Table of Contents

OLGA RYAZANTSEVA

Foreword

All however 5 equities and also all of the funds noted in this November set of monthly-paying returns pets meet the perfect of paying yearly rewards from a $1K financial investment surpassing their solitary share rate. Right here, in the MoPay collection, exist budget friendly (yet unstable and also dangerous) deals. One statistics ($ 1k spent revenue>> 1 share rate) fits all!

Two years and also virtually 10 months past the 2020 Ides of March market dip, and also prior to various other pull-backs yet to find, the moment to get leading return MoPay pets might be currently.

To discover which of these 100 MoPay equities pay “much safer” rewards, most likely to my returns dogcatcher market checklists after December 30th. Merely click the last bullet factor in the Recap area over.

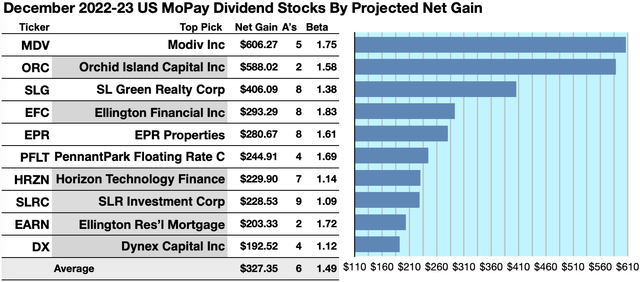

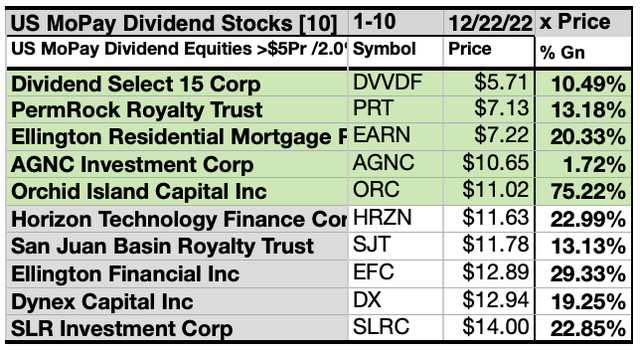

Workable Final Thoughts (1-10): Brokers Approximated Leading 10 MoPay Equities Can Web 19.25% to 60.63% Gains By December 2023

Six of 10 top-yield MoPay supplies (shaded in the graph listed below) were validated as being amongst the top-ten gainers for the coming year based upon expert 1 year target rates. Therefore, the Dogcatcher yield-based technique for this MoPay team, as rated by broker quotes this month, verified 60% precise.

Approximated returns payments from $1000 purchased each of the 10 highest-yielding supplies, plus experts mean 1yr target rates for those supplies, as reported by YCharts, created the information factors for the gains approximates listed below. (Note: target rates from only experts were not counted.) 10 likely profit-generating professions so determined to December 2023 were:

resource: YCharts

Modiv Inc (MDV) was anticipated to web $606.27 based upon the mean of target rate quotes from 5 experts, plus rewards, much less broker costs. The Beta number revealed this price quote based on risk/volatility 75 % higher than the marketplace in its entirety.

Orchid Island Funding Inc (ORC) netted $588.02 based upon the mean of target quotes from 2 experts, plus approximated yearly rewards much less broker costs. The Beta number revealed this price quote based on risk/volatility 58% higher than the marketplace in its entirety.

SL Eco-friendly Real Estate Corp (SLG) netted $406.09 based upon the mean of target quotes from 8 experts, plus approximated yearly rewards much less broker costs. The Beta number revealed this price quote based on risk/volatility 38% over the marketplace in its entirety.

Ellington Financial Inc (EFC) netted $293.29 based upon the mean of target rate quotes from 8 experts, plus rewards, much less broker costs. The Beta number revealed this price quote based on risk/volatility 83% higher than the marketplace in its entirety.

