Table of Contents

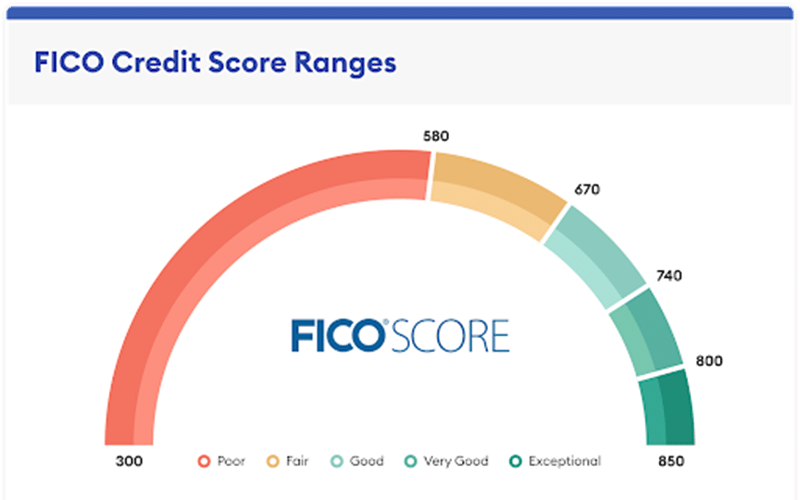

The Fair Isaac Corporation (FICO) scoring scale defines your “financial fitness” in society; that scale ranges from 300 to 850. A lower number means better financial fitness. Few lenders will give a loan to someone who scores below 700.

Only student loans and secured consumer debt can help improve your poor financial fitness. However, secured consumer debt is recommended because it helps boost your bad financial fitness. Best consumer card companies won’t let you apply until you get a 740+ rating.

We will cover all the key points in building your good personal financial history starting from scratch. While most people think having multiple accounts increases your score, the reality is high-paying accounts increase your score. You should only open accounts that you plan on paying off quickly.

IMPORTANT: You must clear your personal credit reports from Equifax, TransUnion, and Experian of any derogatory accounts before using Debt Removal Secrets. Doing so will raise your scores instantly when finished.

Once all derogatory accounts have been deleted from your personal financial profile, the financial history may have very little information about you on the public records. This is referred to as a ‘thick’ file in the financial realm.

On average, a customer will spend 5 YEARs building up their financial history from a ‘thick files ’to an 880+ Beacon score, but here are a couple of key secrets that can help you speed up the process. Our goal is to reach the top tier of financial history within 6 months. All we ask is that you dedicate one hour of time each week.

GET A FREE CREDIT REPORT

If you want to get a free copy of your own personal consumer reports, you can order them online at www.myFICO.com/freereport.

Make sure all the details are accurate on all three credit report profiles. Ask them to fix any errors and make sure they provide proof of identity, such as a driver’s license or utility bill.

We recommend checking your credit report at least once every week by using CreditKarma.com. They perform a soft “inquire” which doesn’t lower your credit scores, unlike some other free services that perform a hard “inquire”.

CREDIT REPORTING AGENCIES

It’s your chance to check out what’re really important about your account. You can order FREE copies of your report from the FTC’ s site.

You’ll receive three separate reports: one each from Equifax, Experian, and Transunion. They’re not just free — they’re also updated monthly.

Use Debt Removal Secrets if you want to dispute any debt with greater efficiency.

Experian Personal

Phone: +1 (888) 397-3742 | M-F 7:00 a.m. to 7:00 p.m. (CST)

Email: https://experian.com/consumer-information/cis-contact-business

Credit Form: https://consumer.ftc.gov/files/articles/pdf/pdf-0093-annual-report-request-form.pdf

Freeze Form: Experian (Personal Credit) Security Freeze

Experian Business

Phone: +1 (800) 303-1640 | M-F 8:00 a.m. – 4:00 p.m. (CST)

Support: https://smallbusiness.experian.com/pdp.aspx?pg=Help

Equifax Personal

Phone: +1 (888) 378-4329 | M-F 9:00 a.m. – 9:00 p.m. | Sat-Sun 9:00 a.m. – 6:00 p.m. (EST)

