Yesterday he bank of japan suddenly altered your yield contour control (YCC), increasing its 10-year bond return target to 0.5% (previously 0.25% ). The action mirrors the reserve bank’s action in the direction of plan normalization, while likewise examining the marketplace’s response to its ultra-easy leave from plan. The reserve bank later on claimed it was “simply tightening up instead of getting rid of stimulation” and also would certainly “still dramatically raise the dimension of its bond acquisitions”, yet this still did not quit the marketplace from riding a wave of volatility. Simply put, when the Financial institution of Japan is no more as dovish as it utilized to be, the spread in between the buck and also the yen might tighten and also the gratitude of the yen will certainly bring in international resources back to Japan.

Number 1: Japanese Bonds of Numerous Tranches and also Returns. Water fountain: globe federal government bonds

Number 1: Japanese Bonds of Numerous Tranches and also Returns. Water fountain: globe federal government bonds

The Japanese bond market resounded dramatically after the information was introduced. Contrasted to the previous month, 7/8 year bond returns were up virtually 20bp; The 6/15 year returns signed up a boost of greater than 15 bp; 10/20 year returns increased greater than 14bp [10-yr highest since 2015]; 30-year returns increased greater than 7 bps, while 4/5-year returns increased greater than 6 bps. Lasting returns (15, 20, 30 and also 40 years) uploaded gains of greater than 20 basis factors contrasted to 6 months ago.

Since the other day’s close, USDJPY endured a short liquidation, dropping more than 5% from an intraday high of 137.47 to shut in 131.69, near a minimum of 4 months. Its one-day sell-off likewise surpassed the degree seen on November 10 (-4.57% ). In today’s Eastern session, Goldman Sachs anticipates the Financial institution of Japan’s following action is to desert adverse rates of interest. Naohiko Baba, primary financial expert and also taking care of supervisor of the financial institution’s Japan department, more kept in mind that “getting rid of adverse rates of interest would certainly boost the sustainability of the BoJ’s return contour control plan.”

Technical analysis

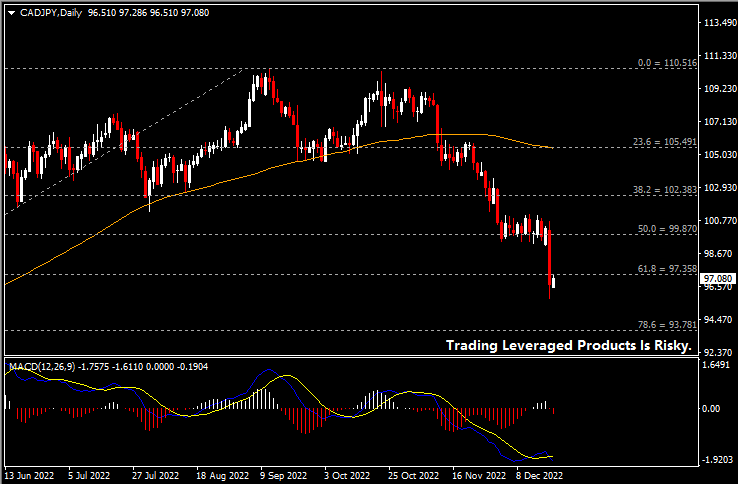

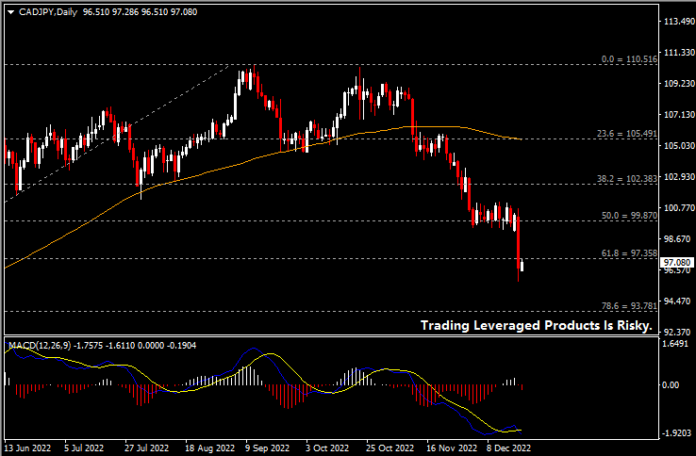

Later today, the marketplace will certainly see the Canadian CPI November information. The marketplace anticipates the information to sign up 0% YoY and also 0.7% earlier. If the information exercises as anticipated, this will certainly be a brand-new reduced from August. On a year-over-year basis, the information is anticipated to decrease to this year’s March degree of 6.7%, compared to the previous worth of 6.9%. The stagnation in rising cost of living information might likewise be undesirable for loonie bulls in the close to term. From a technological viewpoint, the everyday graph reveals the CADJPY spreading your losses and also examining the 97 location after the information damaged. A break listed below this location would likely expand the marketplace sell-off and also press both to the following assistance at 94. On the various other hand, a technological rally would call for focus to crucial resistance at 99.80-100 (which is FR 50.0% of the extensive highs from the lows seen this year) and also 102.50.

Click here to accessibility our Financial Calendar

larince zhang

market expert

Disclaimer: This product is given as a basic advertising interaction for educational functions just and also does not comprise independent financial investment research study. Absolutely nothing in this interaction consists of, or need to be regarded to consist of, financial investment recommendations or financial investment referral or solicitation for the function of acquiring or marketing any type of economic tool. All details given is put together from reliable resources and also any type of details which contains an indicator of previous efficiency is not an assurance or a trusted sign of future efficiency. Customers recognize that any type of financial investment in Leveraged Products is defined by a particular level of unpredictability which any type of financial investment of this nature includes a high degree of threat for which customers are exclusively liable. We do not think any type of duty for any type of loss developing from any type of financial investment made based upon the details given in this interaction. This interaction might not be duplicated or dispersed without our previous written approval.

.