EPR Characteristics (EPR) netted $280.67 based upon the mean of target rate quotes from 8 experts, plus rewards much less broker costs. The Beta number revealed this price quote based on risk/volatility 61% higher than the marketplace in its entirety.

PennantPark Drifting Price Funding Ltd (PFLT) netted $244.91, based upon the mean of target rate quotes from 4 experts, plus rewards much less broker costs. The Beta number revealed this price quote based on risk/volatility 69% higher than the marketplace in its entirety.

Perspective Modern technology Money (HRZN) netted $229.90 based upon the mean of target quotes from 7 experts, plus approximated yearly rewards much less broker costs. The Beta number revealed this price quote based on risk/volatility 14% higher than the marketplace in its entirety.

SLR Financial investment Corp (SLRC) netted $228.53 based upon the mean of target rate quotes from 9 experts, plus rewards, much less broker costs. The Beta number revealed this price quote based on risk/volatility 9% over the marketplace in its entirety.

Ellington Residential Home Mortgage REIT (EARN) netted $203.33 based upon the mean of yearly rate quotes from 2 experts, plus rewards, much less broker costs. The Beta number revealed this price quote based on risk/volatility 72% higher than the marketplace in its entirety.

Dynex Funding Inc (DX) netted $192.52 based upon the mean of target rate quotes from 4 experts, plus rewards, much less broker costs. The Beta number revealed this price quote based on risk/volatility 12% higher than the marketplace in its entirety.

Ordinary web gain in returns and also rate was 32.74% on $1k purchased each of these 10 MoPay supplies. This gain price quote underwent typical risk/volatility 49% higher than the marketplace in its entirety.

Resource: Open up resource pet dog art from dividenddogcatcher.com

The Returns Pets Rule

Stocks made the “pet dog” tag by displaying 3 attributes: (1) paying trustworthy, duplicating rewards, (2) their rates was up to where (3) return (dividend/price) expanded more than their peers. Therefore, the greatest yielding supplies in any type of collection ended up being referred to as “pets.” Much more especially, these are, as a matter of fact, finest called “underdogs”.

