Table of Contents

First Time Home Buyer Grants Mississippi

First time home buyer grants Mississippi offers programs to assist first-time homebuyers with closing costs and down payment assistance.

To be eligible for these programs, you must meet certain criteria, including where you can purchase, the length of time you must live in your home, and salary constraints.

Discover how these state-run initiatives assist residents in establishing roots in the Magnolia State.

Mississippi and Local Incentives for First-Time Homebuyers

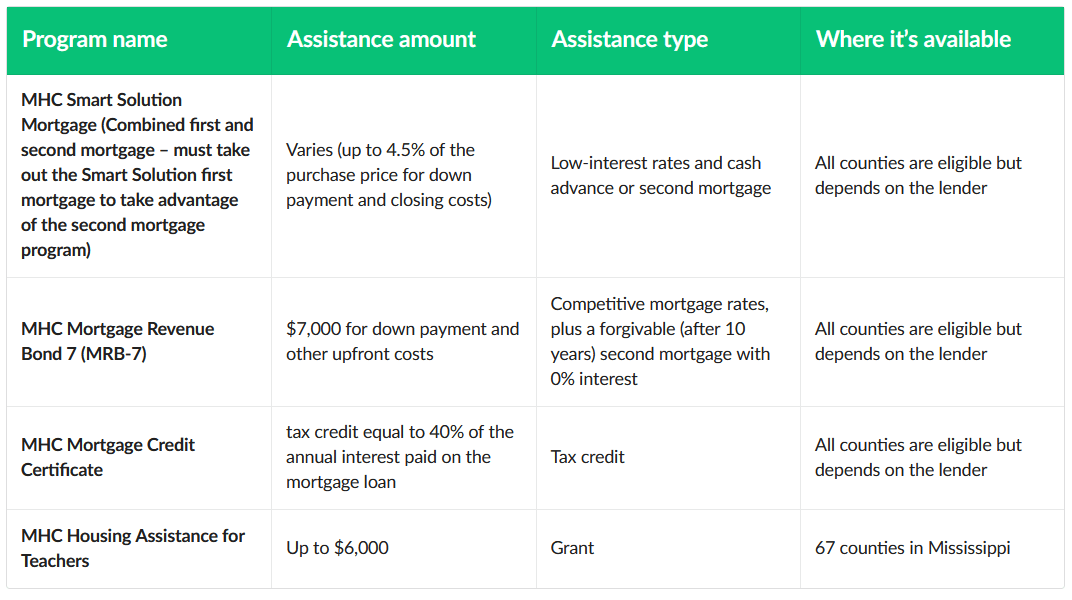

The Mississippi Home Corporation (MHC) offers a variety of programs to first-time homebuyers through participating lenders.

These incentives include a tax credit, a forgiven second mortgage, and a unique teacher recruitment program.

Each program has its own set of prerequisites and requirements for support. The following is a summary of the programs.

What to know about different types of down payment assistance

The majority of first-time homebuyer programs make mortgages more affordable by providing down payment and closing cost assistance in the form of a grant or a forgiving loan.

One program in Mississippi offers a tax credit. While it may appear that a forgiving mortgage is free, there are precise requirements that must be followed, or you may be required to repay the money.

Here’s how each type of down payment assistance works.

➣ Second mortgage that is forgiven. If you obtain a forgiven second mortgage, you are typically obliged to stay in your house for a specified period of time.

These loans are not repayable and do not accrue interest. However, if you relocate or refinance before the loan’s term expires, you will forfeit the forgiveness and will be liable for repaying the lender.

➣ Grant – If you receive a housing grant, you will receive cash rather than a lien on your home (as with a second mortgage).

Certain types of housing incentives, such as forgiven loans, include a stipulation that you remain in the home for a specified period of time.

If you violate the terms of the agreement, you may be required to reimburse the grant.

How first-time homebuyer programs in Mississippi operate

Not only are these Mississippi programs available to first-time homeowners, but they can also be paired with an FHA, VA, or USDA home loan to significantly reduce mortgage expenses.

