Reverse Mortgage LESA Account & How it Works LESA reverse mortgage important information and resources you need to know before opting into a LESA reverse Qualifying for a reverse mortgage now is not the same as it was

Reverse Mortgage LESA Account & How it Works LESA reverse mortgage important information and resources you need to know before opting into a LESA reverse Qualifying for a reverse mortgage now is not the same as it was

Reverse Mortgage on Second Home Reverse mortgage on second home important information, tips, and resources that will help educate you on deciding if a reverse mortgage on a second home is right for Not only has the reverse-mortgage sector…

What Credit Score Do You Start With? When people begin to use credit, they begin to create a credit history as well as a credit score, but what credit score do you start with? Do you have a credit score…

How Much Will a Secured Credit Card Raise My Score Thinking about getting a secured credit card to help raise your credit score, but wondering “How much will a secured credit card raise my score?” Well, continue reading to find…

Can I Finance a Car with No Credit? Many people looking to buy a car that either have bad credit or no credit at all, have been asking the question, “Can I Finance a Car with No Credit?” In this…

Can Credit Card Companies Garnish Your Wages If you are behind on your credit debt, you’re probably wondering can credit card companies garnish your wages? Continue reading to learn more information and resources to help with credit If you…

In this article we will be discussing bad credit car leasing and provide you with tips and resources to help you lease a car even if your credit is less than For many drivers, leasing a car is an…

Introduction to Credit Enhancement It is a way for a borrower or a bond issuer to attempt to improve their debt or creditworthiness through Credit Enhancement Lenders can be assured of repayment through additional collateral, insurance, or a third-party guarantee…

Credit Card Refinancing vs Debt Consolidation In this article, you will learn the difference between credit card refinancing vs debt consolidation and which one will work best for your Credit card refinancing and debt consolidation are two well-known terms…

Before Selling a Home to Pay Off Debt, Ask Yourself These Questions You might be asking yourself should I sell my house to pay off debt, but before you jump the gun and sell your house to pay off debt,…

Leasing a car is a terrific method to drive the newest model and can even result in lower monthly payments than financing a new But, is it easier to lease a car with bad credit instead of doing a…

Returning to your car and finding a parking ticket on the windshield is the quickest way to anger most If it’s not enough to have to pay the cost of the parking ticket, but do parking tickets affect insurance…

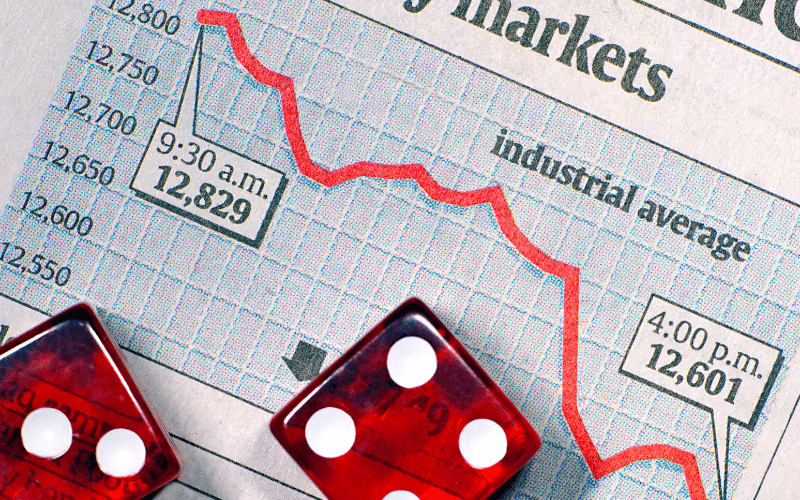

In this article you will learn important information and resources about mutual funds vs hedge Both mutual funds and hedge funds are professionally managed portfolios comprised of pooled funds with the purpose of maximizing returns through This implies…

What Is an Options Market Making? The term option market making relates to a person or business who assertively quotes two-sided markets in a specific security, offering bids and offers (known as asks) including the market size of Market…

In this article we will go over the difference between hedge fund vs mutual fund to help you decide which is the best investment option Mutual funds and hedge funds are both financial vehicles that offer managed portfolios to…

Learn important information between a debit spread vs credit An options spread is the simultaneous purchase and sale of multiple option contracts on the same underlying There are two types of vertical spreads: credit spreads and debit