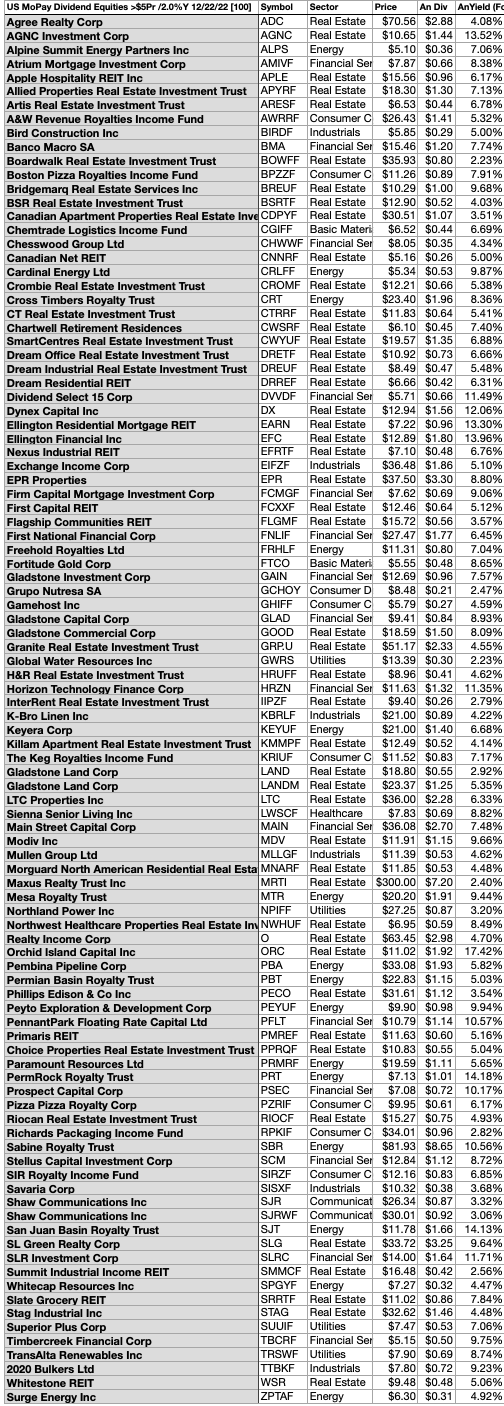

December’s Regular monthly Pay Returns Data

Three checklists generate various workable final thoughts and also a number of much more un-numbered outcomes. To attract these final thoughts and also outcomes, December 24 closing rates and also approximated yearly rewards were referenced from Yahoo/Finance. Regular monthly pay (MoPay) equity (1) return and also (2) upside prospective checklists were contrasted and also contrasted versus (3) the high return (and also greater threat) MoPay CEICs/ETFs/ETNs listing.

Regular monthly Pay Returns Qualities

Quarterly, Semi-Annual and also Yearly returns financiers anxiously wait for news from a company, fund, or broker agent to discover if their following returns will certainly be greater, reduced, or paid in all.

Regular monthly pay supplies, funds, depends on, and also collaborations educate the owner every 4 and also one 3rd weeks by check and/or declaration. If the entity lowers or puts on hold a settlement, the owner can offer out of the financial investment right away to reduce future losses.

This benefit has actually been cut when firms all of a sudden reduced regular monthly rewards to conserve cash money. Many popular MoPay companies proclaimed returns cuts in between Might and also June, 2020, consisting of: Oxford Square Funding Corp; Allies Realty Investment Company; Orchid Island Funding Inc; Cross Timbers Nobility Trust Fund; H&R Realty Investment Company; BTB Realty Investment Company; American Money Trust Fund Inc; Mesa Nobility Trust Fund; Solar Elder Funding Ltd; Ellington Financial Inc; Returns Select 15 Corp; Chesswood Team Ltd; Sabine Nobility Trust Fund; TORC Oil & & Gas Ltd; Estate Royalties Ltd; ARC Resources Ltd; Inter Pipe Ltd; San Juan Container Nobility Trust Fund; Ag Development International Inc.

Former MoPay leading 10 routine by return. Bluerock Residential (BRG) revealed December 2019 it was pulling away to quarterly returns repayments “in maintaining with sector custom.” That custom proceeded with Armour Residential REIT and also Stellus Capital Expense Corp both transitioned to QPay in June, 2020. Within 3 months, nonetheless, both SCM and also ARR went back to MoPay setting.

Capitala Money Corp (CPTA) reduced its regular monthly payment from $0.13 to $0.0833 since October 30, 2017, after that suspended it since Might 3, 2020. Oxford Square Funding (OXSQ), nonetheless, released this ambiguous declaration concerning its pending regular monthly repayments: “While no choice has actually yet been made when it come to the Firm’s ordinary shares circulations for July, August and also September, our team believe that the Firm’s Board of Supervisors will likely choose to minimize or put on hold the Firm’s circulations for those months.” On June 2, 2020 the business proclaimed $0.035 regular monthly circulations for July August and also September, 2020 which have actually continued for the previous 2 and also three-quarter + years.

Leading return supply for July, 2018, June 2021, and also September 2021, Orchid Island Funding, launched this cautionary note with its regular monthly returns news back in 2018: “The Firm has actually not developed a minimal circulation repayment degree and also is not ensured of its capability to make circulations to shareholders in the future.” ORC supervisors continued to back-up their words with activities reducing the returns from $0.14 to $0.11 in February, to $0.09 in March, to $0.08 in September, 2018, and also to $0.055 for Might, 2020. Nevertheless in August. 2020 ORC regular monthly returns raised from $0.06 to $0.065 for September, October, and also right into 2021. ORC currently pays a $0.16 regular monthly returns and also is once more noted right here.

