Table of Contents

Changing the Status of Your IRA Contribution

In this article you will learn everything you need to know about recharacterized Roth IRA’s. You can move your contribution from one IRA to another at some time, you might want to recharacterize an IRA contribution to change the initial designation—either to correct a mistake or because you changed your mind for another reason.

For example, if you made a Roth IRA contribution but later realized you surpassed the Roth IRA income restrictions and were no longer qualified to contribute, you can recharacterize it as a regular IRA contribution.

You may, on the other hand, choose to recharacterize a traditional IRA contribution if you are ineligible for a deduction because you are covered by a workplace retirement plan.

In such situation, it could be wiser to classify it as a Roth IRA contribution, which allows you to grow your money tax-free.

If you’re curious about how the math works, here’s a look at how recharacterizations work—along with the formula for computing earnings and losses.

Important Points

You can change the designation of your current year’s IRA contributions from a regular IRA to a Roth IRA, or vice versa. You must recharacterize before the individual income tax deadline for that year.

When you recharacterize an IRA contribution, you must transfer the contribution as well as any earnings.

A Roth IRA conversion allows you to change the full balance of your regular IRA to a Roth IRA at any time.

You could recharacterize (or undo) a Roth IRA conversion to a regular IRA before the Tax Cuts and Jobs Act (TCJA) of 2017.

You can no longer recharacterize a Roth IRA conversion because it is now irreversible.

What is an IRA Recharacterization and How Does It Work?

To recharacterize a contribution, you transfer assets from the IRA where the contribution was originally made to the IRA where you wish the assets to be kept.

Recharacterizations are handled by certain financial organizations by simply switching the IRA from one kind to another.

Check with your IRA custodian/trustee about the recharacterization method and any documentation needs.

Recharacterization of IRA Contributions Deadline

The deadline for recharacterizing an IRA contribution made during a given tax year is the same as your tax-filing date for that year, plus any extensions.

If you file your tax return on time (typically by April 15) then request a six-month extension, you have until Oct. 15 of the following year to recharacterize a contribution.

Before filing your tax return, you must file Form 4868 with the Internal Revenue Service (IRS), either electronically or on paper, to request an automatic six-month extension.

Once you’ve finished the purchase and filed electronically, you’ll receive an electronic acknowledgment.

Conversions to a Roth IRA

A Roth IRA conversion allows you to convert the whole balance of a regular IRA to a Roth account. You will owe ordinary income tax on the entire converted amount at your existing tax rate if you do so, which could result in a significant tax payment.

Still, if you expect to be in a higher tax band in retirement than you are now and want to get the taxes out of the way, it can be a wise plan.

When your income is particularly low or your conventional IRA has taken a significant hit from a market collapse, it’s the greatest moment to convert to a Roth IRA.

Warning: It used to be legal to change your mind and convert your Roth conversion to a traditional IRA.

The Tax Cuts and Jobs Act (TCJA) of 2017 made it illegal to recharacterize a Roth conversion’s account balance back to a traditional IRA. 2 Conversions to a Roth IRA are now irreversible.

Recharacterization Earnings and Losses Calculation

If their IRA provider does not provide such services, taxpayers who recharacterize their IRA contributions may face the difficult process of computing the gains (or losses).

Calculating gains or losses correctly is as crucial as the recharacterization itself and failing to do so could result in negative consequences.

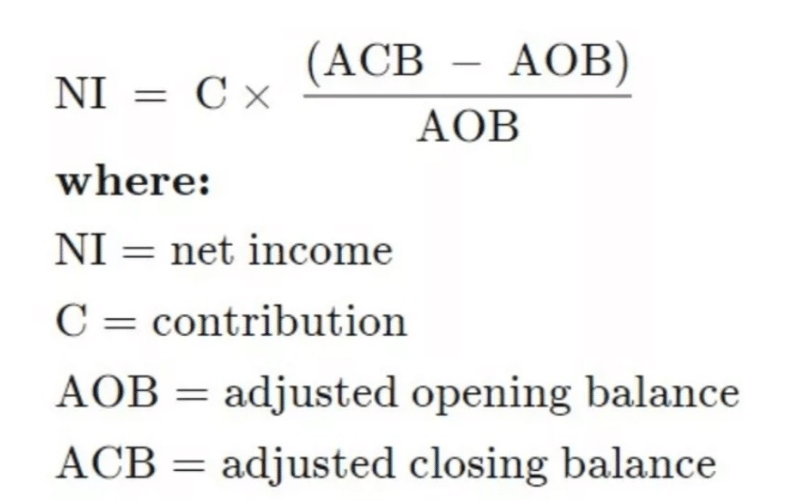

For computing the earnings or losses on the recharacterized amount, the IRS provides a unique formula. The formula is as follows:

The computation period begins immediately before the recharacterized contribution is made to the IRA and concludes immediately before the contribution is recharacterized.

If the IRA is not evaluated on a daily basis, the most recent available fair market value prior to the contribution can be used to start the period, and the most recent available fair market value prior to the recharacterization can be used to conclude the period.

Assume that an IRA is not valued on a daily basis and that the owner receives account statements once a month.

