Table of Contents

A money purchase pension plan, or MPPP, is an employer-sponsored retirement plan in which businesses make annual contributions on behalf of their employees.

The amount that the employer must contribute is determined by the plan itself. Employees may also be able to contribute directly from their wages.

Money purchase pension schemes are similar to 401(k)s, pension plans, and profit-sharing plans.

If your company offers an MPPP plan, it’s critical to understand how it works and how it fits into your overall retirement strategy.

What Is a Money Purchase Pension Plan (MPPP)?

Defined contribution programs include money purchase pension plans. That is, they do not guarantee a specific retirement benefit amount.

Rather, these retirement plans allow businesses and/or employees to make contributions up to annual limits.

Participants, like those in other retirement plans, can take withdrawals once they reach retirement age.

Meanwhile, the account value may rise or fall as a result of investment profits or losses.

Employers must make predefined fixed contributions on behalf of all qualified employees in money purchase pension plans.

As long as the plan is maintained, the company must make these contributions on a yearly basis.

Money purchased under a money purchase plan grows tax-free. Employees are not required to contribute to the plan, although they may choose to do so.

Loans from money purchase plans are permitted by the IRS, but in-service withdrawals are not.

What Are the Money Purchase Pension Plan Contribution Limits?

Each money purchase plan sets its own contribution restrictions, although they cannot exceed the IRS’s maximum limits.

For example, an employer’s plan may require them to contribute 5% or 10% of each employee’s wages to their MPPP plan account.

Contribution restrictions for annual money purchase plans are identical to those for SEP IRAs.

The lesser of the following is the maximum donation allowed in 2022:

• 25% of the employee’s compensation, OR

• $61,000

Inflation-adjusted contribution limitations for money purchase pension plans and other qualified retirement accounts are adjusted by the IRS on a regular basis.

The amount of money in a money purchase plan that an employee will have.

When they retire is determined by the amount provided on their behalf by their company, the amount contributed by the employee, and the performance of their investments during their working years.

Your account balance could play a role in determining when you can retire.

Money purchase plan payouts follow the same rules as other eligible plans in that you can start taking money out penalty-free at age 59 and a half.

If you take money out before then, you may be charged a ten percent penalty.

Money purchase plan programs, like pension plans, must provide the option of receiving dividends as a lifetime annuity.

Other distribution alternatives, such as a lump sum, may be available with money purchase programs.

Participants do not have to pay taxes on their accounts until they start withdrawing money.

The Advantages and Disadvantages of Money Purchase Pension Plans

Money purchase pension plans have several advantages, but they also have some disadvantages that participants should consider.

Advantages of Money Purchase Plans

Here are some of the benefits of a money purchase plan for employees and businesses.

• Tax advantages Contributions made on behalf of employees are tax deductible for employers.

Employee contributions grow tax-free, allowing them to defer paying taxes on investment growth until they withdraw the funds.

• Loan availability. If the plan allows it, employees may be allowed to borrow against their account balances.

• Possibility of enormous balances Employees may be able to accumulate account balances larger than they would with a 401(k)-retirement plan due to the relatively high contribution limits, depending on their wage and the percentage their employer pays on their behalf.

• Reliable retirement income Regular monthly payments from a lifetime annuity might help with budgeting and planning when employees retire and begin drawing down their account.

Money Purchase Pension Plan Disadvantages

The majority of the drawbacks of money purchase pension schemes affect companies rather than employees.

• Expensive to keep up. The administrative and overhead costs of running a money purchase plan are often higher than those of other forms of defined contribution plans.

• A significant financial burden. Because money purchase plan contributions are obligatory (unlike 401(k) contributions, which are elective), a corporation may have difficulties in years when cash flow is low.

• Employees may be unable to participate. Employees may or may not be able to contribute to a plan depending on the rules of the plan.

They could, however, defer a portion of their salary for retirement if their employer offers both a money purchase plan and a 401(k).

