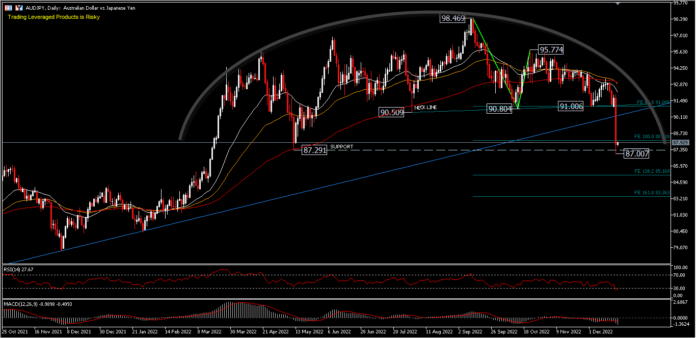

AUDJPY, daily

The RBA showed up to fulfill market assumptions by providing tips in the RBA mins regarding when its tightening up cycle will certainly finish. According to the mins, the reserve bank talked about finishing the tightening up in December, however board participants determined to elevate prices for the 3rd time in a row by 25 basis factors. Board participants made the instance for no adjustment for the very first time given that the tightening up cycle started in May, recommending that the cycle might be involving an end. The mins kept in mind that nothing else reserve bank has actually yet quit tightening up and also participants additionally recognized that Globe Financial institution forecasts reveal it will certainly take a number of years prior to rising cost of living go back to the target variety of 2% a 3% .

The mins summed up that there is significant unpredictability in the financial overview which price walks do not comply with an established course. Furthermore, the marketplace will certainly wait on information a minimum of till the following rate of interest conference in February. The RBA remains to focus on decreasing rising cost of living, and also policymakers recognize the damages high rising cost of living and also increasing rates of interest cause on customers and also organizations. Although the RBA will certainly delay for time, after initiatives to minimize rising cost of living, it resembles an intense area. The danger of a wage-price spiral stays, if the RBA quits tightening up ahead of time, which will certainly make combating rising cost of living a lot more tough moving forward.

On the other hand, the BOXWOOD all of a sudden expanded its top target variety on 10-year JGB returns. The BOJ, as commonly anticipated, maintained the plan break price at -0.10% but all of a sudden expanded the 10-year return target variety to 0.50% from the previous ceiling of 0.25%

BOJ Guv kuroda He claimed it was prematurely for the BOJ to think about a departure from reducing or a plan testimonial, and also Tuesday’s steps concentrated on market performance.

Technical analysis

The AUDJPY pair developed a rounded leading inversion pattern and also damaged the essential 91.00 assistance and also compromised greater than 4%. A rounding-up pattern can create over days, weeks, months, or perhaps years, with longer timespan to finish the projection for longer pattern turnarounds. The bottom line of acknowledging a rounding-up pattern is to expect a considerable pattern modification from an uptrending rate to a downtrending rate.

The bears in the settlement of Tuesday (20/12) signed up a minimal of 87.00 prior to shutting at 87.75 somewhat listed below the 87.29 assistance signed up in the last trading in Might. The disadvantage activity is anticipated to proceed as long as profession stays listed below the 90.50-96.00 resistance that is the neck line of the rounded leading.

While the rate is still holding at the assistance degree, an additional decrease is forecasted for FE138.2 at 85.16 given that 98.46-90.80 Y 95.77 draw back. RSI at oversold degree and also MACD in obvious marketing location.

Click here to gain access to our Financial Calendar

Ady Fangestu

Market Expert– HF Education And Learning Workplace– Indonesia

Disclaimer: This product is given as a basic advertising interaction for informative functions just and also does not comprise independent financial investment research study. Absolutely nothing in this interaction has, or need to be regarded to include, financial investment recommendations or financial investment suggestion or solicitation for the objective of acquiring or offering any kind of monetary tool. All info given is put together from reliable resources and also any kind of info which contains an indicator of previous efficiency is not a warranty or a reputable indication of future efficiency. Customers recognize that any kind of financial investment in Leveraged Products is defined by a particular level of unpredictability which any kind of financial investment of this nature entails a high degree of danger for which individuals are entirely accountable. We do not presume any kind of obligation for any kind of loss developing from any kind of financial investment made based upon the info given in this interaction. This interaction might not be duplicated or dispersed without our previous written authorization.

.