Considering withdrawing your entire pension before age 59½, consider the correct Otherwise, you might lose out on tens of thousands of Making the right choice when choosing a financial advisor can be one of the most important decisions…

Retirement

Considering withdrawing your entire pension before age 59½, consider the correct Otherwise, you might lose out on tens of thousands of Making the right choice when choosing a financial advisor can be one of the most important decisions…

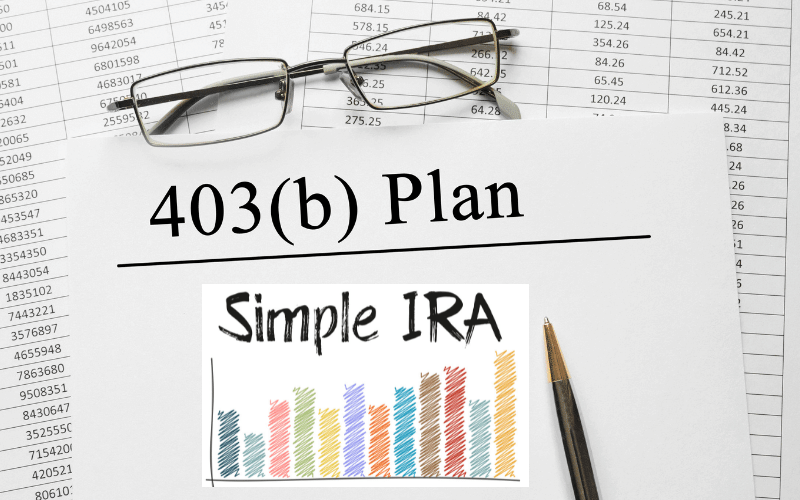

What is a 403(b)? Is 403b pretax or post tax is a question many people planning for retirement are A 403(b) is one type of qualified plan offered to public sector This tax-advantaged retirement savings account offers both…

What Happens to 401k When You Quit Your Job What happens to 401k when you quit your job is a common question that many wonder when they plan on leaving their current Are you worried about losing your retirement…

What to do with 401k after leaving job? Retire allows you to enjoy your golden years with your family and But before you do, you should consider how you will spend your retirement Retirement accounts are great because…

Should I rollover my 401(k) to new employer is a common question those changing jobs want to When you first started working, you probably didn’t care about matching contributions from your But as you get older, you realize…

Did you know that you can deduct 401k capital gains taxes from your retirement savings? This means that if you invest $100,000 in stocks and sell them for $150,000, you only owe tax on the $50,000 Nowadays, many Americans…

If You Need Your 401K Money Now, Follow These Tips With inflation steadily rising many middle-class Americans are screaming out,…

A money purchase pension plan, or MPPP, is an employer-sponsored retirement plan in which businesses make annual contributions on behalf of their The amount that the employer must contribute is determined by the plan Employees may also be…

Which is Better: A Roth IRA or a 403b? The differences between a Roth IRA vs 403b are often A 403b is a retirement account to which your employer can At the same time, a Roth IRA is…

401a vs 401k – What are the key differences, and which will be best for your retirement? Are you thinking…