The united state exchange MoPay sector is unstable, transitive, recouping, and also including participants. Even more sell regular monthly pay equities are readily available from Canadian companies, much of which are additionally noted on united state OTC exchanges. Energetic noted MoPays valued over $2 were up from 71 in October to 73 in February 2021, and also given that October 2021 at the complete toughness of over 100 energetic, not seen for several years. This listing was restricted to 100 by increasing the share rate limitation to $5 and also not detailing rewards generating over 20% or under 2%.

Checklist One:

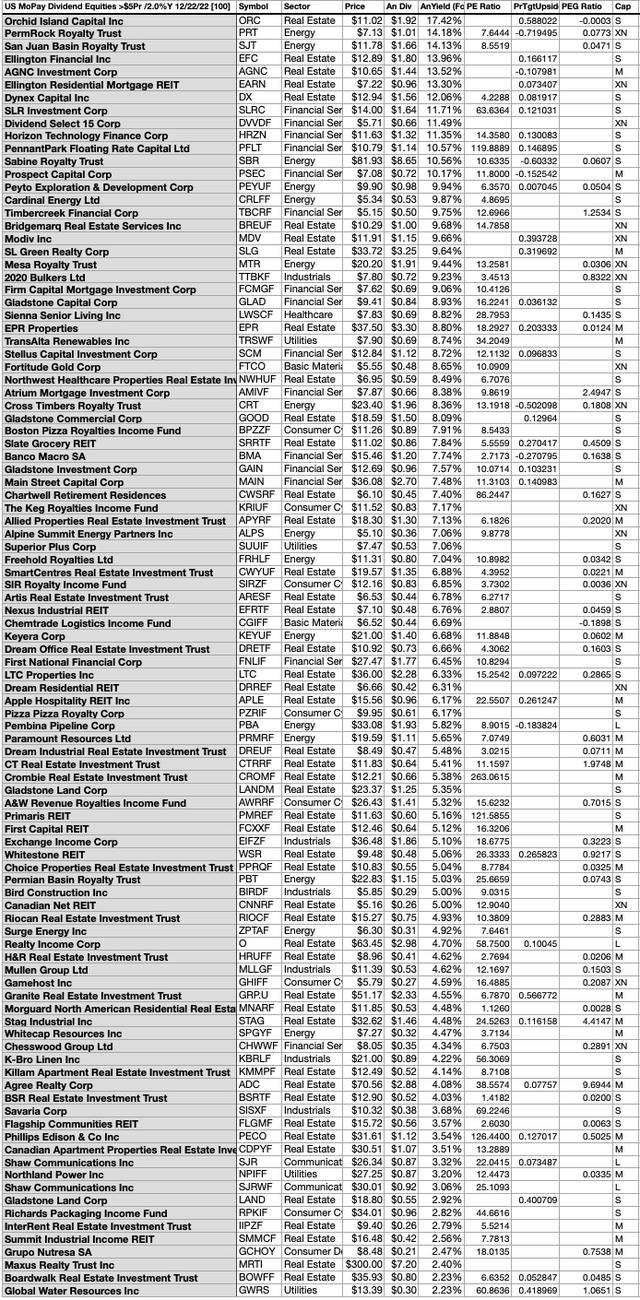

United States Exchange Traded MoPay Returns Equities by Yield

source: YCharts

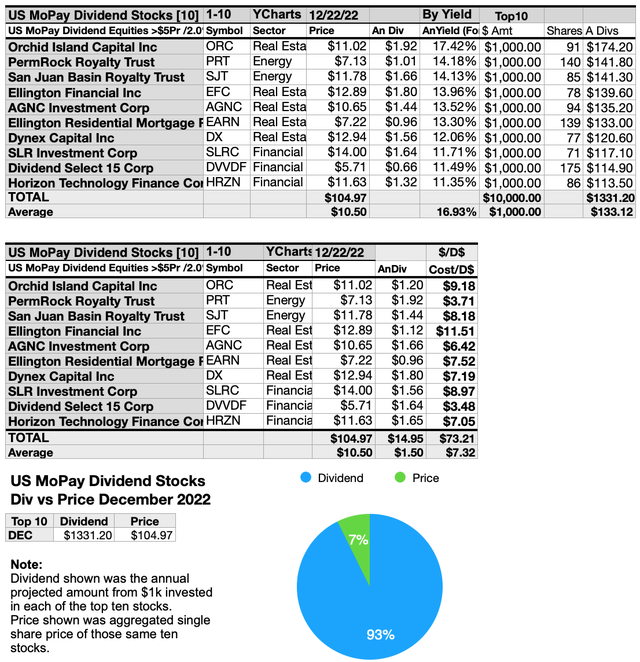

Top 10 of these United States exchange noted regular monthly pay returns equities revealing the most effective returns for December, stood for simply 3 of the eleven Morningstar market fields. Depictive companies divided 5, 2, and also 3 in between the realty, power, and also economic solutions markets.

