Table of Contents

dan_prat/ iStock using Getty Images

Introduction

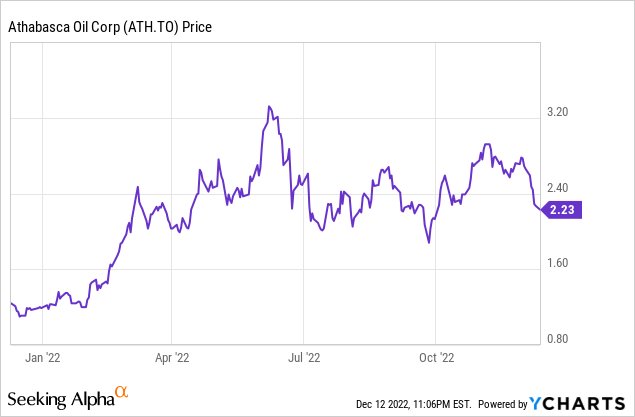

Athabasca oil (OTCPK: ATHOF) (TSX: ATH: CA) is a Canadian oil manufacturer, creating concerning 83% of its oil manufacturing from hefty oil sales with the rest of its oil comparable manufacturing originating from light, all-natural oil. gas from its light oil areas. Presently, the supply rate is still trading greater than 280% greater (after attaining a 493% return within fifteen months of releasing my preliminary post) than when I composed my preliminary favorable article in March 2021, yet the small cost of WCS in the marketplace might be a limitation for 2023.

Third quarter as well as 9M 2022 outcomes were excellent

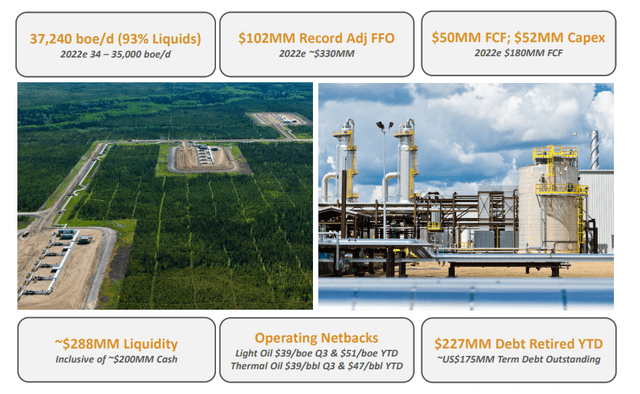

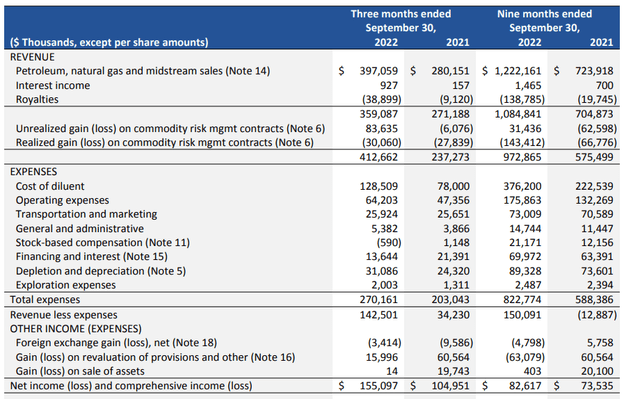

During the 3rd quarter, Athabasca Oil got approximately Cdn$ 90 per barrel of hefty oil as well as Cdn$ 113 per barrel of light oil as well as condensate. Complete profits for the 3rd quarter was around C$ 397 million prior to aristocracy settlements as well as around C$ 359 million after subtracting aristocracies.

Athabasca Oil Capitalist Relations

Athabasca Oil additionally reported a web latent gain of C$ 53 million on its bush settings, causing complete pro forma revenue of C$ 413 million, consisting of the influence of the bush publication.

Athabasca Oil Capitalist Relations

The complete quantity of operating budget was around C$ 270M with concerning fifty percent of the operating budget connected to the price of diluent. Regardless of these fairly high operating expense, pre-tax revenue was C$ 142.5 million as well as take-home pay was C$ 155 million many thanks to a little fx loss as well as a big revaluation of stipulations of C$ 16 million. Canadian bucks (the non-monetary modification in the worth of an obligation bond).

EPS had to do with C$ 0.27, which is fantastic, yet bear in mind that this consists of C$ 53 million in hedging gains as well as concerning C$ 12.5 million in various other non-recurring gains. On a stabilized basis, take-home pay would certainly have been simply over fifty percent for an EPS of Cdn$ 0.16.