Support: cust.serv@equifax.com

Freeze Form: https://equifax.com/personal/help/place-lift-remove-security-freeze/

Equifax Business

Phone: +1 (888) 407-0359 | M-F 8:00 a.m. – 8:00 p.m. (EST)

Support: https://www.equifax.com/business/support/

TransUnion Personal

Phone: +1 (800) 916-8800 | M-F 8:00 a.m. – 11:00 p.m. (EST)

Email: https://directcontent.transunion.com/clientsupport/contactus/clientsupportform.page

Freeze Form: https://www.transunion.com/credit-freeze

Get 3 FREE months of online account management with the Navigator Plus plan! For just $29 per month, you’ll enjoy unlimited online account management, 24/7 customer service, and instant alerts so you can stay ahead of any financial issues that may arise during your loan application process.

With this package, you also get your FICO®, Experian, and TransUnion small business scoring services included for only $9 per month!

SUPPLEMENTARY CREDIT BUREAUS

The next biggest three (3) major agencies are as follows. They collect information from auto dealers, public record databases, banks, etc. and combine that data into one report.

If you’re struggling to get an approval, you may want to check your reports from those three (3) agencies for any old information, discrepancies, mistakes, or other problems that might be holding you back.

LexisNexus Personal (merged with SageStream)

Phone: +1 (800) 543-6862 | 24/7/365

Email: consumer.documents@lexisnexis.com

Credit Form: https://consumer.risk.lexisnexis.com/request

Freeze Form: https://consumer.risk.lexisnexis.com/freeze

Innovis Personal

Phone: +1 (866) 873-3651 | M-F 6:00 a.m. – 5:00 p.m. (PST)

Email: info@innovis.com

Credit Form: https://innovis.com/personal/creditReport

Freeze Form: https://www.innovis.com/personal/securityFreeze

CoreLogic Personal

Phone: +1 (877) 309-5226 | M-F 6:00 a.m. – 5:00 p.m. (PST)

Email: contactus@corelogic.com

Credit Form: https://corelogic.com/teletrack-consumer-report-request.pdf

Freeze Form: https://teletrackfreeze.corelogic.com/

ARS (Advanced Resolution Services) Personal

Phone: +1 (800) 392-8911 | M-F 9:00 a.m. – 5:00 p.m. (EST)

Email: consumerhelp@ars-help.com

Credit form: (must call to get an appointment)

Freeze Form: https://www.ars-consumeroffice.com/add

SPECIALTY CREDIT BUREAUS

Next credit bureaus report on special types of account such as payday loan, buy-now-pay-later, utilities, students and Car loans, Internet and more.

If you do not have any type of loan covered by each credit bureau, then you can Skip initiating freezes with these bureaus.

NCTUE (National Consumer Telecom & Utilities Exchange) | Reports on phone and utilities

Phone: +1 (877) 657-9006

Email: admin@nctue.com

To request a free copy of our credit form, call 1-(866)-349-5185.

Freeze Form: https://www.exchangeservicecenter.com/Freeze/

Clarity Services Inc. | Reports on installment collections, auto, student, bank and phone loans

Phone: +1 (866) 390-3118 | Mon-Fri 9am – 5pm EST

Email: https://www.clarityservices.com/support/

Credit Form: https://consumers.clarityservices.com/reports

Freeze Form: https://www.clarityservices.com/support/security-freeze/

FactorTrust | Reports on installment loan collections, auto, student, bank loans

Phone: +1 (844) 773-3321

Email: sales@factortrust.com

Credit Form: https://www.factortrust.com/consumer/ReportRequest.aspx

Freeze Form: https://www.factortrust.com/Consumer/CreditFreeze/Landing.aspx

Note: If you have an active credit card fraud alert or if you’re under a credit monitoring service, having your account on a credit freeze may prevent you from opening a new credit card. When you’re ready to open a new credit card, remember to remove any existing credit freezes before applying.