Table of Contents

Learn important information between a debit spread vs credit spread. An options spread is the simultaneous purchase and sale of multiple option contracts on the same underlying asset.

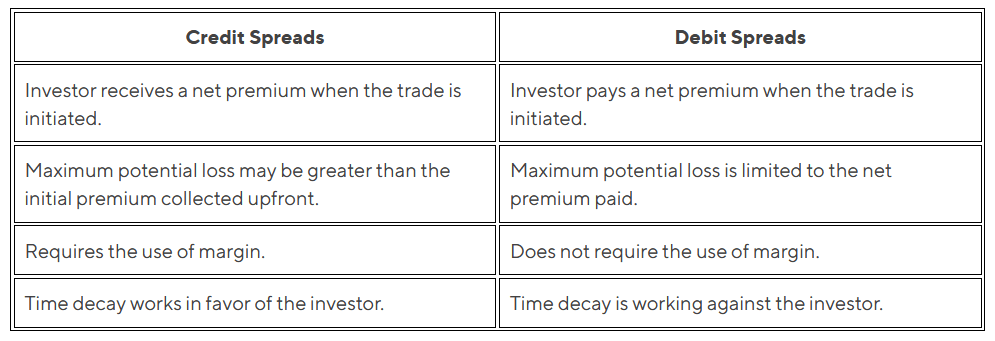

There are two types of vertical spreads: credit spreads and debit spreads.

What is the difference between a credit spread and a debit spread, and how are these tactics used by investors?

When an investor selects a credit spread, or net credit spread, he or she simultaneously sells a higher premium option and purchases a lower premium option, often on the same security but with a different strike price. As a result, their account gets credited.

A debit spread is the inverse: the investor acquires a more expensive option while concurrently selling a less expensive option on the same security, resulting in a net payout or debit to their account.

Continue reading to understand more about the distinctions between credit spreads and debit spreads, as well as the influence of volatility on each.

Why Should You Trade Options Using a Spread Strategy?

The holder of an option contract has the right, but not the responsibility, to buy or sell an underlying asset, which is frequently a security such as a stock.

Using several options techniques exposes investors to the price movement of an underlying asset, allowing them to take a bullish or bearish position without owning the underlying security.

Apart from the underlying’s market price, a variety of other factors, such as volatility, time to expiration, and market interest rates, affect the value of the options contract.

With so many variables to consider, investors have devised a variety of options trading strategies.

A vertical spread is available in two varieties, credit or debit, and entails purchasing (or selling) a call (or put) and concurrently selling (or buying) another call (or put) with a different strike price but the same expiration date. Consider these two options trading tactics.

How a Credit Spread Works

A credit spread occurs when an investor sells a high-premium option on the same asset and purchases a low-premium option on the same security.

These deals result in a credit to the trader’s account, as the trader’s option sells for more than the trader’s option buys.

In this case, the investor expects that both options are out-of-the-money and expire worthless on the expiration date, allowing the investor to retain the initial net premium collected.

How a Debit Spread Works

A debit spread occurs when an investor purchases a high-premium option on the same asset and sells a low-premium option on the same security.

These transactions cause a debit on the trader’s account. However, they enter the transaction in the intention of profiting from price movement during the life of the options contract.

The best-case scenario is that both options are in-the-money on the expiration date, allowing the investor to profit from both contracts.

Credit Spreads

To illustrate how credit spreads function, an investor buys and sells options on the same underlying security with the same expiration date but different strike prices concurrently.

The premium received by the investor on the option they sell exceeds the premium paid on the option they buy, resulting in a net return or credit to the investor.

One critical point to remember is that credit spreads force traders to employ margin loans, as their short leg will be more valuable than their long leg if both options are in-the-money at expiry.

Therefore, before a trader may engage in a credit spread, they must ensure that their brokerage account is properly configured.

The strategy is divided into two components. The bull put credit spread is the first credit spread method.

It involves the investor purchasing a put option at one strike price and selling it at a higher strike price.

Put options typically appreciate in value when the underlying asset’s price declines and depreciate in value as the underlying asset’s price increases.

Thus, this is a bullish strategy, as the investor anticipates an increase in the underlying’s price to the point where both options expire worthless.

If the underlying asset’s price is greater than the higher strike price specified on expiration day, the investor earns the maximum profit.

On the other hand, if the underlying security falls below the long-put strike price, the investor faces the strategy’s maximum loss.

Time decay is another factor that can work in the investor’s favor when it comes to credit spreads.

This is the phenomena in which options depreciate in value as the expiration date approaches.

With the underlying asset’s price remaining constant, the difference in value between the two credit spread options will naturally disappear, allowing the investor to either close out both contracts for a profit or let them expire worthless.

The alternative credit spread trading method is referred to as a bear call credit spread, or simply a bear call spread.

It is, in some ways, the inverse of the bull put spread. The investor purchases a call option at one strike price and sells it at a lower strike price, anticipating a decline in the underlying asset’s price.

Bull put spreads can be beneficial if the underlying security’s price remains below a certain level for the period of the options contracts.

If the security’s strike price at expiration is less than the lower call’s strike price, the spread seller retains the entire premium on the options they sell in the strategy.

However, there is a risk. If the underlying security’s price climbs above the long-call strike price at the strategy’s expiration, the investor will sustain the maximum loss.

Debit Spreads

The flipside of a credit spread is a debit spread. As with a credit spread, a debit spread entails the purchase of two identical sets of options on the same underlying securities with the same expiration date.

However, in a debit spread, the investor purchases one set of options at a greater premium and sells another set at a lower premium.

While a credit spread strategy results in a net credit to the trader’s account upon execution, a debit spread strategy results in an immediate net debit, hence the name.

The debit occurs because the premium paid on the options purchased by the investor is more than the premium received on the options purchased.

Typically, investors employ debit spread tactics to offset the cost of purchasing an expensive option outright.

They may prefer a debit spread to acquiring a single option if they anticipate the underlying asset’s price movement to be moderate.

As with credit spreads, debit spreads are available in bullish and bearish configurations.

A bull-debit spread can be built using call options, in which the investor acquires a lower strike price call option and sells a higher strike price call option.

The maximum gain is equal to the difference in strike prices minus the upfront premium paid and is attained if the underlying asset rises above the higher strike price call on expiration day.

Similarly, a bear-debit spread can be constructed using put options.

With debit spread techniques, the investor is required to make an initial investment in the trade, which also serves as the investor’s maximum possible loss.

In contrast to credit spreads, time decay often works against the investor in a debit spread, as they are hoping for both options to expire in the money, allowing them to close both contracts and pocket the difference.

Pros and Cons of Credit and Debit Spreads, Depending on Volatility

Debit Spread vs Credit Spread Bottom Line

Among the several options techniques employed by investors, one prominent variety is the options spread, which can be either a credit spread, or a debit spread.

In these methods, the spread is a term that refers to the practice of purchasing and selling different options that have the same underlying security and expiration date but have different strike prices.

The fact that spreads impose upper and lower limitations on prospective gains and losses is critical to the strategy.

When building the spread, the investor may set the strike prices of the options he or she buys and sells.

This provides the investor with some discretion over the level of risk they take on.

Are you ready to begin investing? Opening a brokerage account with SoFi Invest® is simple.

You may buy and sell stocks, ETFs, and cryptocurrency, among other things, yet SoFi charges no management fees.

Even better, SoFi members receive comprehensive financial guidance from professionals who can assist in resolving any issues that may arise.