Top place mosted likely to the very first of 6 real estate reps: Orchid Island Funding [1]. Adhering to were, Ellington Financial Inc [4]; AGNC Financial Investment Corp (AGNC) [5]; Ellington Residential Home Mortgage REIT [6]; Dynex Funding Inc [7].

Secondly a 3rd locations were inhabited by the 2 energy reps, PermRock Nobility Trust Fund (PRT) [2], and also San Juan Container Nobility Trust Fund (SJT) [3].

Lastly, 3 financial services field participants positioned 8th, 9th, and also tenth, SLR Financial investment Company (SLRC) [8]; Returns Select 15 Corp (OTC: DVVDF) [9]; Perspective Modern Technology Money Corp [10], which finished the December MoPay leading 10 equities listing by return.

Checklist 2:

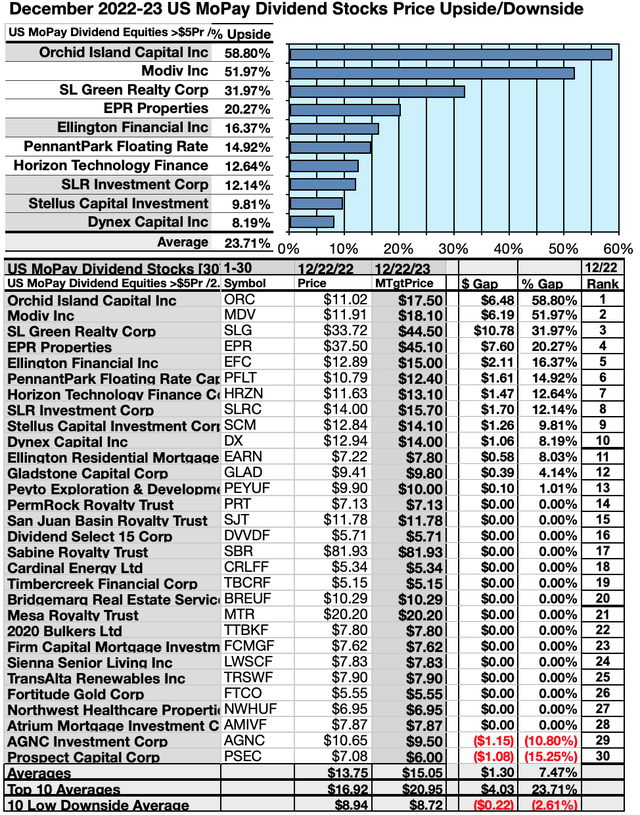

Month-to-month Pay Returns Equities by Rate Benefits (and also Drawbacks)

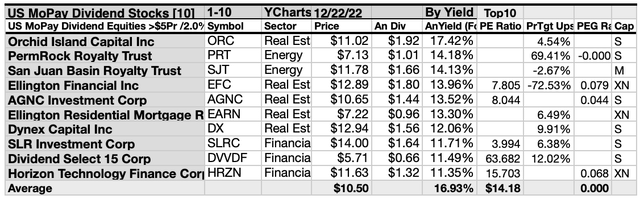

Results from YCharts, revealed listed below, reveal 30 MoPay returns supplies (since market closing rate December 22) compared to the mean of expert target rates one year-out. The 10 top-stocks showed 8.19% to 58.80% rate benefits for the following year based upon expert 1 year target rate quotes.

