Table of Contents

What To Consider Before Purchasing a Home in Idaho

What To Consider Before Purchasing a Home in Idaho

First time home buyer Idaho information and resources. Idaho has high home prices that are rising faster than the national average. However, this should not deter you as a first-time homebuyer.

There are numerous tools available to assist you in achieving your objectives, including low-interest mortgages, homebuyer education seminars, and down payment aid.

Buying a house in Idaho:

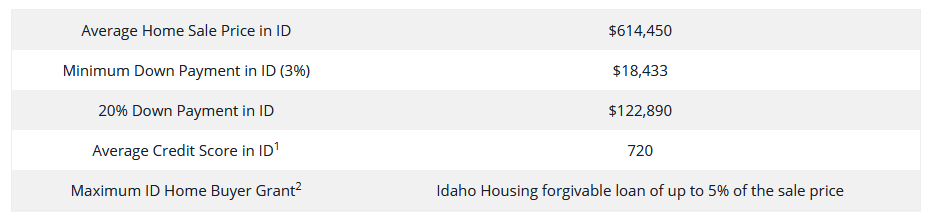

According to Redfin, the median listing price in Idaho in December 2021 was $614,450. And statewide housing values increased by 26,3 percent annually.

Unlike the majority of other states, Idaho does not offer statewide homebuyer assistance programs.

However, the private sector does offer some assistance. And there are other financing schemes that might make the buying of a home more reasonable.

Idaho home buyer stats:

The amount of the down payment is based on the state’s most recent available median house sale price.

The “minimum” down payment for a conventional mortgage with a minimum credit score of 620 is 3 percent.

If you qualify for a VA loan (guaranteed by the Department of Veterans Affairs) or a USDA loan (guaranteed by the Department of Agriculture), you may not be required to make a down payment.

Idaho first-time homebuyer financing

You can obtain a conventional loan with a low interest rate if you are a first–time homebuyer in Idaho with a 20 percent down payment. And you have no obligation to pay private mortgage insurance (PMI).

Obviously, few first-time buyers have sufficient funds for a 20 percent down payment. The good news is, though, that you do not need that much. Not even remotely.

Using one of the following low–down–payment mortgage options, borrowers can frequently acquire a new residence with as little as 3 percent or even no money down:

➣ Conventional 97 – From Fannie Mae or Freddie Mac. Minimum down payment of 3 percent and FICO score of 620. Once you have 20 percent equity in your house, you can typically cease paying mortgage insurance after a few years știind you have 20 percent equity.

➣ FHA loan – Federal Housing Administration-backed. 3.5% down payment and a minimum credit score of 580. However, you are responsible for mortgage insurance until you refinance to a different type of mortgage, move, or pay off the loan in full.

➣ VA loan – Exclusively for veterans and military personnel. There is no down payment necessary. Minimum credit score requirements vary by lender, but are often 620. No mortgage insurance is required after closing. These are arguably the greatest accessible mortgages, so apply if you qualify.

➣ USDA loan – For persons with low-to-moderate earnings who are purchasing a home in a specified rural area. No down payment is necessary. The minimum credit score required varies by lender but is often 640. Reduced mortgage insurance premiums

➣ Idaho Housing Loans – There may be attractive interest rates and down payment help available. Additional information is available below.

Note: Government lending programs (such as FHA, VA, and USDA mortgages) require the purchase of a primary dwelling. Therefore, you cannot utilize these loans to purchase a second house or investment property.

Depending on the mortgage financing you select, you may be able to move into your new home with little out-of-pocket expenses.

These schemes even permit the use of gifted funds or down payment assistance (DPA) for the down payment and closing charges.

If you are unsure of which program to choose for your first mortgage loan, your lender can assist you in determining the best option depending on your finances and home-buying objectives.

Idaho first-time home buyer programs

Unlike other states, Idaho’s government does not offer or facilitate mortgage loans.

Idaho Housing and Finance Association is the closest substitute (Idaho Housing). This is “an organization that supports its business operations through earned fees and profits, analogous to a private financial institution.”

