Ultimate Guide to Reverse Mortgage Foreclosure Process If a senior with a reverse mortgage cannot pay their property taxes, they could lose their If your spouse has taken out a reverse-mortgage without including you in terms of the loans…

Mortgages

Ultimate Guide to Reverse Mortgage Foreclosure Process If a senior with a reverse mortgage cannot pay their property taxes, they could lose their If your spouse has taken out a reverse-mortgage without including you in terms of the loans…

Texas Foreclosure Laws Texas foreclosure laws are handled differently than most Foreclosure laws vary from state to state, but in general, foreclosure proceedings begin with a notice to This means that the bank must notify the homeowner that…

2nd Mortgage Loans with Bad Credit Getting 2nd mortgage loans with bad credit can be a good option if your credit score is not so Many Americans with bad credit are not eligible for traditional loans such as mortgages…

Can You Pay Off a Reverse Mortgage Early? Seniors with reverse mortgages often ask can you pay off a reverse mortgage early? A reverse mortgage is a great way to retire early but has Many seniors who get a…

How Can I Lower Monthly Mortgage Payment Without Refinancing? Homeownership has become increasingly expensive over the last few In fact, according to the National Association of Realtors, homeowners paid trillion dollars in mortgage interest payments between 2005 and…

It may be possible to qualify for a HELOC with bad credit, even if you do not qualify for a traditional bank Fortunately, there are alternatives For example, you might consider applying for a home equity line of…

Wondering how to pay off a reverse mortgage early? In this post we will discuss what exactly a reverse mortgage is and the benefits of paying off a reverse mortgage early and what you need to do to get the…

Did you know that you can refinance with bad credit and late payments on your credit profile?? It’s true! And not only can you do it, but you can get a lower rate than you would otherwise qualify In…

No Closing Cost Reverse Mortgage Options A no closing cost reverse mortgage is one where there are no fees or charges associated with borrowing against home This type of loan is ideal for those looking to take out a…

Understanding Seller Tax Credits Seller tax credits are funds contributed by the seller to the buyer’s side of the deal at They can be used to cover any fees associated with the sale, including closing costs, repair expenses,

Learn ways to save on mortgage costs as rates for a 30-year fixed rate mortgage soars over Some homeowners may be surprised by their monthly mortgage payments when buying a Here are tips for With 30-year fixed…

Will using a HELOC to pay off mortgage loans faster can be a good option if you have equity in your A home equity line of credit (HELOC) is a great way to get extra cash flow from your…

Silent Second Mortgage A silent second mortgage is when you take out a loan (in addition to a mortgage) to…

First Time Home Buyer RI In this article you will discover important information and resources for first time home buyer…

Michigan First Time Homebuyer In this article you will discover important information and resources if you are a Michigan first…

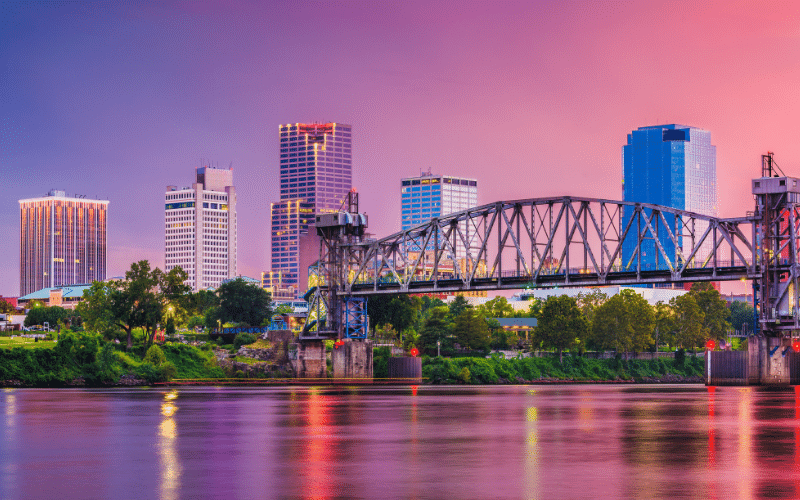

First Time Home Buyer Arkansas Here you will discover important information and resources if you are a first time home…