Table of Contents

What Is a Net Principal Limit on a Reverse Mortgage?

Keep reading to learn the ins and out of principal limit on reverse mortgages.

The amount of money a reverse mortgage borrower can get once the loan closes after closing fees are deducted is known as the net principal limit.

The net principal limit is determined by a number of factors, including the equity worth of the home and the amount of upfront fees paid by the borrower.

Understanding the Net Principal Limits of Reverse Mortgages

Reverse mortgages are for those over the age of 62. Home equity conversion mortgages, often known as home equity loans, allow borrowers to access cash for the value in their houses without having to make monthly payments.

Borrowers’ primary loan balances are determined by the appraised value of their home, their equity worth, and their age.

Money might be disbursed in installments or as a lump amount, depending on the terms of the reverse mortgage.

The Federal Housing Administration (FHA) and the United States Department of Housing and Urban Development (HUD) back most reverse mortgages (HUD).

On the HUD website, interested borrowers can look for an FHA-approved lender.

A reverse mortgage is a form of second mortgage in which the secured collateral is the borrower’s home.

At a set interest rate, interest accumulates during the life of the loan. Most crucially, borrowers must repay the entire loan if the property is sold.

In the event of a death, complete repayment is also expected if the secured property and any recourse assets are left to the lender.

The net principal of a reverse mortgage loan is the amount a borrower receives after all costs and fees have been deducted.

The net principal limit is usually higher than the reverse mortgage initial principal limit, which is the most money you can get in the first year.

Note: Beginning in 2013, a regulation limited the amount of reverse mortgage earnings borrowers could receive in the first year of their loan to 60% of the initial principal limit.

Things to Consider

Reverse mortgage loans come with a slew of fees. The origination charge, upfront mortgage insurance premium, appraisal fees, title insurance, and home inspection fees are all included in the costs.

The FHA has certain guidelines for calculating principal offers, and borrowers are only allowed to borrow a particular amount over the course of their lives. 5

Reverse mortgages provide borrowers with a variety of personalized alternatives.

The ability to choose a single-disbursement lump-sum payment with a set interest rate is perhaps the most appealing feature.

Monthly disbursements and lines of credit are two other alternatives available with variable rates.

The borrower’s net principal limit is the total balance available after fees for all of these alternatives.

The present net principal limit and the net principal limit can be compared.

The revolving balance on the borrower’s account is the current net principal limit.

The net principal limit at the start of the loan and the current net principal limit would be the same.

The FHA’s maximum reverse mortgage loan ceiling for 2022 is $970,800.

Net Principal Limits on Reverse Mortgages: Pros and Cons

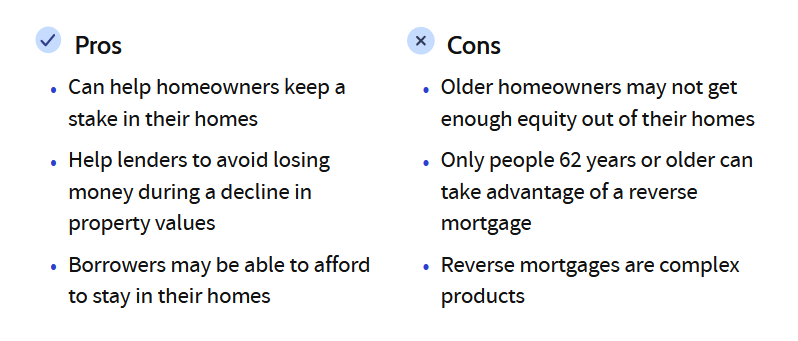

One of the most important advantages of reverse mortgage net principal limits is that they ensure that homeowners keep a major interest in their houses.

Without a stake in the property, the owner may let many non-essential aspects of the house deteriorate, preferring to save money for heirs.

Net principal limits on reverse mortgages also help lenders avoid losing money if property prices fall.

Reverse mortgage net principal limits that are too low, on the other hand, may prevent elderly homeowners from fully utilizing their home equity.

Assume, as is frequently the case, that they are no longer able to make a significant amount of money.

These homeowners may be forced to sell their homes or forego necessary repairs.

Reverse Mortgage Net Principal Limit Example

You must be 62 years old or older and have enough equity in your house to make a reverse mortgage profitable and reasonable.

Assume the Smiths own a $300,000 property and the primary limit factor is 0.50.

The lending limit has no bearing on the calculation because their home worth is less than the lending limit.

The principal limit on their reverse mortgage is $150,000 in this scenario.

This is the total amount they can borrow, after which they must pay fees, closing charges, the remaining balance on their previous mortgage, and any liens on the property.

Assume that all of these expenses total $30,000. The remaining principle will be $120,000.

They’ll owe $150,000 on their reverse mortgage and receive $120,000 in the form of a line of credit or a lump-sum payment.

Discrimination in mortgage lending is prohibited. There are actions you can take if you believe you’ve been discriminated against because of your color, religion, sex, marital status, use of public assistance, national origin, disability, or age.

Filing a report with the Consumer Financial Protection Bureau or HUD is one such action.

What Is a Principal Limit Factor?

The amount of cash supplied to the borrower as a percentage of the value of their house is the primary limit factor.

Interest rates and the age of the youngest borrower or non-borrowing spouse have an impact.

When Is It Necessary to Repay a Reverse Mortgage?

Reverse mortgage loans are often repaid for one of two reasons: the borrower passes away or decides to sell their house.

You may be required to repay your mortgage sooner if you do not pay your home insurance or property taxes on time.

How Do You Calculate a Reverse Mortgage’s Principal Limit?

The age of the youngest borrower or eligible non-borrowing spouse, the maximum claim amount, and the interest rate on the loan are used to compute the principal limit for a reverse mortgage.

In Conclusion

The net principal limit on a reverse mortgage refers to the amount of money accessible to borrowers after all expenses related with the loan have been deducted.

Depending on the reverse mortgage terms, borrowers can access up to the net principal limit as a lump amount, monthly payments, a line of credit, or a combination of the three.

There are advantages and disadvantages to getting a reverse mortgage, but for some elderly homeowners, the freedom to age in place with the funds from a reverse mortgage may be the most important benefit.