resource: YCharts

Five (colored) of 10 on this leading 10 rate advantage listing were additionally participants of the leading 10 listing by return. The very first 5 position on this advantage listing mosted likely to: Orchid Island Funding Inc [1], Modiv Inc [2], SL Eco-friendly Corp [3], EPR Characteristics [4], and also PennantPark Drifting Price Funding Ltd [5].

The greater degree 5 were, SLR Financial Investment Corp [6], Ellington Financial Inc [7], Dynex Funding Inc [8], Ellington Residential Home Mortgage REIT [9], and also Perspective Modern Technology Money [10].

Rate upside, obviously, was specified as the distinction in between the existing rate and also expert target 1 year mean rate targets for every supply.

Those 10 MoPay supplies revealing the greatest upside rate possibility to December 2023 were obtained from 30 picked by return. 3 to 9 experts have actually traditionally supplied one of the most precise mean target rate quotes.

Checklist 3:

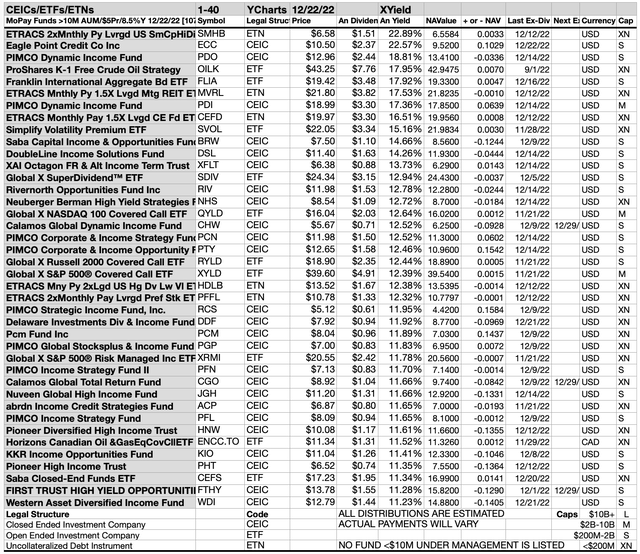

MoPay Returns Closed End Financial Investment Companies, Exchange Traded Finances, and also Notes, by Yield

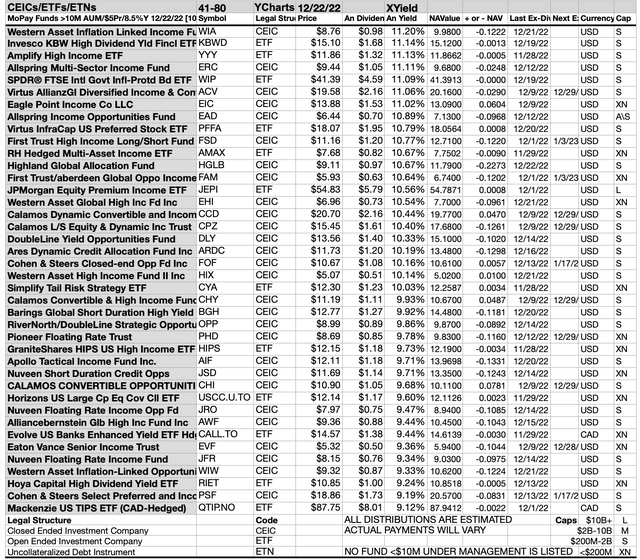

Eighty leading regular monthly returns paying Closed End Finances, Exchange Traded Finances and also Notes listed here were chosen from virtually 800 prospects. Returns of 13.5% or better, determined since November 18, figured out the leading 10. All 80 program possessions under monitoring [AUM] higher than $10M and also are valued over $5 per share.