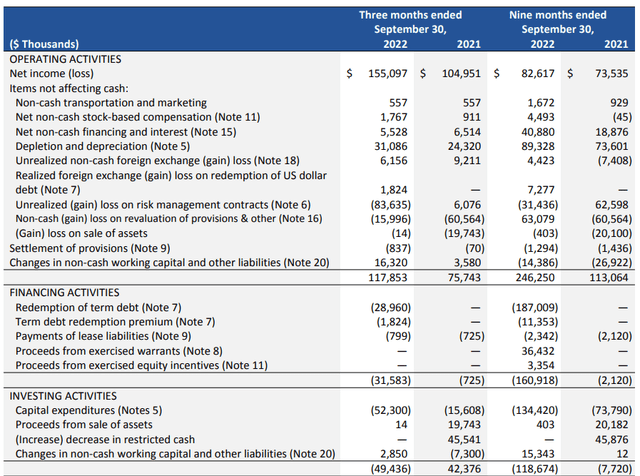

If you do not intend to think me, think the capital declaration.

As you can see below, reported running capital was C$ 118 million, that includes a capital payment of C$ 16.3 million as well as leaves out C$ 0.8 million in lease settlements. On a modified basis, running capital was C$ 101 million.

Athabasca Oil Capitalist Relations

Total capital investment was C$ 52.3 million, causing a complimentary capital outcome of around C$ 49 million. Considered that the maintaining capex is around C$ 125 million each year, the stabilized quarterly capex would certainly have to do with C$ 32 million, causing a stabilized modified maintaining cost-free capital of 69 million Canadian bucks. That’s Cdn$ 0.12 per share. Nevertheless, this consists of a C$ 30 million recognized loss in the bush publication, so we should not be as well severe on Athabasca Oil. However after including back that C$ 30 million in recognized hedging losses, the underlying cost-free capital outcome would certainly still have actually been simply C$ 99 million or … C$ 0.169 per share.

Profits: do not be tricked by the reported take-home pay of Cdn$ 0.27 per share.

Oil rate utilize functions both ways

It do without stating that the solid efficiency in YTD is generally because of the really solid oil rate, so it is constantly essential to take a look at just how capital will certainly change if a reduced oil rate is utilized as a base situation situation.

The overview for 2023 released by Athabasca Oil is really intriguing. The business expects an overall modified funds circulation of C$ 415 million based upon a WTI rate of US$ 85 as well as a WCS spread of US$ 17.5, causing an understood rate of US$ 67.5 for its hefty oil. While the $17.5 spread is not unreasonable, there is a trouble now: The spread is presently concerning $30/barrel, which’s the major reason that Athabasca’s supply rate has actually been under a solid stress. When it comes to the futures market, a barrel of WCS for distribution in August 2023 is presently trading at simply US$ 49/barrel.

The good news is, Athabasca additionally offered a level of sensitivity evaluation: for each US$ 5 modification in the rate of oil, capital will certainly lower by C$ 50 million. For every single US$ 5 modification in the spread, the capital will certainly relocate by C$ 80M. As a result, an understood WCS rate of $50/barrel would certainly minimize capital by 3.5 * C$ 50M = C$ 175M, in which situation the modified capital would certainly be C$ 240M.

Note that this must still suffice to cover the CA$ 140 million CAPEX (containing CA$ 125 countless upkeep CAPEX as well as some little non-maintenance things), yet the circulation from cost-free cash money of 100 million Canadian bucks to 50 United States bucks. obtain delighted. With 586 million shares superior, the FCF per share would certainly be simply Cdn$ 0.17. However, for every buck that the rate of oil surges over that $50 degree on a WCS basis, the FCFPS will certainly increase by C$ 0.017.

While the business will plainly stay FCF favorable at US$ 50 WCS, it would certainly tax its strategies to redeem 10% of its shares every year. At the existing share rate of C$ 2.25, it would certainly set you back C$ 131 million to redeem 10% of its shares. Maybe proceeded initiatives in the carbon capture as well as storage room will certainly assist soften the influence of oil rate volatility.

As well as naturally, if both the WTI oil rate as well as the WCS spread relocate the ideal instructions as well as struck the business’s base situation, the FCFPS would certainly strike C$ 0.46, making the existing supply rate be rather appealing.

financial investment thesis

Athabasca Oil was an excellent telephone call alternative on the hefty oil rate in March 2021, yet sadly both functions both means. The business must anticipate the WCS infect enhance significantly from the existing $30/bbl or its 2023 outcomes will certainly be rather inadequate. Regardless, I anticipate the 4th quarter monetary outcomes to be a wake-up telephone call for the marketplace, as WCS’s typical rate is most likely to be just $55/barrel. Many thanks to the weakening Canadian buck, it’s still most likely to be around C$ 70 a barrel, yet it would certainly threaten to anticipate as well much of the 4th quarter.

I still purchase oil, yet Athabasca Oil is not on top of my listing. The bonds are trading over the same level for a YTM of much less than 7%, which plainly suggests that the financial debt market isn’t worried concerning Athabasca’s credit history account (neither am I), yet I do not have a placement in the bonds either. 2026 at 9.75%.

.