Other possibilities may be available throughout the year through local county governments.

It’s worthwhile to contact local nonprofit housing organizations and housing authorities to inquire about new options.

If you wish to establish a permanent residence in Mississippi by utilizing housing assistance to purchase your first house, follow these simple steps.

➣ Apply for a Mortgage with a Program-Approved Lender

For each program, the Mississippi Housing Corporation provides a link to a list of approved lenders.

Lenders differ per program, but if you begin with a Smart Solution mortgage, you may be eligible for further assistance based on your circumstances.

➣ Complete Your Requirements for Homebuyer Education

MHC requires homebuyer education for all of its first-time homebuyer programs.

This requirement is intended to assist you in comprehending all of the risks and rewards associated with homeownership.

➣ Become Aware of Your Income Limits

Programs for first-time homebuyers exist to assist low- to moderate-income individuals in entering the housing market.

Make certain to study the terms of your program carefully to see whether you qualify for assistance.

➣ Be Aware of the Payback Requirements Prior to Selling or Refinancing

When you accept aid from a first-time homebuyer program, you will almost certainly be forced to remain in your house for a specified period of time.

If you quit early, you will very certainly be required to repay all or a portion of the money.

Additionally, if you refinance your loan during the same time period, you will be required to repay the aid.

➣ Expect Higher Requirements for Credit Score

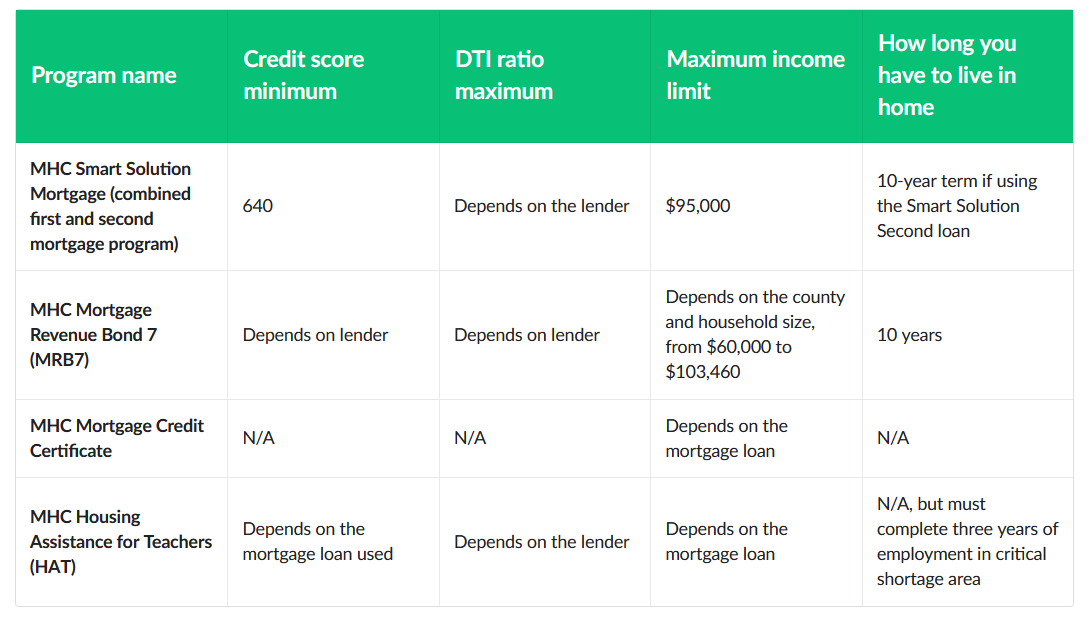

Some of these programs require a credit score of 640 or higher. Ensure that your credit is in order prior to applying for one of these programs, as the credit score required may be higher than that required for conventional mortgages.

Mississippi rules for first-time homebuyers

If you are a first-time home buyer in Mississippi, you should familiarize yourself with the state’s fundamental qualifying standards, which include a minimum credit score and income restrictions.