Idaho Housing provides a variety of mortgage options, including conventional, FHA, USDA, and VA loans. In addition, it claims to provide “the lowest financing rates in Idaho.”

Other advantages include:

➣ Only a 3% down payment is required for conventional loans

➣ A program for down payment help

➣ Mortgage credit certificates (let you to deduct up to $2,000 in mortgage interest from your federal taxes annually).

➣ Homebuyer education courses supported by on-going assistance for the length of your loan.știin

To qualify for the Idaho Housing program, you must meet income requirements, which were limited at $125,000 in January 2022. However, the website does not specify if this is the overall household income or merely the income of the borrower.

These programs typically have additional eligibility requirements, such as minimum credit scores and maximum housing values. You can complete an eligibility checker to determine whether you qualify.

Idaho grants for first-time homebuyers

Housing Idaho does not offer grants. Instead, it offers two programs that allow you to obtain a second mortgage for your down payment.

The first choice is a conventional loan that can be large enough to cover the majority of your down payment and closing costs.

It carries an interest rate of 5% and is payable in equal monthly installments over a period of 10 years.

If you do not qualify for a Heroes mortgage, you will need a credit score of at least 680.

In addition, you must provide at least 0.5% of the sale price from your own funds. Again, there is a $125,000 income cap.

The second is a loan that is forgiven. In most respects, this is superior. Because there are no monthly payments and no interest rate. However, you can only borrow up to 5% of the selling price.

Each year, 10% of the loan is cancelled. Therefore, by the end of year 10, you will have no debt. However, if you move, sell, or refinance during those 10 years, you must promptly repay the unforgiven half.

In addition, the loan forgiveness does not come without cost. The website states, “For every 0.5% of forgiven loan used, 0.125% will be added to the first mortgage’s interest rate.”

Buying a home in the major cities of Idaho

It may be less expensive to purchase your first home in one of Idaho’s three largest cities than in the state as a whole.

This is due to the fact that housing prices in Boise, Meridian, and Nampa are actually lower than the state average.

In 2021, only Meridian experienced a faster-than-average price increase.

Numerous (perhaps the majority) American localities aid first-time homebuyers with down payment assistance programs.

When we examined, however, none of the three largest communities in Idaho had such a program.

If you are eligible and need assistance, you may always rely on Idaho Housing (see above).

Additionally, you might inquire with your real estate agent or loan officer about alternative down payment help programs administered by local nonprofits and other organizations.

Boise City First-time Home Buyers

In December 2021, the median list price for a residence in Boise was $538,800. According to Realtor.com, this was a 19.8 percent gain from the prior year.

If you wish to purchase a home at this median price, your alternatives for a down payment may include:

➣ $16,160 for a 3 percent deposit

20 percent down payment equals $107,760

“The City of Boise is not currently accepting applications for down payment assistance,” the City of Boise’s website stated when we looked. You could check back to see if the policy has changed by the time this is read.

It is recommended that you to check out the following buyer assistance progrmas, NeighborWorks Boise and Autumn Gold.

Meridian first-time home buyers

In Meridian, the median list price for a property in December 2021 was $599,000. According to Realtor.com, this was an increase of 33.7% from the previous year.

If you wish to purchase a home at this median price, your down payment choices may include:

➣ $17,970 for a down payment of 3 percent

➣ $119,800 with a 20% down payment

It does not appear that the city of Meridian or the county of Ada offer down payment assistance programs. The Meridian team of the private company Supreme Lending does suggest a program that involves a forgiven loan, but it only applies to FHA mortgages.

Nampa first-time home buyers

In December 2021, the median asking price for a property in Nampa was $45știiștiiștiiștiiștiiștiiștiiștiiștiiștiiștiiștiiștiiștiiștiiștiiștiiștiiștiiștii According to Realtor.com, this was a 15 percent increase year-over-year.

If you wish to purchase a home at this median price, your down payment choices may include:

➣ $13,500 for a 3 percent deposit

➣ $90,000 required for a 20% down payment

We were unable to locate any mention of a down payment assistance program on the websites of the City of Nampa or Canyon County.

If you are seeking aid, however, you should inquire with your agent or loan officer about DPA from local charity and other groups.