What Is Substitution Bias?

Substitution bias describes a possible bias in economic index numbers if they do not incorporate data on consumer expenditures switching from relatively more expensive products to cheaper ones as prices changed.

Behavioral finance incorporates components of psychology to discuss the real habits of capitalists and the succeeding result on markets, unlike traditional finance which presumes simply rational investors as well as effective markets.

In a series of posts, we will certainly discuss one of the most typical behavioral biases financiers drop victim to and also placed them in the context of background or present

Over the past six months, markets have marched higher practically uninterrupted given that the lows back in March, just as the economy was thrown right into the deepest economic downturn since the Great Depression.

Many investors discover this disconnect between the equity market as well as the economic climate bewildering and also are regularly asking us: is it warranted?

Investors usually swap the economy and also the stock exchange.

Investors usually swap the economy and also the stock exchange.

When the economic situation is booming, we would expect supplies to act likewise.

This appears logical offered U.S firms are based, run and offer in the United States and financial growth effects company profits and also profits.

Furthermore, when the economic situation remains in a recession or recovering (as it is now) we would anticipate securities market motions to mirror (or at least be highly associated) to those changing economic problems. Nevertheless, just taking these assumptions at face value mirrors substitution bias.

Substitution bias is the extremely natural and also typical tendency to take mental shortcuts in attempting to get to a complex answer, which often leaves us without a complete understanding of the trouble itself.

The good news is, by leveraging data, checking throughout resources and also, most notably, being open to a much more intricate conversation can aid in navigating this substitution bias predisposition.

While it is always difficult to totally associate where market gains and losses emanate from, we can explain that the economy and the securities market are not in fact 1 to 1 in the United States.

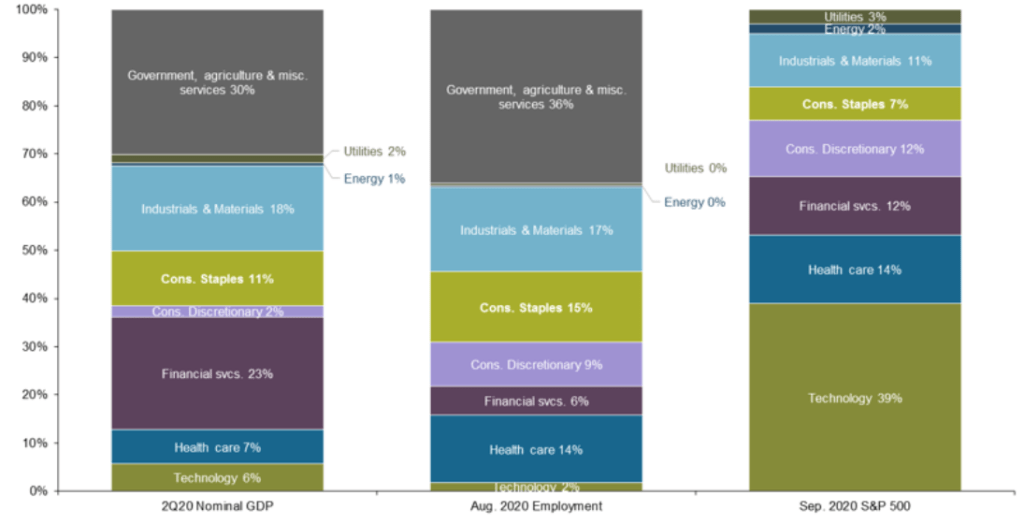

As shown, the make-up of the equity market is greatly heavy to technology at 39%, which has actually done incredibly well throughout this time around, yet just 2% of total payroll jobs (Graph 1).

Going deeper right into the solution market, the sectors most influenced by COVID-19 (including retail, hotels and tourist, transport, amusement, and dining establishments) stand for 20% of all payroll jobs as well as 19% of GDP, yet these very same markets only stand for regarding 7% of S&P 500 revenues.

In summary, while the stock market and also the economic climate are connected, they have considerably various make-ups, which can result in the economy and also markets appearing to be on various wavelengths.

By accepting substitution bias, financiers might think the marketplace rally is not justified, but a deep appearance under the surface recommends that in fact, it is.

” By yielding substitution bias, investors might believe the marketplace rally is not justified, however a deep appearance under the hood simply that actually, it is.”

Samantha Azzarello

Industry share of GDP, work, S&P 500 Consumer Price Index