicated as tighter credit scores problems and also better care hold.

LDI is the very first “of lots of market troubles,” Beauty Global Monitoring Inc. President Marc Rowan stated last month. “For the very first time in a years, capitalists are not just inquiring about the benefit, yet additionally the threat related to investing.”

— With the help of Jan-Patrick Barnert, Finbarr Flynn, Yvonne Male and also David Ingles.

To speak to the writers of this tale:

Neil Callanan in London at [email protected]

Tasos Vossos in London in [email protected]

Olivia Raimonde in New York City in [email protected]

© 2022 Bloomberg L.P.

.