For example, in the Mississippi Employer-Assisted Housing Teacher program, you must commit to teaching for a specified number of years in the state.

The chart below summarizes the various program criteria to assist you in determining your best fit.

Things to Know: If you’re purchasing a home in Mississippi, it’s critical to understand that while many of the down payment assistance programs are accessible statewide (except for the HAT program), many of them need you to work with specific lenders.

Additionally, it is critical to understand the median income requirements for the programs that require them.

Visit the HUD website and enter your state and county information to determine the current Mississippi income restrictions.

National programs for first-time homebuyers

The majority of Mississippi’s first-time homebuyer programs require you to obtain a mortgage from a recommended lender.

While MHC grants and forgivable loans will assist with closing expenses and down payments, it is vital to secure an affordable mortgage loan in order to utilize them.

While traditional mortgages are available, if you are concerned about qualifying for or affording one, numerous government programs exist to assist low- to moderate-income homeowners.

Note: Although many people utilize them, not all of the loans listed below are unique to first-time borrowers.

➣ Conventional loans – Families with low to moderate incomes may struggle to qualify for a typical mortgage.

These loans are not backed by the federal government and come with stricter eligibility rules and loan limitations than government-supported programs.

The Fannie Mae HomeReady® and Freddie Mac Home Possible® programs are two examples of traditional first-time homebuyer financing.

➣ FHA loans – Many first-time homebuyers use FHA loans because they have lower credit score criteria (580) and need a smaller down payment (3.5 percent).

Please keep in mind that you will be required to pay two different types of FHA mortgage insurance on the loans. While these loans allow purchasers to have a lower credit score, many Mississippi lenders require a minimum credit score of 640.

It’s worth mentioning that the FHA loan maximum for a single-family house in Mississippi (in all counties) increases to $420,680.

➣ VA loans – The United States Department of Veterans Affairs (VA) insures VA loans for veterans and active-duty military personnel.

No down payment is required, no mortgage insurance is required, and there are no loan limits with these loans.

If you qualify for a Mississippi housing assistance program, the funds may be used to cover closing costs, fees, and other house-related expenses.

➣ USDA loans – If you’re considering settling in rural Mississippi and have a low- to moderate-income, you should consider a USDA loan.

If you purchase in a USDA-designated location, these mortgages provide 100 percent financing.

Trends in home prices in Mississippi’s main metropolitan areas

In Mississippi, home prices vary significantly by county. For example, median home prices in Rankin County (which includes the state capital of Jackson) increased 14.9 percent year over year to $199,691 in the fourth quarter of 2021, according to National Association of Realtors data. In Rankin County, the average monthly mortgage payment increased by $121 to $765.

In Harrison County, which includes Gulfport (Mississippi’s second-largest city), the median home price increased 13.8 percent year over year to $199,462.

This equates to a monthly mortgage payment of $765, an increase of $116 over the previous year.

The less costly Holmes County saw a 12.3 percent increase in median home prices to $70,301. Monthly mortgage payments increased by $37 to $269 on average.

Frequently Asked Questions about Mississippi’s first-time homebuyer programs

In Mississippi, who qualifies as a first-time homebuyer?

As with the Federal Housing Administration, you are considered a first-time homeowner if you have not bought a property in the preceding three years.

However, some grants and forgiven loans, such as the HAT program, may have different eligibility requirements, so if you are purchasing a second home or have questions about your status, it is prudent to contact the program organizers to determine your eligibility.

Can I qualify for down payment assistance in Mississippi?

You may qualify for housing aid in Mississippi if you meet the income, credit, and, in the case of HAT, professional standards and are willing to enroll in a homebuyer education course.

How much money do I need for a down payment on a property in Mississippi?

It varies according to the mortgage product. If you qualify for a USDA or VA loan, you will not be required to make a down payment.

The minimum down payment required by the FHA is 3.5 percent, but if you obtain a Smart Solution Second mortgage, the down payment may be covered by the lender.