If the owner were recharacterizing a contribution in March 2022 that occurred in December 2021, the beginning period (market value) would be the November 2021 month-end value (from the November statement) and the ending fair market value would be the February 2022 month-end statement.

Example of IRA Recharacterization Calculation

On December 1, 2020, Dan made a $1,600 contribution to his regular IRA. His traditional IRA balance was $4,800 prior to the contribution.

When Dan submitted his tax return in April 2021, he discovered that he could only deduct $1,200 from his income.

Because he couldn’t deduct the remaining $400, Dan chose to invest it in a Roth IRA, which allows profits to grow tax-free, as opposed to standard IRA earnings, which grow tax deferred.

Dan must recharacterize the $400 to his Roth IRA and add any earnings (or subtract any losses) on the $400 in order to treat it as a Roth IRA contribution.

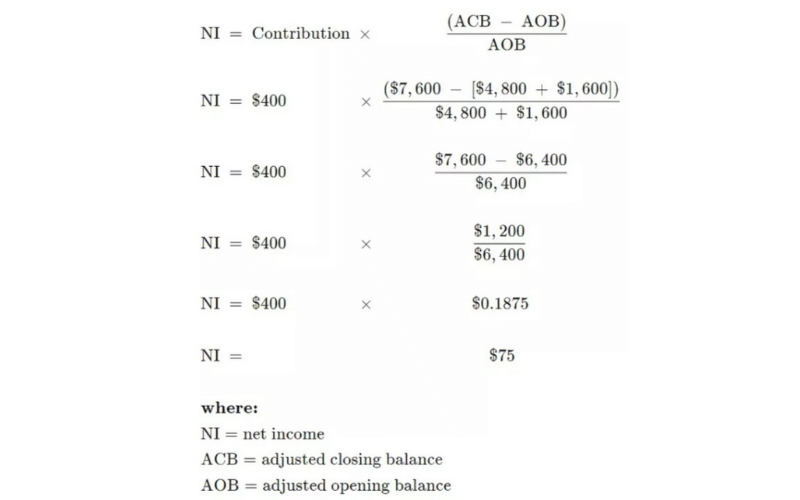

When Dan recharacterizes the $400 in April, the value of his regular IRA is $7,600. He didn’t make any additional contributions to the IRA, and he didn’t receive any dividends from it. The following is how Dan estimates his profits and losses:

The Full Recharacterization Calculation

During the computation period, the $400 contribution generated $75. As a result, Jack must transfer $475 ($400 + $75) to his Roth IRA. The $400 will be considered as if he had contributed to the Roth IRA from the outset for tax reasons.

Only in the case of a partial recharacterization is a calculation of earnings or loss required. In other words, no calculations are required if the full IRA balance is being recharacterized.

For example, suppose you opened a new Roth IRA in January 2020 and contributed $3,000 to it. The IRA had earned $500 by October 2020, bringing the total to $3,500.

You decide to treat the $3,000 as a traditional IRA contribution in order to claim a deduction for it.

Because the Roth IRA had no further contributions or payouts before the $3,000 contribution, and because the IRA had no balance prior to the $3,000 contribution, you can recharacterize the whole balance to a traditional IRA.

Forms for Filing Taxes

On IRS Form 5498.8, your IRA custodian will record your IRA contributions (to both you and the IRS). Even if a gift is later recharacterized, it is still reported.

If you recharacterize your donation, you’ll get two Form 5498s: one for the original contribution and another for the amount credited to the other IRA as a characterization.

You’ll also get a Form 1099-R for the IRA that received the donation initially. Form 1099-R is used to record retirement account distributions.

In box 7 of Form 1099-R, your custodian will enter a special code to indicate that the transaction is a recharacterization and hence not taxable.

IRS Form 8606 must be used to report partial recharacterizations. You must file Form 8606 with your tax return, but you do not need to file it for full recharacterizations.

How do you reclassify a donation to an individual retirement account (IRA)?

To recharacterize an IRA contribution, you’ll need a separate IRA—either an existing one or a new one—to accept the withdrawn funds. Recharacterize a contribution by notifying your financial institution(s).

If both IRAs are managed by the same IRA provider, you just need to tell that one institution. Inform the custodian of the original IRA contribution, as well as the institution that will accept the recharacterized contribution, if this is not the case.

Recharacterization can usually be done online or with standard forms given by your IRA custodian. You must use Form 8606 to disclose the recharacterization on your tax return for the year in which you made the original donation.

In 2022, how much can I put into an IRA?

You can put $6,000 into your Roth and regular IRAs in 2022, plus a $1,000 catch-up contribution if you’re 50 or older.

The cumulative total of all of your IRAs is the limit. So, if you put $4,000 to a regular IRA, the most you may contribute to a Roth during the same tax year is $2,000 (or $3,000 if you’re 50 or older).

Your modified adjusted gross income (MAGI) determines whether you’re able to contribute the full amount—or anything at all—to a Roth IRA. If your MAGI is $214,000 or over for the 2022 tax year, you won’t be eligible to contribute to a Roth IRA if you’re married and file jointly.