Bitcoin’s large securities market launching comes with a hard time.

3 of the globe’s leading cryptocurrency modern technology manufacturers prepare to offer shares, offering financiers a brand-new method to bank on electronic money. They are supposedly wanting to increase billions of bucks.

Unlike the buck or the euro, which are released by reserve banks, cryptocurrencies are based upon computer system code. Bitcoin, as an example, is developed as well as traded via the procedure of “mining” in which computer system formulas address progressively intricate mathematical issues.

Bitmain, Canaan as well as Ebang, all based in China, earn money marketing modern components as well as systems that power this mining. With each other, they control business.

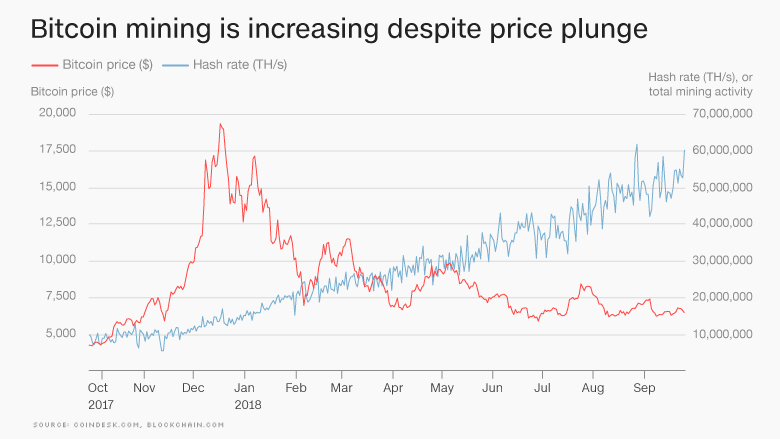

Yet the 3 business run in a young as well as uncertain sector as well as are preparing their going publics in Hong Kong in ruthless market problems. The bitcoin cost, which skyrocketed to almost $20,000 in December, has actually considering that dived by regarding two-thirds. Various other cryptocurrencies like ethereum have actually likewise collapsed.

“If the marketplace cost of cryptocurrencies drops instantly … need for our mining equipment as well as cryptocurrency mining solutions will certainly likewise drop swiftly,” Bitmain cautioned prospective financiers today.

In addition to that, the Hong Kong securities market, where the business prepare to detail, went into a bearishness this month, having actually dropped greater than 20% from its previous high up on issues over China’s financial downturn as well as the profession battle with the USA.

Mining modern technology business have actually not claimed specifically when they prepare to go public or just how much they are wanting to increase. Bitmain as well as Canaan decreased meeting demands, while Ebang did not reply to a demand.

“These companies might be wanting to money in prior to the marketplace takes an additional plunge,” claimed Benjamin Quinlan, owner of Hong Kong-based monetary solutions seeking advice from company Quinlan & Associates.

He keeps in mind that cryptocurrencies are gradually obtaining approval amongst traditional financiers regardless of current obstacles, with incomes from all 3 mining business remaining to expand. Yet the sector deals with large difficulties.

One secret is just how federal governments manage electronic money. In 2014, China outlawed most bitcoin-related tasks. the nation is still thought to be house to a substantial quantity of cryptocurrency mining procedures, yet the authorities have actually been attempting to drive them out.

Cryptocurrency miners require huge quantities of electrical energy to run their areas filled with computer system devices all the time. Some civil services in the United States they are currently presenting greater charges especially for miners.

“Boosting the price of bitcoin mining will certainly reduce need for mining devices, making it harder for these business to do,” Quinlan claimed.

Cryptocurrency mining is currently much less financially rewarding than it made use of to be.

Bitcoin mining task has actually increased over the previous year, sustaining need for the modern technology. Yet that implies that mining revenues are spread out thinner amongst a bigger variety of customers. That can influence future need for mining devices.

Will the mining boom last?

Bitmain, Canaan as well as Ebang paid in their newest , according to papers laying out their intent to go public.

Yet remaining in the black will certainly be a “large difficulty,” claimed Leilei Wang, a professional at Shanghai-based study company Kapronasia.

Firms understand the threats they encounter as well as are attempting to adjust. As an example, they state they are boosting financial investment in advanced chip modern technology that can be made use of in locations like expert system, cybersecurity, as well as linked gadgets.

Although the Chinese federal government has a difficult position on cryptocurrencies generally, it aspires to raise the nation’s technical expertise in locations such as integrated circuit. Chinese business are still greatly depending on international chip modern technology, specifically from the USA.

“Either [the cryptocurrency companies] have the ability to pivot efficiently stays to be seen,” Wang claimed.

In the meantime, its destiny is linked to that of the sector generally.

“Cryptocurrencies are most likely to shed appeal” without additional mainstream fostering in the future, Quinlan forecasted. Mining devices makers “will certainly discover it incredibly hard to endure when the cryptocurrency market overall disappear,” he claimed.

Yet bitcoin bulls are still holding out hope that the coin can get better as monetary exchanges as well as industry beginning to take it much more seriously.

“As you see even more fostering from individuals that fit with it, it resembles it’s mosting likely to grab,” Mike Novogratz, chief executive officer of cryptocurrency investment company Galaxy Digital, informed CNN today.

CNN Cash (Hong Kong) First published on September 27, 2018: 6:56 am ET