Table of Contents

Acid Test Ratio Meaning

Acid Test Ratio Meaning

An acid-test ratio measures the amount of money in a company’s cash. If a company has an acid-test ratio of 0.86, 86 cents of cash covers a dollar in bills. The company needs to develop more quick assets to improve its acid-test ratio. A company that wants to increase its acid-test ratio to 1:1 should focus on creating more easily convertible assets into cash.

Fast Ratio

An acid test ratio is a measure of a company’s liquidity. A company with a higher ratio is generally considered financially healthier and more robust. A high acid test ratio indicates a company has sufficient liquidity to meet its current obligations. However, companies may face trouble if their ratio is low.

The acid test ratio is calculated by comparing a company’s liquid assets and short-term liabilities. A company with adequate liquid assets can pay off short-term obligations without liquidating its long-term assets.

Most businesses rely on their long-term assets to generate revenue. Therefore, a high acid test ratio means a company’s cash balances are in good shape, allowing it to concentrate on competitive strategies.

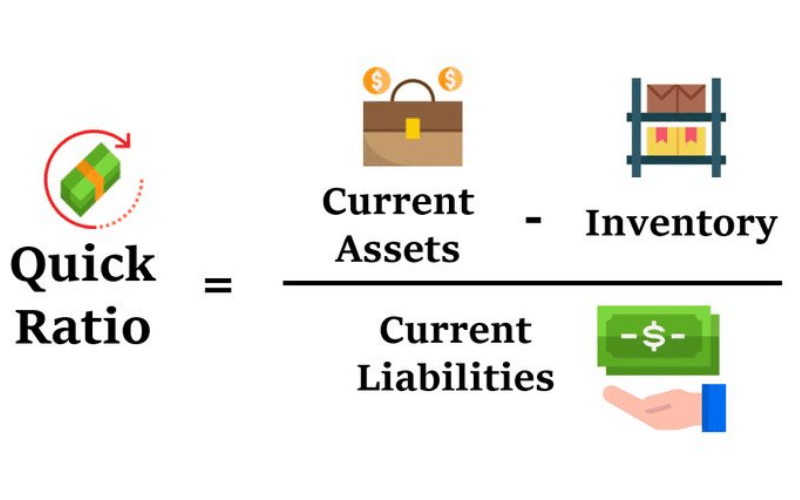

To calculate the acid test ratio, look at the company’s financial statements. Most companies don’t break down their assets by quick assets, but you can still calculate it based on the current total. Start by subtracting the current asset total from the inventory and prepaid assets.

Then, divide that number by the current liability total. The fast acid test ratio will show if a company has enough liquid assets to meet its short-term obligations without selling long-term assets. If the quick ratio is low, the company might not be able to secure adequate funding from a lender.

The fast acid test ratio can help you analyze your company’s liquidity quickly and easily. The current ratio measures a company’s ability to meet its short-term obligations by including only assets that can be converted to cash within 90 days or a year. It is essential to know your current ratio, as it shows your overall liquidity level.

The quick acid test ratio is a common way to analyze a company’s financial health. It is also a great indicator of a company’s ability to pay its current liabilities. The standard liquid ratio is 1:1, so a low quick ratio means the company cannot pay its current liabilities. On the other hand, a high quick ratio means a company has more liquid assets and can cover its current liabilities.

Quick Ratio

The acid test ratio is a calculation used to determine a company’s liquidity. It includes a company’s assets and liabilities and measures its ability to meet short-term obligations. Quick assets include cash and accounts receivable.

These assets are readily convertible into cash and must be paid within 12 months. In addition, it excludes inventory.

The calculation of the acid test ratio can vary from company to company, depending on the industry, market, and business. The main point of the ratio is to provide a realistic picture of the company’s liquidity. A company should include cash equivalents as well as short-term investments. The ratio should exclude accounts receivables, which may take longer to recover.

The acid-test ratio is a vital part of a business’s financial health. Cash flow management is crucial in ensuring a company can meet its obligations. The best way to manage cash flow is to have enough assets to pay the bills as they come due.

However, it may not be as easy to manage cash flow as it seems. Fortunately, other ratios can help a business assess its liquidity.

Another vital component of a business’s liquidity is the quick ratio. Taking inventory out of the equation and dividing current assets by current liabilities provides an acid liquidity test. A firm’s quick ratio should be at least 1:1, indicating that it can meet all its obligations simultaneously. If the quick ratio is higher than this, the firm can meet its current liabilities without having to sell long-term assets.

For businesses that rely on inventory, this ratio can be critical. Because inventory is challenging to sell promptly, low ratios indicate that the industry is at risk of running out of cash and may be unable to meet its short-term obligations. Conversely, a high acid test ratio indicates that the company has sufficient cash to pay bills.

The acid test ratio, also known as the quick ratio, measures a company’s liquidity and ability to meet its short-term obligations. It excludes inventory and accounts payable, which makes it more stringent than the current ratio. It is a more comprehensive measure of the company’s short-term financial health.

Acid Test Ratio

An acid test ratio is a simple financial statement indicating a company’s ability to meet its current liabilities. A low value indicates that the company’s financial situation is unsound, while a high one shows that it is well on its way to a bright future. However, it is essential to note that an acid test ratio is only one of many financial metrics available to investors.

An acid test ratio shows how liquid a company is and can help investors determine whether it can repay its debts promptly. The company may be at risk of defaulting on its obligations if the ratio is low. In addition, a high value can signal a company’s ability to repay its debts.

The acid test ratio, also known as the quick ratio, measures a company’s ability to meet short-term liabilities. It is calculated by dividing the company’s current assets (including accounts receivable) by its current liabilities. The ratio should be 1.0 or higher, which means a company has enough liquid assets to pay its short-term obligations.

Another problem with the acid test ratio is that it does not include inventory. This is because inventory is not considered a liquid asset. However, some businesses can convert inventory into cash very quickly.

Therefore, ignoring inventory from the calculation could lead to the wrong results and unnecessary panic. Another problem with the acid test ratio is that it does not provide detailed information about a company’s cash flow, which is essential for paying obligations.

On the other hand, the quick ratio includes accounts receivable, assuming that these can be converted into cash quickly. This is not always the case.

A company’s optimal acid test ratio will vary depending on its industry, nature, and financial stability. For instance, a business with a stable financial standing and long-term contract revenue will benefit from a low acid test ratio. On the other hand, a low acid test ratio will not be ideal for a new and struggling company.