Table of Contents

A simple explanation of time decay options. Options are one of the most common types of derivatives, providing holders with the right to buy or sell a stock at a predetermined price.

Option contracts usually have an expiration date by which the option holder must exercise them (or they can let it expire if exercising the option would cause them to lose money).

Many factors influence how the value of an option, i.e. the premium that the option buyer must pay to the option seller, is determined. The underlying stock’s current price, the strike price, and the time until expiration all have an impact.

Time decay options, also known as theta, is the decrease in an option’s value as the expiration date approaches. Learn why time decay is important and why you should be aware of it.

Time Decay Options: Definition and Example

Time decay options describes how the value of an option contract decreases, or decays, as the option’s expiration date approaches.

Assume BDS is trading at $40 and you want to buy a call option with a strike price of $50 and an expiration date of 180 days.

In this hypothetical example, you might have to pay $200 for that contract. If BDS rises above $50 in the next 180 days, you can exercise your option to buy shares at a discount.

Note: As part of the contract specifications, options contracts include an expiration date. In the United States, the expiration date is the last date on which an in-the-money options contract can be exercised.

The Saturday following the third Friday of each month is the most common expiration date for an option contract.

If the option expires in 30 days, the same option may cost only $50 because there is less time for XYZ’s price to change to the point where exercising the option is profitable.

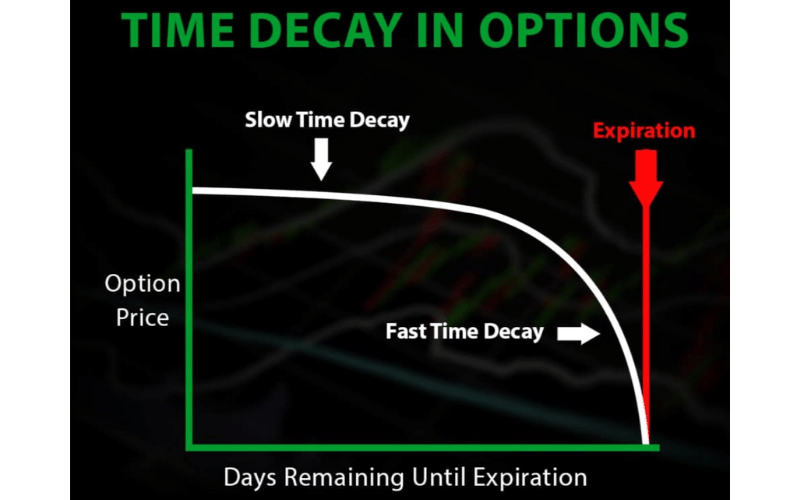

The value of an option decreases with each passing day due to time decay. The value of the option will typically fall faster as the expiration date approaches.

The daily decrease in the option’s price will be greater in the week preceding expiration than in the month preceding expiration.

One thing to keep in mind is that options that are in the money have less time decay because they have intrinsic value. Options at the money or out of the money suffer from greater time decay.

What Is the Process of Time Decay Options?

Because of the way option prices are determined, time decay works. In general, higher premiums are demanded for options that are more likely to be exercised.

That is, options that are in the money or close to it are more expensive than options that are far out of the money. Similarly, options with long expiration dates command higher premiums.

Tip: If exercising an option is profitable, it is in the money. For example, if you own a call option with a strike price of $50 on a stock that is currently trading at $55, you have an option that is in the money. You could use it to buy shares and then sell them for a $5 profit.

Let’s look into why this is the case. If an option on a stock trading at $25 expires tomorrow and is $10 out of the money, the chances of the share’s price changing by $10 in a single day are slim.

If the option is $10 out of the money, but the expiration date is a year away, there is much more time for the stock’s price to change dramatically.

Options that are in the money have intrinsic value because they can be exercised for a profit right away. Out-of-the-money options are valuable because they have the potential to gain intrinsic value as stock prices change.

The amount that people are willing to pay for an option decreases as the chances of it gaining intrinsic value decrease.

What Does This Mean for Individual Investors?

Investors interested in trading options should keep in mind that the contract’s expiration date influences its value.

If you buy options close to their expiration date, you should be prepared for a sharp drop in their value.

Some options traders choose to profit from this by selling options close to their expiration date, but you must be willing to accept the risks, including potentially unlimited losses, that come with selling certain options.

Important Points

• Time decay options describes how the value of an option contract decreases, or decays, as the option’s expiration date approaches.

• The value of an option tends to decrease as the expiration date approaches.

• Time decay affects out-of-the-money options more than in-the-money options.

• When the expiration date is far away, time decay has little effect on option prices, but it accelerates as the date approaches.