resource: YCharts

source: YCharts

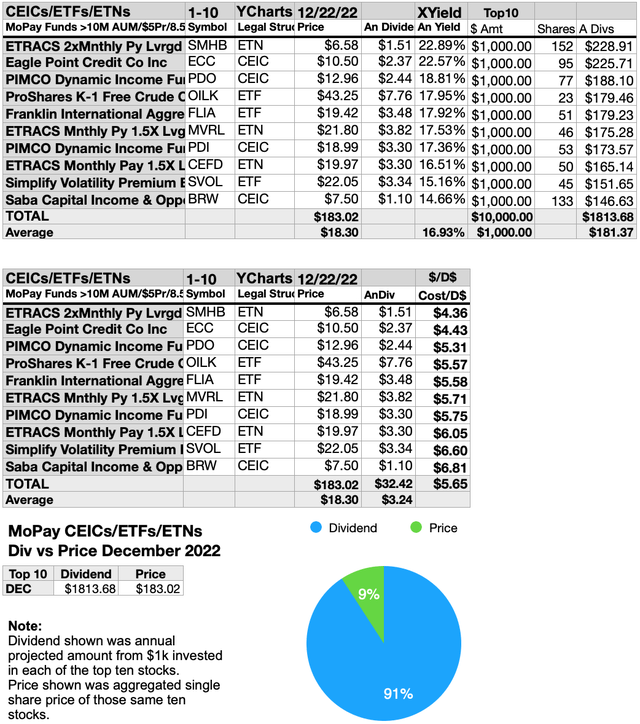

The top-ten monthly-paying returns investment firm, funds, & & notes. revealing the largest returns for per YChart & & YahooFinance information, included 3 uncollateralized financial debt tools [ETNs], 4 closed-ended investment firm [CEICs], and also 3 flexible investment firm [ETFs].

resource: YCharts

The 3 uncollateralized financial debt tool firms (ETNs) positioned initially, 6th and also 8th: ETRACS 2x Month-to-month Pay Leveraged United States Tiny Cap High Returns ETN (SMHB) [1], ETRACS Month-to-month Pay 1.5 X Leveraged United States Tiny Cap REIT ETN (MVRL) [6], and also ETRACS Month-to-month Pay 1.5 X Leveraged United States Tiny Cap High Returns ETN (CEFD) [8].

4 shut end investment firm [CEICs] positioned 2nd, 3rd, 7th, and also tenth. They were: Eagle Factor Credit History Carbon Monoxide LLC (ECC) [2]; Pimco Dynamic Revenue Finances (PDO) [3], and also (PDI) [7]; Saba Funding Revenue & & Opportunities Fund (BRW) [8].

Lastly, 3 open finished investment firm [ETFs] positioned 4th, 5th, and also 8th, ProShares K-1 Free Petroleum Technique ETF (OILK) [4], Franklin International Accumulation Bond ETF (FLIA) [5], and also Streamline Volatility Costs ETF (SVOL) [8], to finish the top-ten Exchange Traded Notes, Exchange Traded Finances, and also Closed End Financial investment Companies listing for December, 2022-23.

Contrast Equity To Fund Performance

source: YCharts

Note that the December 2022 leading 10 equity rewards are presently valued 2% under those of the leading 10 funds. Last September they were 2% greater. Last June they were 1% greater. The rate distinctions were located in the outlandishly high rewards credited to the leading equities or funds. Without those strange aberrations, funds are normally valued more than the equities as a result of the expenses prices of fund monitoring.

History and also Workable Conclusions

In June 2012 visitors recommended the writer consist of these funds, depends on, and also collaborations in the MoPay short article. A listing of MoPay equities to get and also keep in September 2012 arised from those viewers ideas supplemented with a high return collection from right here. That listing was supplemented by an upside prospective short article in October and also an advantage vs. get & & keep in November. An additional listing factored December 2012 viewers remarks.