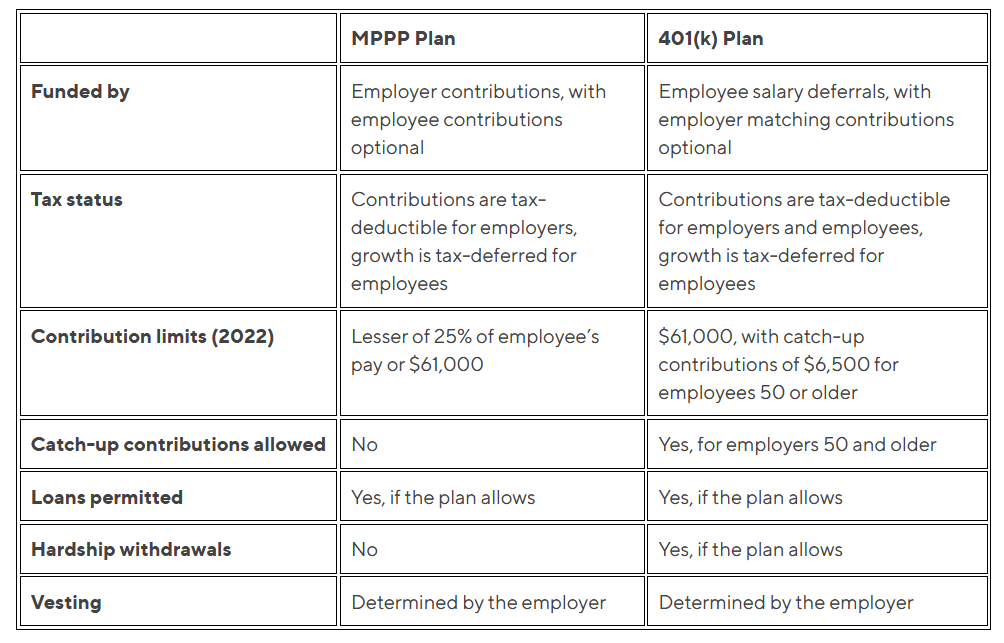

401(k) vs. Money Purchase Pension Plan

The fundamental distinctions between a pension and a 401(k) have to do with how they are funded and distributed.

In a money purchase plan, the employer provides the funding, and the employees can contribute as well.

Employees contribute to 401(k) funds through elective salary deferrals and optional company contributions.

The employer may use a vesting schedule for both types of plans to determine when the employee can keep all of the employer’s contributions if they leave the company.

Employee contributions are always instantly vested.

The total annual contribution limits for both defined contribution plans are the same in 2022, at $61,000 (including both employer and employee contributions).

401(k) catch-up contributions are available to employees over the age of 50.

The overall employee contribution ceiling for 2022 is $20,500, plus a $6,500 catch-up contribution.

Both plans may or may not allow loans, and if you move employment or retire, you can roll funds from a money purchase pension plan or a 401(k) into a new qualified plan or an Individual Retirement Account (IRA).

Employees may be able to take hardship withdrawals from a 401(k) if they meet certain criteria, but the IRS does not allow hardship withdrawals from a money purchase pension plan.

The Bottom Line

➣ An annual company payment to an employee’s retirement savings is known as a money purchase pension plan.

➣ Employees may have 401(k) plans but do not contribute to their pension plans.

➣ This is a “qualified” retirement savings plan, which means the money is tax-free until it is withdrawn.

Employees can use money purchase pension plans to help them accomplish their retirement goals. They’re similar to 401(k)s, but there are a few key distinctions.

The most important thing is to start saving for retirement, whether it’s through a money purchase pension plan, a 401(k), or another form of account.

There are additional solutions available if you don’t have access to a money purchase pension plan or similar plan at work, such as starting an IRA online using the SoFi Invest brokerage platform.

The sooner you start saving for retirement, the more time your money has to grow thanks to compounding interest.

Finance World Direct > Archived > Retirement