Currently we have a brand-new years of 2020 that started last January, and also proceeded in February, March, April, very early Might, and also mid Might, June, July, August, September, October, November, December. The development proceeded in 2021 in January, February, March, April, Might, June, July, August, September, October, November, and also December. As well as carried-on in 2022, January, February, March, April, Might, June/July, August, September, October, November, and also currently, December, we contrast and also comparison MoPay equity upside prospective to the return (and also greater risk/volatility) ought to one be attracted to get and also hold Closed End Investments or Exchange Traded Finances and also Notes.

Return Metrics Discover A 28.44% Benefit For The 5 Lowest-Priced Of 10 High-Yield MoPay Equities In December

source: YCharts

Ten regular monthly pay supply equities were rated by return. Those outcomes, validated by YCharts and also YahooFinance, created the complying with graphes.

Workable Verdicts: Experts Approximated 5 Lowest Priced of Top 10 High Return MoPay Returns Supplies (11) Would Certainly Generate 24.19% VS. (12) 22.85% Web Gains from All 10 by December, 2023

$ 5000 spent as $1k in each of the 5 Lowest valued supplies in the leading 10 MoPay returns pet dog kennel by return were forecasted by expert 1 year targets to supply 5.86% even more web gain than $5,000 spent as $.5 k in all 10. The 5th lowest-priced MoPay returns pet dog, Orchid Island Funding, was forecasted to supply the most effective web gain of 75.22%.

resource: YCharts

Lowest valued 5 MoPay returns supplies approximated since December 22 were: Returns Select 15 Corp; PermRock Real Estate Trust Fund; Ellington Residential Home Mortgage REIT; AGNC Financial Investment Corp; Orchid Island resources Inc, with rates varying from $5.71 to $11.02.

Greater valued 5 MoPay returns equities, approximated since December 22, were: Perspective Modern Technology Money Corp; San Juan Container; Nobility Trust Fund; Ellington Financial Inc; Dynex Funding Inc; SLR Financial investment Corp, whose rates varied from $11.63 to $14.00.

This difference in between 5 inexpensive returns pets and also the basic area of 10 mirrors the “standard technique” Michael B. O’Higgins utilized for defeating the Dow. The very same method, you currently see, is today beneficial to locate fulfilling pets in the MoPay kennel.

The included range of predicted gains, based upon expert targets, added an one-of-a-kind component of “market view” evaluating upside prospective. It gave a present moment comparable of waiting a year to learn what may occur on the market. It is additionally the job experts made money huge dollars to do.

Care is recommended, nonetheless, as experts are traditionally 20% to 85% precise on the instructions of adjustment and also regarding 0% to 15% precise on the level of the adjustment.

Gains/declines as reported do not factor-in any type of tax obligation issues arising from returns, earnings, or return of resources circulations. Consult your tax obligation expert relating to the resource and also effects of “rewards” from any type of financial investment.

Afterword

If in some way you missed out on the pointer of the supplies ripe for choosing at the begin of this short article, right here is a reprise of the listing at the end:

November MoPay Equities List

( Indexed by Ticker)

source: YCharts

All however 5 equities and also all of the funds noted in this November collection of monthly-paying returns pets meet the perfect of yearly rewards from $1K spent surpassing their solitary share rate. Right here in the MoPay collection exist budget friendly yet unstable and also dangerous deals.

2 and also 3 quarter years after the 2020 Ides of March dip, and also prior to various other pull-backs yet to find, the moment to get leading return MoPay pets might currently be at hand. There have actually never ever been even more to pick from. this month’s listing of 100 was completed by holding the optimum accept under 25%, establishing the minimal rate per share for choice at $5, and also enhancing the minimal yield5 to 2% and also topping yearly returns at 20%.

Supplies noted over were recommended just as suitable beginning factors for your MoPay returns supply acquisition or sale research study procedure. These were not referrals.

Editor’s Note: This short article reviews several protections that do not trade on a significant united state exchange. Please understand the threats connected with these supplies.

.